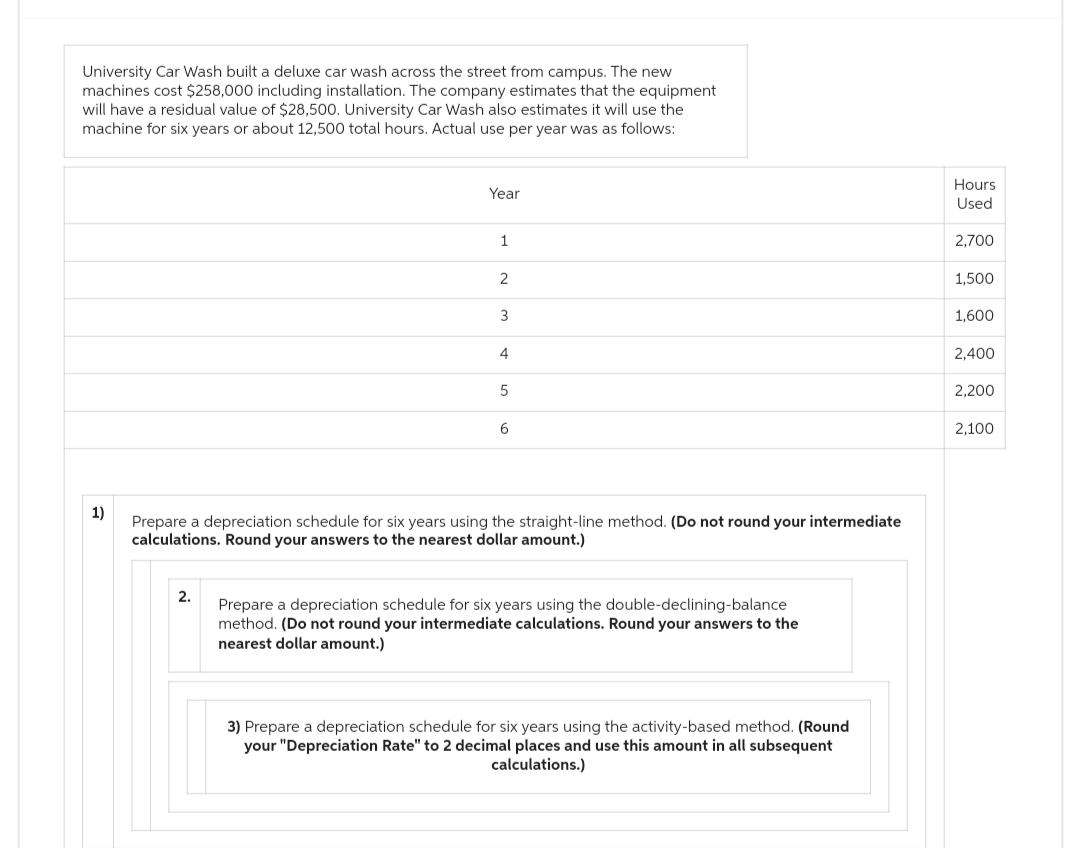

University Car Wash built a deluxe car wash across the street from campus. The new machines cost $258,000 including installation. The company estimates that the equipment will have a residual value of $28,500. University Car Wash also estimates it will use the machine for six years or about 12,500 total hours. Actual use per year was as follows: 1) Year 2. 1 2 3 4 5 6 Prepare a depreciation schedule for six years using the straight-line method. (Do not round your intermediate calculations. Round your answers to the nearest dollar amount.) Prepare a depreciation schedule for six years using the double-declining-balance method. (Do not round your intermediate calculations. Round your answers to the nearest dollar amount.) 3) Prepare a depreciation schedule for six years using the activity-based method. (Round your "Depreciation Rate" to 2 decimal places and use this amount in all subsequent calculations.) Hours Used 2,700 1,500 1,600 2,400 2,200 2,100

University Car Wash built a deluxe car wash across the street from campus. The new machines cost $258,000 including installation. The company estimates that the equipment will have a residual value of $28,500. University Car Wash also estimates it will use the machine for six years or about 12,500 total hours. Actual use per year was as follows: 1) Year 2. 1 2 3 4 5 6 Prepare a depreciation schedule for six years using the straight-line method. (Do not round your intermediate calculations. Round your answers to the nearest dollar amount.) Prepare a depreciation schedule for six years using the double-declining-balance method. (Do not round your intermediate calculations. Round your answers to the nearest dollar amount.) 3) Prepare a depreciation schedule for six years using the activity-based method. (Round your "Depreciation Rate" to 2 decimal places and use this amount in all subsequent calculations.) Hours Used 2,700 1,500 1,600 2,400 2,200 2,100

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 15PB: Urquhart Global purchases a building to house its administrative offices for $500,000. The best...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:University Car Wash built a deluxe car wash across the street from campus. The new

machines cost $258,000 including installation. The company estimates that the equipment

will have a residual value of $28,500. University Car Wash also estimates it will use the

machine for six years or about 12,500 total hours. Actual use per year was as follows:

1)

Year

1

2

3

4

5

6

Prepare a depreciation schedule for six years using the straight-line method. (Do not round your intermediate

calculations. Round your answers to the nearest dollar amount.)

Prepare a depreciation schedule for six years using the double-declining-balance

method. (Do not round your intermediate calculations. Round your answers to the

nearest dollar amount.)

3) Prepare a depreciation schedule for six years using the activity-based method. (Round

your "Depreciation Rate" to 2 decimal places and use this amount in all subsequent

calculations.)

Hours

Used

2,700

1,500

1,600

2,400

2,200

2,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning