ulation of earnings available for common stockholders divided by common stock equity?

ulation of earnings available for common stockholders divided by common stock equity?

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 66P

Related questions

Question

please help me answer and analyze the following

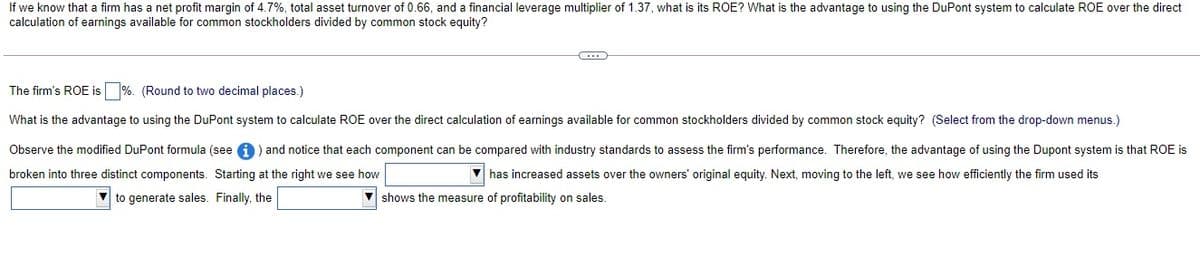

Transcribed Image Text:If we know that a firm has a net profit margin of 4.7%, total asset turnover of 0.66, and a financial leverage multiplier of 1.37, what is its ROE? What is the advantage to using the DuPont system to calculate ROE over the direct

calculation of earnings available for common stockholders divided by common stock equity?

The firm's ROE is %. (Round to two decimal places.)

What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity? (Select from the drop-down menus.)

Observe the modified DuPont formula (see a ) and notice that each component can be compared with industry standards to assess the firm's performance. Therefore, the advantage of using the Dupont system is that ROE is

broken into three distinct components. Starting at the right we see how

V has increased assets over the owners' original equity. Next, moving to the left, we see how efficiently the firm used its

to generate sales. Finally, the

shows the measure of profitability on sales

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage