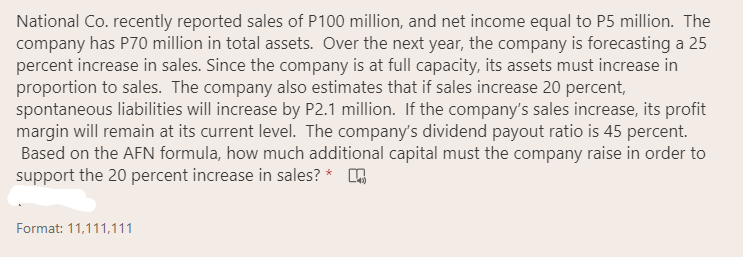

National Co. recently reported sales of P100 million, and net income equal to P5 million. The company has P70 million in total assets. Over the next year, the company is forecasting a 25 percent increase in sales. Since the company is at full capacity, its assets must increase in proportion to sales. The company also estimates that if sales increase 20 percent, spontaneous liabilities will increase by P2.1 million. If the company's sales increase, its profit margin will remain at its current level. The company's dividend payout ratio is 45 percent. Based on the AFN formula, how much additional capital must the company raise in order to support the 20 percent increase in sales? *

National Co. recently reported sales of P100 million, and net income equal to P5 million. The company has P70 million in total assets. Over the next year, the company is forecasting a 25 percent increase in sales. Since the company is at full capacity, its assets must increase in proportion to sales. The company also estimates that if sales increase 20 percent, spontaneous liabilities will increase by P2.1 million. If the company's sales increase, its profit margin will remain at its current level. The company's dividend payout ratio is 45 percent. Based on the AFN formula, how much additional capital must the company raise in order to support the 20 percent increase in sales? *

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 9P

Related questions

Question

10

Transcribed Image Text:National Co. recently reported sales of P100 million, and net income equal to P5 million. The

company has P70 million in total assets. Over the next year, the company is forecasting a 25

percent increase in sales. Since the company is at full capacity, its assets must increase in

proportion to sales. The company also estimates that if sales increase 20 percent,

spontaneous liabilities will increase by P2.1 million. If the company's sales increase, its profit

margin will remain at its current level. The company's dividend payout ratio is 45 percent.

Based on the AFN formula, how much additional capital must the company raise in order to

support the 20 percent increase in sales? * A

Format: 11,111,111

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning