Unknown Variable Name A B C Semiannual required return Based on this equation and the data, it is value greater than $1,000. Variable Value $1,000 to expect that Jackson's potential bond investment is currently exhibiting an intrinsic Now, consider the situation in which Jackson wants to earn a return of 13.75%, but the bond being considered for purchase offers a coupon rate of 15.75%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to (rounded to the nearest whole dollar) is its par value, so that the the nearest whole dollar, then its intrinsic value of bond is Given your computation and conclusions, which of the following statements is true?

Unknown Variable Name A B C Semiannual required return Based on this equation and the data, it is value greater than $1,000. Variable Value $1,000 to expect that Jackson's potential bond investment is currently exhibiting an intrinsic Now, consider the situation in which Jackson wants to earn a return of 13.75%, but the bond being considered for purchase offers a coupon rate of 15.75%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to (rounded to the nearest whole dollar) is its par value, so that the the nearest whole dollar, then its intrinsic value of bond is Given your computation and conclusions, which of the following statements is true?

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 9Q: In Chapter 7, we saw that if the market interest rate, rd, for a given bond increased, the price of...

Related questions

Question

Transcribed Image Text:Complete the following table by identifying the appropriate corresponding variables used in the equation.

Unknown Variable Name.

A

B

C

Semiannual required return

Based on this equation and the data, it is

value greater than $1,000.

Variable Value

$1,000

to expect that Jackson's potential bond investment is currently exhibiting an intrinsic

Now, consider the situation in which Jackson wants to earn a return of 13.75%, but the bond being considered for purchase offers a coupon rate of

15.75%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to

(rounded to the nearest whole dollar) is

its par value, so that the

the nearest whole dollar, then its intrinsic value of

bond is

Given your computation and conclusions, which of the following statements is true?

OA bond should trade at a par when the coupon rate is greater than Jackson's required return.

When the coupon rate is greater than Jackson's required return, the bond should trade at a discount.

O When the coupon rate is greater than Jackson's required return, the bond should trade at a premium.

When the coupon rate is greater than Jackson's required return, the bond's intrinsic value will be less than its par value.

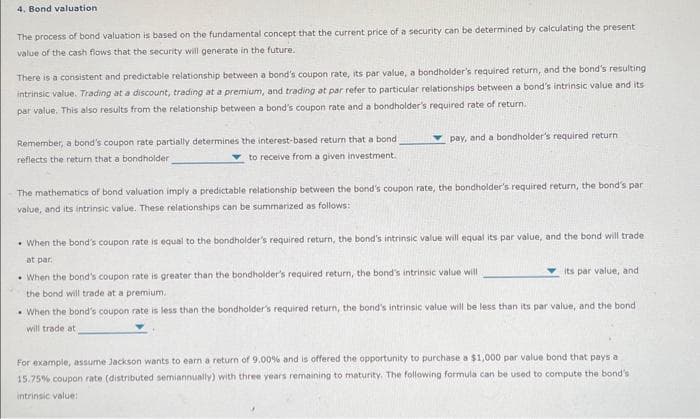

Transcribed Image Text:4. Bond valuation

The process of bond valuation is based on the fundamental concept that the current price of a security can be determined by calculating the present

value of the cash flows that the security will generate in the future.

There is a consistent and predictable relationship between a bond's coupon rate, its par value, a bondholder's required return, and the bond's resulting

intrinsic value. Trading at a discount, trading at a premium, and trading at par refer to particular relationships between a bond's intrinsic value and its

par value. This also results from the relationship between a bond's coupon rate and a bondholder's required rate of return.

Remember, a bond's coupon rate partially determines the interest-based return that a bond i

reflects the return that a bondholder

to receive from a given investment.

pay, and a bondholder's required return

The mathematics of bond valuation imply a predictable relationship between the bond's coupon rate, the bondholder's required return, the bond's par

value, and its intrinsic value. These relationships can be summarized as follows:

When the bond's coupon rate is equal to the bondholder's required return, the bond's intrinsic value will equal its par value, and the bond will trade

at par.

When the bond's coupon rate is greater than the bondholder's required return, the bond's intrinsic value will

the bond will trade at a premium.

When the bond's coupon rate is less than the bondholder's required return, the bond's intrinsic value will be less than its par value, and the bond i

will trade att

its par value, and

For example, assume Jackson wants to earn a return of 9.00% and is offered the opportunity to purchase a $1,000 par value bond that pays a

15.75% coupon rate (distributed semiannually) with three years remaining to maturity. The following formula can be used to compute the bond's.

intrinsic value:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning