Upward and Onward, Inc., a5 S501(e)(3) organization that provides training programs for government assistance recipients, reports the following income and expenses from the sale of products associated with the training program.

Upward and Onward, Inc., a5 S501(e)(3) organization that provides training programs for government assistance recipients, reports the following income and expenses from the sale of products associated with the training program.

Chapter2: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 14SP

Related questions

Question

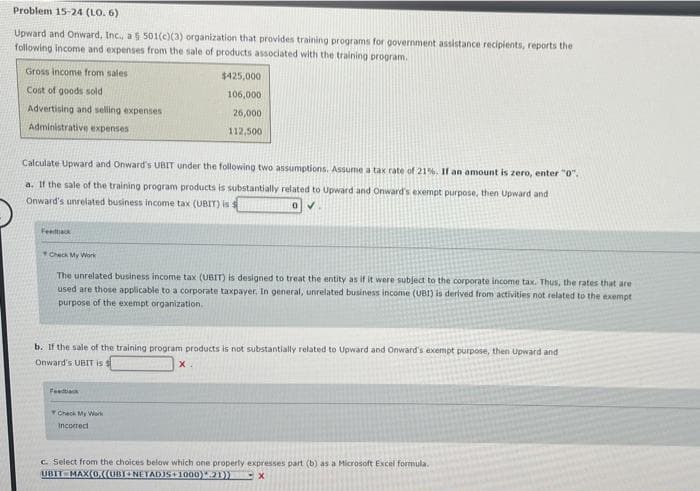

Transcribed Image Text:Problem 15-24 (LO. 6)

Upward and Onward, Inc., a 5 501(c)(3) organization that provides training programs for government assistance recipients, reports the

following income and expenses from the sale of products associated with the training program.

Gross income from sales

$425,000

Cost of goods sold

106,000

Advertising and selling expenses

26,000

Administrative expenses

112,500

Calculate Upward and Onward's UBIT under the following two assumptions. Assume a tax rate of 21%. It an amount is zero, enter "0".

a. If the sale of the training program products is substantially related to Upward and Onward's exempt purpose, then Upward and

Onward's unrelated business income tax (UBIT) is

Veedack

Check My Work

The unrelated business income tax (UBIT) is designed to treat the entity as if it were subject to the corporate income tax. Thus, the rates that are

used are those applicable to a corporate taxpayer, In general, unrelated business income (UBI) is derived from activities not related to the exempt

purpose of the exempt organization.

b. If the sale of the training program products is not substantially related to Upward and Onward's exempt purpose, then Upward and

Onward's UBIT is s

X.

Feetk

Check My Work

Incorrect

C. Select from the choices below which one properly expresses part (b) as a Microsoft Excel formula.

UBIT MAX(0,((UBINETADIS+1000)1)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you