Unreleased checks a Are outstanding checks b. Are treated as certified checks c. Are part of the payor's cash balance Should be a book-reconciling item si d.

Unreleased checks a Are outstanding checks b. Are treated as certified checks c. Are part of the payor's cash balance Should be a book-reconciling item si d.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter10: Auditing Cash, Marketable Securities, And Complex Financial Instruments

Section: Chapter Questions

Problem 31CYBK

Related questions

Question

Please answer asap

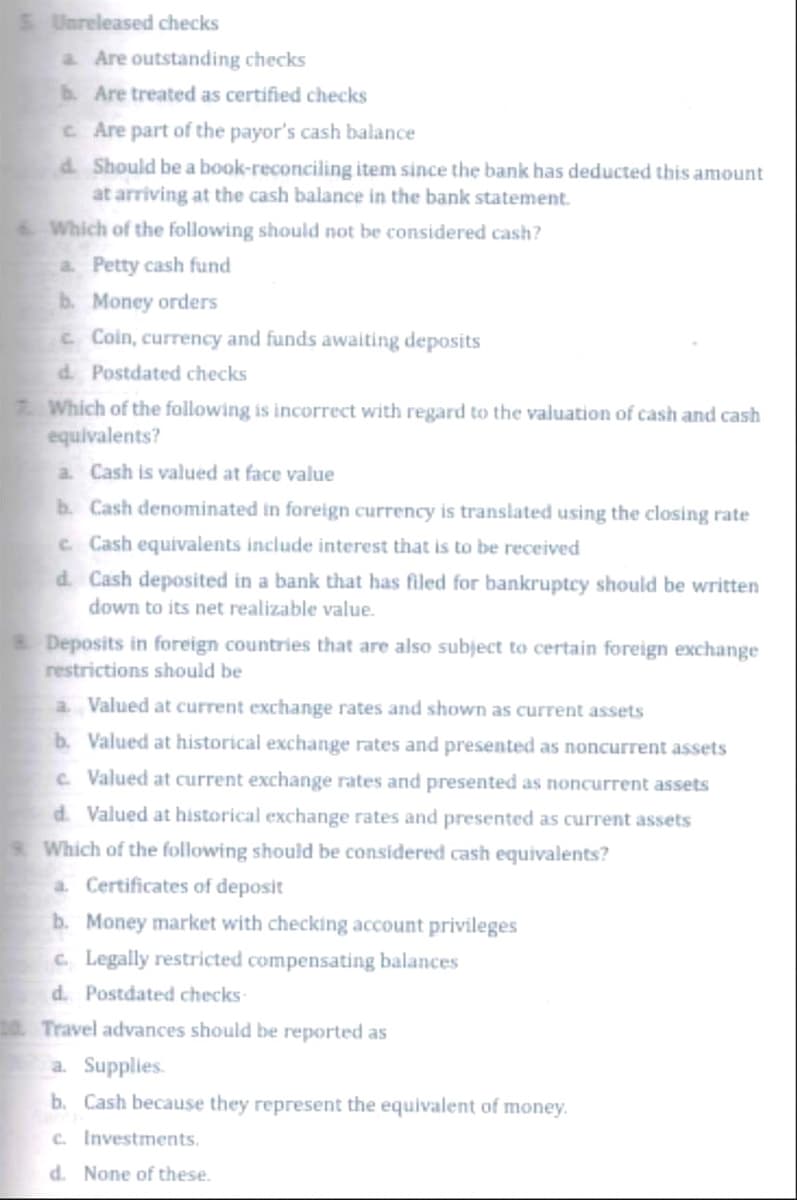

Transcribed Image Text:5. Unreleased checks

a Are outstanding checks

b. Are treated as certified checks

c. Are part of the payor's cash balance

d. Should be a book-reconciling item since the bank has deducted this amount

at arriving at the cash balance in the bank statement.

Which of the following should not be considered cash?

a. Petty cash fund

b. Money orders

c Coin, currency and funds awaiting deposits

d. Postdated checks

7. Which of the following is incorrect with regard to the valuation of cash and cash

equivalents?

a. Cash is valued at face value

b. Cash denominated in foreign currency is translated using the closing rate

c. Cash equivalents include interest that is to be received

d. Cash deposited in a bank that has filed for bankruptcy should be written

down to its net realizable value.

Deposits in foreign countries that are also subject to certain foreign exchange

restrictions should be

a. Valued at current exchange rates and shown as current assets

b. Valued at historical exchange rates and presented as noncurrent assets

c. Valued at current exchange rates and presented as noncurrent assets

d. Valued at historical exchange rates and presented as current assets

s. Which of the following should be considered cash equivalents?

a. Certificates of deposit

b. Money market with checking account privileges

c. Legally restricted compensating balances

d. Postdated checks-

10. Travel advances should be reported as

a. Supplies.

b. Cash because they represent the equivalent of money.

c. Investments.

d. None of these.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College