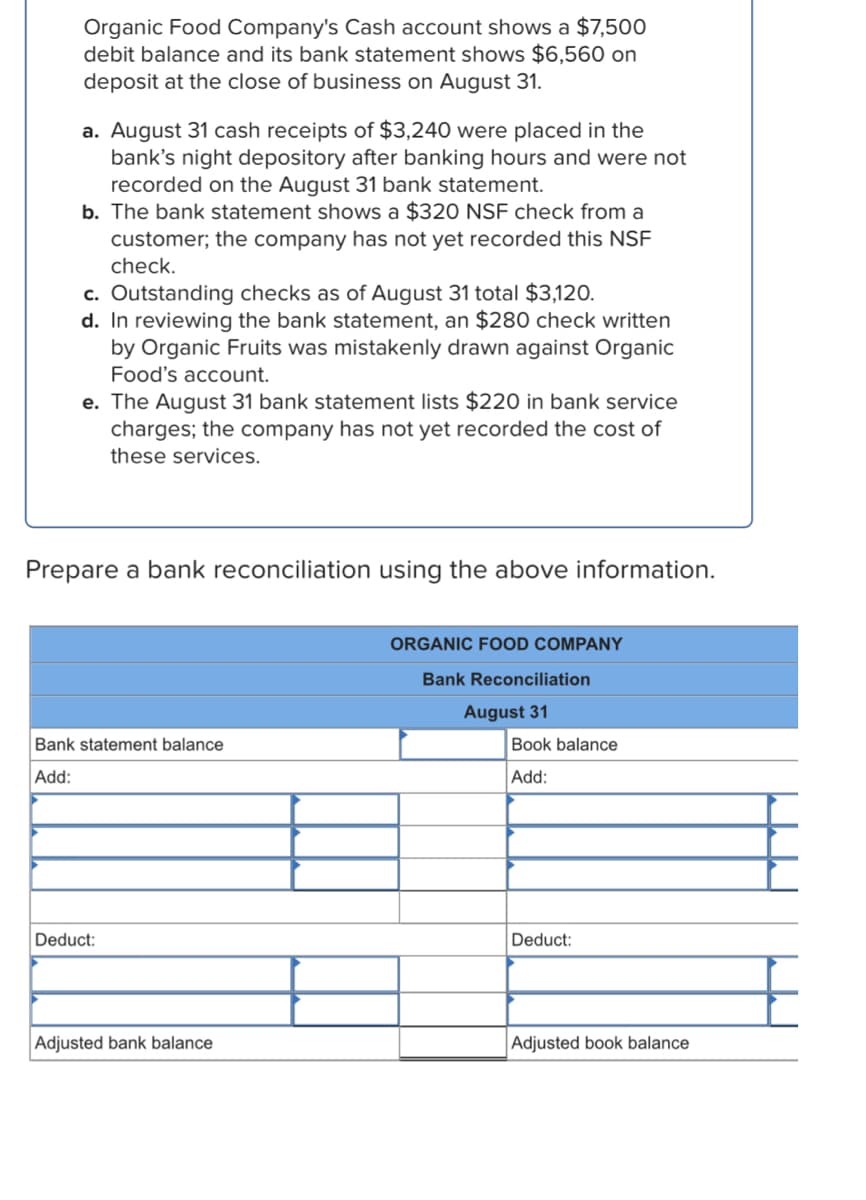

Organic Food Company's Cash account shows a $7,500 debit balance and its bank statement shows $6,560 on deposit at the close of business on August 31. a. August 31 cash receipts of $3,240 were placed in the bank's night depository after banking hours and were not recorded on the August 31 bank statement. b. The bank statement shows a $320 NSF check from a customer; the company has not yet recorded this NSF check. c. Outstanding checks as of August 31 total $3,120. d. In reviewing the bank statement, an $280 check written by Organic Fruits was mistakenly drawn against Organic Food's account. e. The August 31 bank statement lists $220 in bank service charges; the company has not yet recorded the cost of these services.

Organic Food Company's Cash account shows a $7,500 debit balance and its bank statement shows $6,560 on deposit at the close of business on August 31. a. August 31 cash receipts of $3,240 were placed in the bank's night depository after banking hours and were not recorded on the August 31 bank statement. b. The bank statement shows a $320 NSF check from a customer; the company has not yet recorded this NSF check. c. Outstanding checks as of August 31 total $3,120. d. In reviewing the bank statement, an $280 check written by Organic Fruits was mistakenly drawn against Organic Food's account. e. The August 31 bank statement lists $220 in bank service charges; the company has not yet recorded the cost of these services.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 1PB

Related questions

Question

Transcribed Image Text:Organic Food Company's Cash account shows a $7,500

debit balance and its bank statement shows $6,560 on

deposit at the close of business on August 31.

a. August 31 cash receipts of $3,240 were placed in the

bank's night depository after banking hours and were not

recorded on the August 31 bank statement.

b. The bank statement shows a $320 NSF check from a

customer; the company has not yet recorded this NSF

check.

c. Outstanding checks as of August 31 total $3,120.

d. In reviewing the bank statement, an $280 check written

by Organic Fruits was mistakenly drawn against Organic

Food's account.

e. The August 31 bank statement lists $220 in bank service

charges; the company has not yet recorded the cost of

these services.

Prepare a bank reconciliation using the above information.

ORGANIC FOOD COMPANY

Bank Reconciliation

August 31

Bank statement balance

Book balance

Add:

Add:

Deduct:

Deduct:

Adjusted bank balance

Adjusted book balance

![g information applies to the questions

low.]

d Company's Cash account shows a $7,500

e and its bank statement shows $6,560 on

e close of business on August 31.

cash receipts of $3,240 were placed in the

ht depository after banking hours and were not

on the August 31 bank statement.

statement shows a $320 NSF check from a

the company has not yet recorded this NSF

ng checks as of August 31 total $3,120.

ng the bank statement, an $280 check written

c Fruits was mistakenly drawn against Organic

count.

st 31 bank statement lists $220 in bank service

he company has not yet recorded the cost of

rices.

reconciliation using the above information.

ORGANIC FOOD COMPANY

Bank Reconciliation

August 31

ce

Book balance

Add:

Deduct:

Adjusted book balance](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F324640e1-23f3-4173-967e-0be7ca979ee5%2F7d86f377-8d20-435c-9b5f-b4e7b7cb79ff%2Fw12qftc_processed.jpeg&w=3840&q=75)

Transcribed Image Text:g information applies to the questions

low.]

d Company's Cash account shows a $7,500

e and its bank statement shows $6,560 on

e close of business on August 31.

cash receipts of $3,240 were placed in the

ht depository after banking hours and were not

on the August 31 bank statement.

statement shows a $320 NSF check from a

the company has not yet recorded this NSF

ng checks as of August 31 total $3,120.

ng the bank statement, an $280 check written

c Fruits was mistakenly drawn against Organic

count.

st 31 bank statement lists $220 in bank service

he company has not yet recorded the cost of

rices.

reconciliation using the above information.

ORGANIC FOOD COMPANY

Bank Reconciliation

August 31

ce

Book balance

Add:

Deduct:

Adjusted book balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College