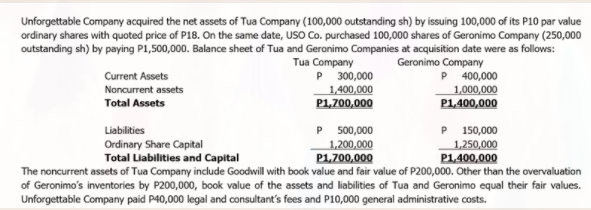

Unforgettable Company acquired the net assets of Tua Company (100,000 outstanding sh) by issuing 100,000 of its P10 par value ordinary shares with quoted price of P18. On the same date, USO Co. purchased 100,000 shares of Geronimo Company (250,000 outstanding sh) by paying P1,500,000. Balance sheet of Tua and Geronimo Companies at acquisition date were as follows: Tua Company Geronimo Company P 400,000 1,000,000 P1.400,000 Current Assets P 300,000 Noncurrent assets 1,400,000 P1,700,000 Total Assets P 500,000 1,200,000 P1,700,000 P 150,000 1,250,000 Liabilities Ordinary Share Capital Total Liabilities and Capital P1.400,000 The noncurrent assets of Tua Company include Goodwill with book value and fair value of P200,000. Other than the overvaluation of Geronimo's inventories by P200,000, book value of the assets and liabilities of Tua and Geronimo equal their fair values. Unforgettable Company paid P40,000 legal and consultant's fees and P10,000 general administrative costs.

Unforgettable Company acquired the net assets of Tua Company (100,000 outstanding sh) by issuing 100,000 of its P10 par value ordinary shares with quoted price of P18. On the same date, USO Co. purchased 100,000 shares of Geronimo Company (250,000 outstanding sh) by paying P1,500,000. Balance sheet of Tua and Geronimo Companies at acquisition date were as follows: Tua Company Geronimo Company P 400,000 1,000,000 P1.400,000 Current Assets P 300,000 Noncurrent assets 1,400,000 P1,700,000 Total Assets P 500,000 1,200,000 P1,700,000 P 150,000 1,250,000 Liabilities Ordinary Share Capital Total Liabilities and Capital P1.400,000 The noncurrent assets of Tua Company include Goodwill with book value and fair value of P200,000. Other than the overvaluation of Geronimo's inventories by P200,000, book value of the assets and liabilities of Tua and Geronimo equal their fair values. Unforgettable Company paid P40,000 legal and consultant's fees and P10,000 general administrative costs.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter8: Investing Activities

Section: Chapter Questions

Problem 19PC

Related questions

Question

q20. the

Transcribed Image Text:Unforgettable Company acquired the net assets of Tua Company (100,000 outstanding sh) by issuing 100,000 of its P10 par value

ordinary shares with quoted price of P18. On the same date, USO Co. purchased 100,000 shares of Geronimo Company (250,000

outstanding sh) by paying P1,500,000. Balance sheet of Tua and Geronimo Companies at acquisition date were as follows:

Tua Company

P 300,000

1,400,000

P1,700,000

Geronimo Company

P 400,000

1,000,000

P1.400,000

Current Assets

Noncurrent assets

Total Assets

Liabilities

Ordinary Share Capital

Total Lilabilities and Capital

P 500,000

1,200,000

P1,700,000

P 150,000

1,250,000

P1,400,000

The noncurrent assets of Tua Company include Goodwill with book value and fair value of P200,000. Other than the overvaluation

of Geronimo's inventories by P200,000, book value of the assets and liabilities of Tua and Geronimo equal their fair values.

Unforgettable Company paid P40,000 legal and consultant's fees and P10,000 general administrative costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning