What is the total non-controlling interest in net income of subsidiary (NCINI5) on Dec 31, 20x5?

What is the total non-controlling interest in net income of subsidiary (NCINI5) on Dec 31, 20x5?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

QUESTIONS:

1. What is the total non-controlling interest in net income of subsidiary (NCINI5) on Dec 31, 20x5?

2. What is the amount of consolidated assets on Dec 31, 20x5?

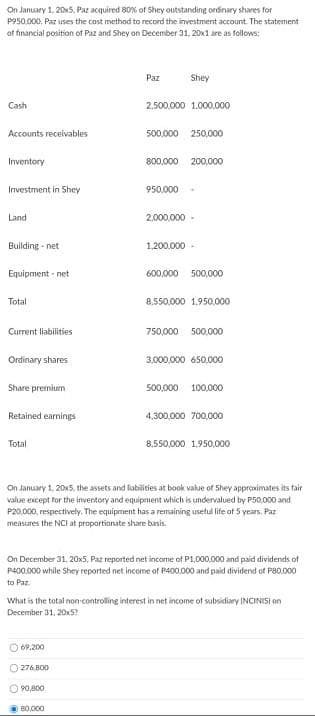

Transcribed Image Text:On January 1, 20x5, Paz acquired 80% of Shey outstanding ordinary shares for

P950.000, Paz uses the cost method to record the investment account. The statement

at financial position of Paz and Shey on December 31, 20x1 are as follows:

Paz

Shey

Cash

2.500.000 1.000.000

Accounts receivables

500.000 250,000

Inventory

B00,000 200,000

Investment in Shey

950.000

Land

2,000,000 -

Building - net

1.200.000 -

Equipment - net

600,000 500,000

Total

8.550.000 1.950,000

Current liabilities

750,000 500,000

Ordinary shares

3,000,000 650,000

Share premium

500,000 100,000

Retained earnings

4,300,000 700,000

Total

8.550,000 1.950.000

On January 1. 20x5, the assets and labities at book value of Shey approximates its fair

value except for the inventory and equipment which is undervalued by P50.000 and

P20.000, respectively,. The equipment has a remaining usetul lite of 5 years. Paz

measures the NCI at proportionate share basis.

On December 31. 20x5, Paz reported net income of P1,000,000 and paid dividends oft

P400.000 while Shey reported net income of P400,000 and paid dividend of P80.000

to Paz.

What is the total non controlling interest in net income of subsidiary INCINISI on

December 31, 20x5?

O 69.200

O 276 B00

O P0,800

B0,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning