uiz Saved McDermott Company's bank statement for September 30 showed an ending cash balance of $1,574. The company's Cash account in Its general ledger showed a $1,235 debit balance. The following information was also available as of September 30. The bank deducted $205 for an NSF check from a customer deposited on September 15 The September 30 cash recelpts, $1,410, were placed in the bank's night depository after banking hours on that date and this amount did not appear on the September 30 bank statement A $31 debit memorandum for checks printed by the bank was Included with the canceled checks. Outstanding checks amounted to $1,385. Included with the bank statement was a credit memo in the amount of $955 for an EFT in payment of a customer's account. Included with the canceled checks was a check for $355, drawn on the account of another company. E Required: a. Prepare a bank reconciliation as of September 30. b. Prepare the journal entries for the items on the company's bank reconciliation as of September 30. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a bank reconciliation as of September 30. McDermott Company Bank Reconciliation At September 30 Updates to Bank Statement Updates to Company's Books Ending Cash Balance per Bank Statement Ending Cash Balance per Books Additions: Additions: 0 Deductions: Deductions: 0 Up-to-date ending cash balance Up-to-date ending cash balance Prey 1 of 5 Next> e here to search X

uiz Saved McDermott Company's bank statement for September 30 showed an ending cash balance of $1,574. The company's Cash account in Its general ledger showed a $1,235 debit balance. The following information was also available as of September 30. The bank deducted $205 for an NSF check from a customer deposited on September 15 The September 30 cash recelpts, $1,410, were placed in the bank's night depository after banking hours on that date and this amount did not appear on the September 30 bank statement A $31 debit memorandum for checks printed by the bank was Included with the canceled checks. Outstanding checks amounted to $1,385. Included with the bank statement was a credit memo in the amount of $955 for an EFT in payment of a customer's account. Included with the canceled checks was a check for $355, drawn on the account of another company. E Required: a. Prepare a bank reconciliation as of September 30. b. Prepare the journal entries for the items on the company's bank reconciliation as of September 30. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a bank reconciliation as of September 30. McDermott Company Bank Reconciliation At September 30 Updates to Bank Statement Updates to Company's Books Ending Cash Balance per Bank Statement Ending Cash Balance per Books Additions: Additions: 0 Deductions: Deductions: 0 Up-to-date ending cash balance Up-to-date ending cash balance Prey 1 of 5 Next> e here to search X

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 1PA

Related questions

Question

Transcribed Image Text:uiz

Saved

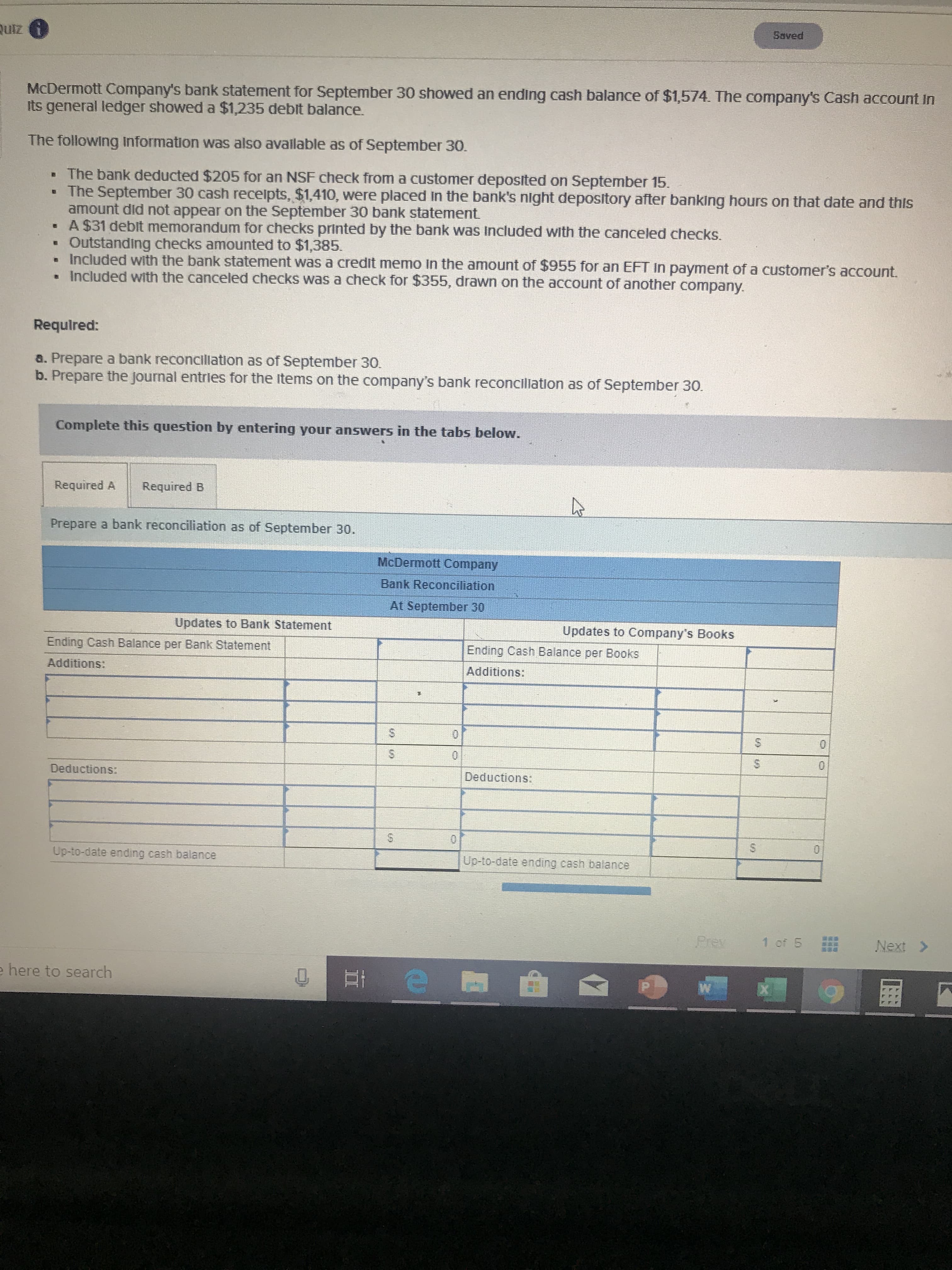

McDermott Company's bank statement for September 30 showed an ending cash balance of $1,574. The company's Cash account in

Its general ledger showed a $1,235 debit balance.

The following information was also available as of September 30.

The bank deducted $205 for an NSF check from a customer deposited on September 15

The September 30 cash recelpts, $1,410, were placed in the bank's night depository after banking hours on that date and this

amount did not appear on the September 30 bank statement

A $31 debit memorandum for checks printed by the bank was Included with the canceled checks.

Outstanding checks amounted to $1,385.

Included with the bank statement was a credit memo in the amount of $955 for an EFT in payment of a customer's account.

Included with the canceled checks was a check for $355, drawn on the account of another company.

E

Required:

a. Prepare a bank reconciliation as of September 30.

b. Prepare the journal entries for the items on the company's bank reconciliation as of September 30.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Prepare a bank reconciliation as of September 30.

McDermott Company

Bank Reconciliation

At September 30

Updates to Bank Statement

Updates to Company's Books

Ending Cash Balance per Bank Statement

Ending Cash Balance per Books

Additions:

Additions:

0

Deductions:

Deductions:

0

Up-to-date ending cash balance

Up-to-date ending cash balance

Prey

1 of 5

Next>

e here to search

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,