Initial cost (Year O) Annual operations and maintenance costs (Years 1 thru 5) Annual gross benefits (Years 1 thru 5) Upload Choose a File Portland, OR Bend, OR $700,000 $800,000 $600,000 500,000 Boise, ID 800,000 1,000,000 400,000 Seattle, WA $1,000,000 1,100,000 1,375,000 625,000 1,500,000

Initial cost (Year O) Annual operations and maintenance costs (Years 1 thru 5) Annual gross benefits (Years 1 thru 5) Upload Choose a File Portland, OR Bend, OR $700,000 $800,000 $600,000 500,000 Boise, ID 800,000 1,000,000 400,000 Seattle, WA $1,000,000 1,100,000 1,375,000 625,000 1,500,000

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 3TP: Brindis Babysitting Center currently rents a 1200 sq foot facility for her 20-child facility. Her...

Related questions

Question

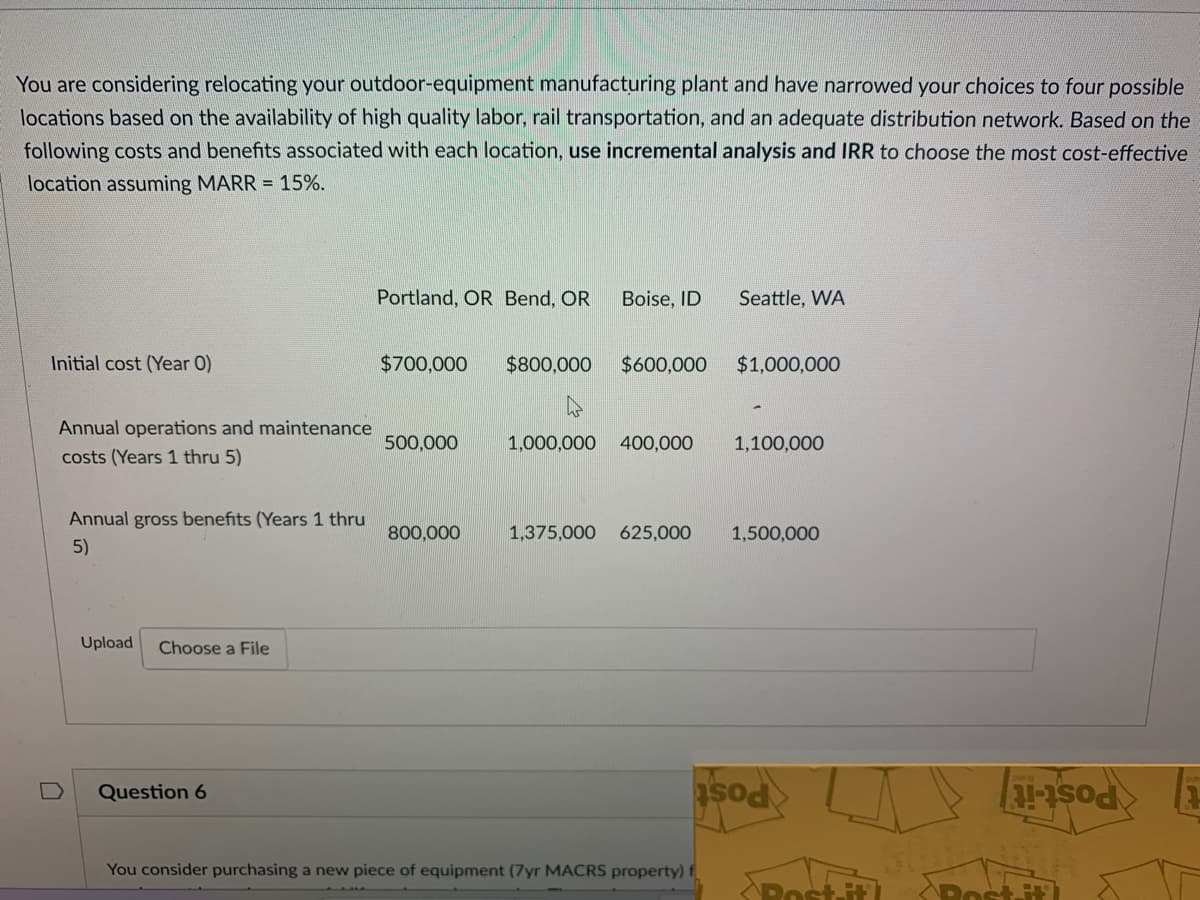

Transcribed Image Text:You are considering relocating your outdoor-equipment manufacturing plant and have narrowed your choices to four possible

locations based on the availability of high quality labor, rail transportation, and an adequate distribution network. Based on the

following costs and benefits associated with each location, use incremental analysis and IRR to choose the most cost-effective

location assuming MARR = 15%.

Initial cost (Year 0)

Annual operations and maintenance

costs (Years 1 thru 5)

Annual gross benefits (Years 1 thru

5)

Upload Choose a File

Question 6

Portland, OR Bend, OR Boise, ID

$700,000 $800,000 $600,000

500,000

800,000

Seattle, WA

$1,000,000

1,000,000 400,000 1,100,000

You consider purchasing a new piece of equipment (7yr MACRS property) f

1,375,000 625,000 1,500,000

sod

POLE

1-10 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning