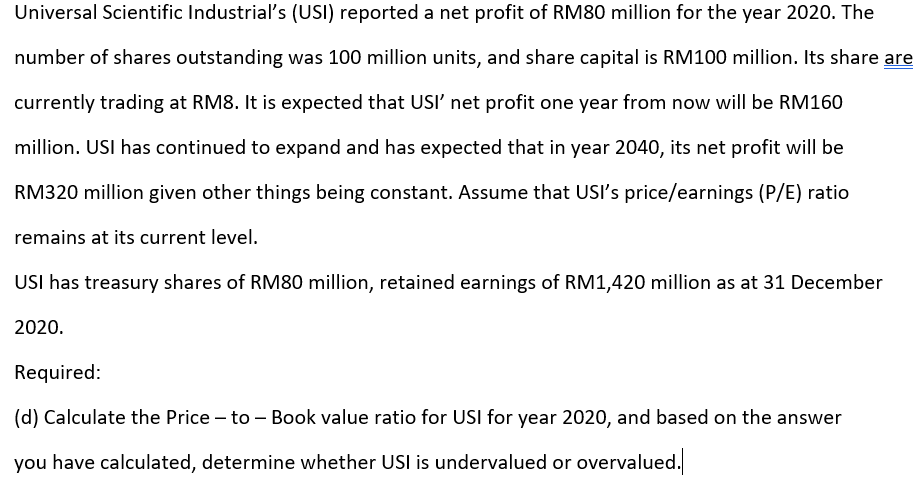

Universal Scientific Industrialľ's (USI) reported a net profit of RM80 million for the year 2020. The number of shares outstanding was 100 million units, and share capital is RM100 million. Its share are currently trading at RM8. It is expected that USI' net profit one year from now will be RM160 million. USI has continued to expand and has expected that in year 2040, its net profit will be RM320 million given other things being constant. Assume that USI's price/earnings (P/E) ratio remains at its current level. USI has treasury shares of RM80 million, retained earnings of RM1,420 million as at 31 December 2020. Required: (d) Calculate the Price – to – Book value ratio for USI for year 2020, and based on the answer you have calculated, determine whether USI is undervalued or overvalued.

Universal Scientific Industrialľ's (USI) reported a net profit of RM80 million for the year 2020. The number of shares outstanding was 100 million units, and share capital is RM100 million. Its share are currently trading at RM8. It is expected that USI' net profit one year from now will be RM160 million. USI has continued to expand and has expected that in year 2040, its net profit will be RM320 million given other things being constant. Assume that USI's price/earnings (P/E) ratio remains at its current level. USI has treasury shares of RM80 million, retained earnings of RM1,420 million as at 31 December 2020. Required: (d) Calculate the Price – to – Book value ratio for USI for year 2020, and based on the answer you have calculated, determine whether USI is undervalued or overvalued.

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 10P

Related questions

Question

Please help me

Transcribed Image Text:Universal Scientific Industrial's (USI) reported a net profit of RM80 million for the year 2020. The

number of shares outstanding was 100 million units, and share capital is RM100 million. Its share are

currently trading at RM8. It is expected that USI' net profit one year from now will be RM160

million. USI has continued to expand and has expected that in year 2040, its net profit will be

RM320 million given other things being constant. Assume that USI's price/earnings (P/E) ratio

remains at its current level.

USI has treasury shares of RM80 million, retained earnings of RM1,420 million as at 31 December

2020.

Required:

(d) Calculate the Price – to – Book value ratio for USI for year 2020, and based on the answer

you have calculated, determine whether USI is undervalued or overvalued.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning