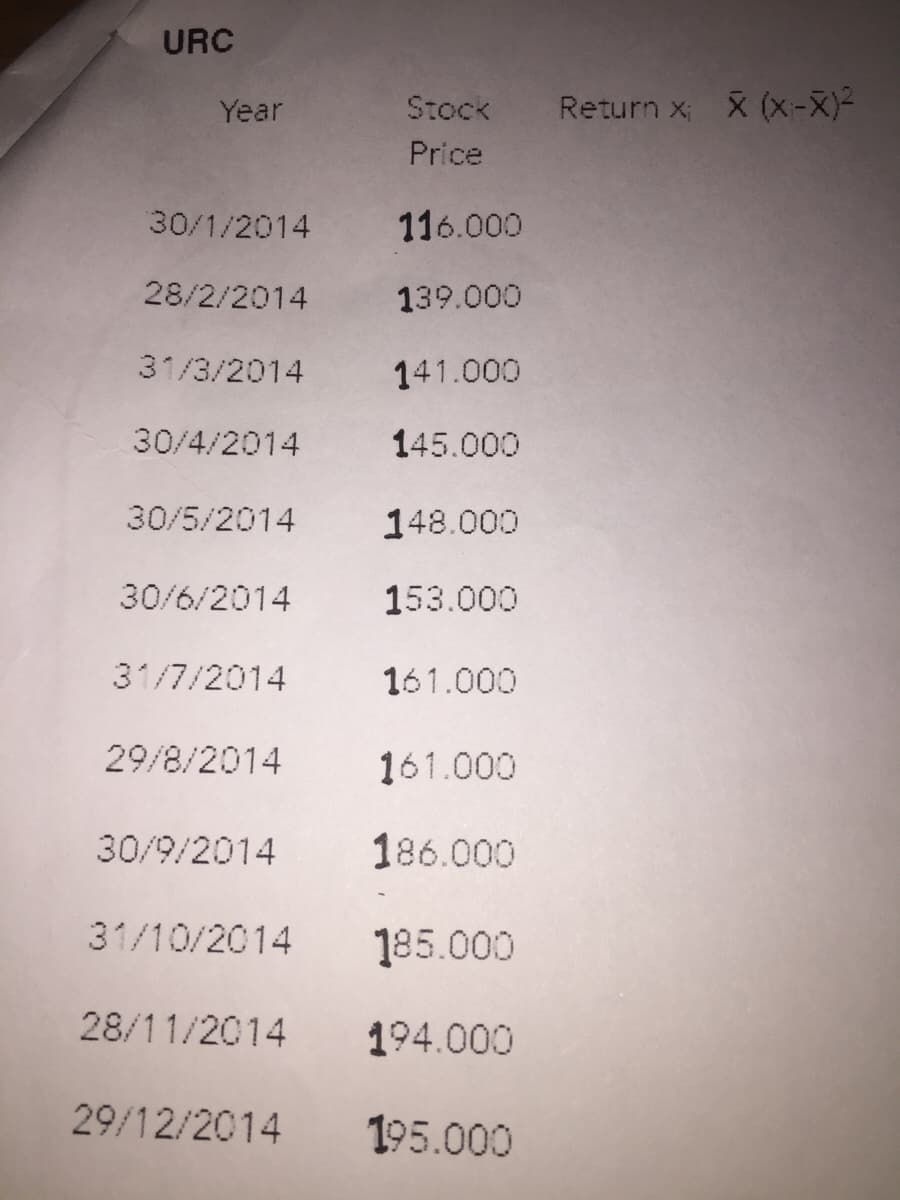

URC Stock Return x; X (x-X)² Year Price 30/1/2014 116.000 28/2/2014 139.000 31/3/2014 141.000 30/4/2014 145.000 30/5/2014 148.000 30/6/2014 153.000 31/7/2014 161.000 29/8/2014 161.000 30/9/2014 186.000 31/10/2014 185.000 28/11/2014 194.000 29/12/2014 195.000

Q: Explanation of Solution Determine the increase in stock price Stock Pr ice = [EPS × PERatio] -…

A: EPS is calculated using the Pat i.e. Net Profit after Tax divided by the No. of the company's shares…

Q: stment for Baldwin will be $212.290,124 s will be $124,190.791 ue stock totaling 52853.000 stal will…

A: Equity and debt are long term sources of capital and are not used in working capital.

Q: Number of price Number of price share T share T+1 A 5000 20 10,000 12 В 8000 40 8000 44 C 15000 10…

A: Hi, since you have posted multiple questions, we will answer only the first one as per authoring…

Q: Questions 7 & 8 use this table: Year 2016 2017 2018 2019 Price N/A N/A N/A N/A $68.12 $95.32 $104.18…

A: Data given Year 2016 2017 2018 2019 Price ($) N/A 68.12 95.32 104.18 EPS N/A -7.55…

Q: Pioneer's preferred stock is selling for $40 in the market and pays a $4.40 annual dividend. a.…

A: Value of a preferred stock depends on the dividend amount paid by the stock and the investor’s…

Q: Investors require a 17% rate of return on Levine Company's stock (i.e., rs = 17%). What is its…

A: 1) Value of stock = D0 *(1+g) / (ke -g) Where, D0 = $2.50 g = growth rates ke = 17%

Q: Calculate Expected return and standard deviation of returns if the investor purchases the stock at…

A: The expected return and standard deviation are two statistical measures that can be used to analyze…

Q: v Investments: High-Dividend Stocks (Compare Exercise 42 in Section 6.1.) During the first quarter…

A: The Plains All American Pipeline LP (PAA) cost $50 per share. A yield of 5% was expected from PAA…

Q: REF’s EPS in current year (2020) is $12. It was $8 in year 2015. The company pays out 40% of its…

A: The cost of equity is the expected return of equity investors.

Q: The market price of a stock is $24.51 and it just paid a dividend of $1.94. The required rate of…

A: The conceptual formula used:

Q: Using the stock table for Dell Technologies below, calculate the earnings per share. Round your…

A: EPS: EPS stands for Earnings per share. It tells about the profit earned on each share. EPS = […

Q: a. What is the stock's value to you, the investor? b. Should you purchase the stock?

A: Stock valuation refers to the method or techniques that is used by the company’s or investors to…

Q: Ashely's CFO wants to use P/E ratio to value the stock's terminal value in year 4. The CFO forecasts…

A: The price-to-earnings ratio (P/E ratio) is a valuation ratio that compares a company's current share…

Q: What is the yield to maturity of a share of Six Flags B $1.88 preferred stock if the investor buys…

A: Yield to maturity on the preferred stock is equal to required rate on preferred stock

Q: Forecast Year 2. 4 Terminal No. of outstanding shares. Terminsi year growih raie Cost of eguity 500…

A: Particulars Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 O/S Shares 500 500 500 500 500 500 Net…

Q: What is the yield to maturity of a share of Six Flags B $1.88 preferred stock if the investor buys…

A: Given information: Preferred stock dividend is $1.88 Stock price is $32.00

Q: Use the following information regarding Duke Energy stock to answer Questions 25-28: 52 Weeks VOL…

A: Dividends are the returns that will be paid to the investors who hold the stock of the company. This…

Q: Use the given stock table to find the closing price for ABC Technologies (ABC). 52-Week High 76.63…

A: Stock Table: To get an insight into the performance of the particular stock, one should read the…

Q: III.Determine the total transaction fee of each stock investment when it will be sold. Complete the…

A: 13. Transaction price = 1000 shares * P 217.75 = P217,750 14. Broker's commission is calculated on…

Q: Quèstion 12 What is the covariance of returns between stocks A and B? Expected retum of A is 30% and…

A: Data given: Expected return of A =30% Expected return of B = 23.333333% Year Return A Return B…

Q: Question 5. Volatility and Option Hedging Today, is January 4, 2016. IBM common…

A: Stoc price today is $135.95 Strike price is $130 Call Price is $6.50 risk free rate is 0.58% Expiry…

Q: pllowing stocks and the PSEI. 2. AGI SM Year Stock Return x x (x--X)² Year Stock Return x x (X;-x)²…

A: Note: As per our guidelines, we can only answer one question at once. Please post other questions…

Q: Use the given stock table to find the closing price for ABC Technologies (ABC). 52-Week Div Yld Vol…

A: In the stock table Close is taken as Closing Price

Q: (S in millions) 2024 $182 $29 2023 $279 $24 Net income Dividends on preferred stock Average shares…

A: Price-earnings ratio measures what is ratio between the market price per share and earnings per…

Q: F H. Inputs for GE Year Dividend Div growth Term value Investor CF beta 1.1 2017 1.04 1.04 mkt_prem…

A: According to the question, from year 2032, the growth rate becomes constant to 9.10%. Hence,…

Q: Stock Return x X (x-X) Year Price 704.500 30/1/2014 694.000 28/2/2014 31/3/2014 705.000 30/4/2014…

A: To find the returns, we will use the following formula, = (current price - previous price) /…

Q: What is the yield to maturity of a share of Six Flags B $1.88 preferred stock if the investor buys…

A: Yield to maturity = Annual dividend / Share price

Q: Year AT&T Stock Returns Market Index Returns 1 8…

A: Beta of a stock is the slope between the market return and the stock return and is calculated in…

Q: X company stock price was $10 at the beginning of 2018, $14 at the beginning of 2019, $15 at the…

A: Coefficient of variation The coefficient of variation is an important statistical measure used in…

Q: Stock Alpha and Stock Beta have following historical returns. Mr. Andersion invested 60% of his…

A: since there are more than 3 subparts of the question answers of only 1st 3 subparts will be…

Q: Question 5. Volatility and Option Hedging Today, is January 4, 2016. IBM common…

A: To Find: Historic Volatility

Q: (Common stock valuation) Abercrombie & Fitch's common stock pays a dividend of $1.75. It is…

A: Dividend amount (D1) = $1.75 Stock price (P0) = $37.65 Required return (r) = 11% Growth rate = g

Q: A B C D Stock Edita Telecom Egypt CIB Remco Price on April 7th 8 EGP 14.8 EGP 70.25 EGP…

A: Marginal Call: It is the demand for additional capital and is occurred if there is low fund in…

Q: What is the yield to maturity of a share of Six Flags B $1.88 preferred stock if the investor buys…

A: Given data; price of preferred stock = $27 dividend =$1.88

Q: Joe Corps Stock Over the Last 10 years –Beta = 1.1 –Market risk premium = 10% –Current risk-free…

A: Answer: Cost of equity under DGM model is correct. Solution: Calculation of Dividend Growth rate:…

Q: The preferred stock of Placer Corp currently sells for OMR44.44 per share. The annual dividend of…

A: Preferred dividends earn a constant or fixed dividend on their stock in perpetuity. Their rate of…

Q: stock market Future market January KLSE composite index stands at 1162. Investor expects to purchase…

A: The question is related to Spot transactions profit or loss.

Q: Long 1 lot Syarikat XYZ stock @ RM 15Long 1, 3-month Syarikat XYZ put @ RM 0.15 B C D E…

A: Here,

Q: Preferred stock Par value Sale price Flotation cost Annual dividend A $ 100 $…

A: Par value = $ 35 Sale price = $ 37 Flotation cost = $ 4 Annual dividend = $ 5

Q: Question 1- Texas Instruments (TXN) (please include your Excel spreadsheet file!) Actual data for…

A: An Investment is an asset with the goal of generating Income. Investors get return from the…

Q: DMC Year Stock Return x X (x-X)2 Price 30/1/2014 11.768 28/2/2014 13.657 31/3/2014 13.775 30/4/2014…

A: The formula used is shown:

Q: ABD common stock is selling for $36.08 a share. The company has earnings per share of S.34 and a…

A: Market - to Book Value Ratio refers to the ratio which makes the use of the market price and book…

Q: Suppose a stock you bought one year ago at $102.65 recently paid you a dividend of $3.17. You sold…

A: Holding period return can be defined as the total return generated over from a security over a…

Q: preferred stock from Duquesne Light Company (DQUPRA) pays $3.55 in annual dividends. If the…

A: Solution: Preferred stock are those stock which gets preference in receiving dividends over common…

Q: Year AT&T Stock Returns Market Index Returns 1 8…

A: Correlation: It shows the relationship between the movement of the return of two stocks or assets…

Risk and return

Before understanding the concept of Risk and Return in Financial Management, understanding the two-concept Risk and return individually is necessary.

Capital Asset Pricing Model

Capital asset pricing model, also known as CAPM, shows the relationship between the expected return of the investment and the market at risk. This concept is basically used particularly in the case of stocks or shares. It is also used across finance for pricing assets that have higher risk identity and for evaluating the expected returns for the assets given the risk of those assets and also the cost of capital.

Step by step

Solved in 2 steps with 3 images

- Present and future values of $1 at 3% are presented below: N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.91347 4 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 7 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 9 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12.8078 9.25262 13.1920 9.53020 12 1.42576 0.70138 14.1920 9.95400 14.6178 10.25262 13 1.46853 0.68095 15.6178 10.63496 16.0863 10.95400 14 1.51259 0.66112 17.0863 11.29607 17.5989 11.63496 15 1.55797 0.64186 18.5989 11.93794 19.1569 12.29607 16 1.60471 0.62317 20.1569 12.56110 20.7616 12.93794 Debbie has $368,882 accumulated in a 401K plan. The fund…Present and future values of $1 at 3% are presented below: N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.91347 4 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 7 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 9 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12.8078 9.25262 13.1920 9.53020 12 1.42576 0.70138 14.1920 9.95400 14.6178 10.25262 13 1.46853 0.68095 15.6178 10.63496 16.0863 10.95400 14 1.51259 0.66112 17.0863 11.29607 17.5989 11.63496 15 1.55797 0.64186 18.5989 11.93794 19.1569 12.29607 16 1.60471 0.62317 20.1569 12.56110 20.7616 12.93794 Rosie's Florist borrows $300,000 to be paid off in six…attached in ss thx py42 6p2 5 25 22 5828 528

- Question Content Area Present value of $1 Periods 6% 8% 10% 12% 14% 16% 1 0.94340 0.92593 0.90909 0.89286 0.87719 0.86207 2 0.89000 0.85734 0.82645 0.79719 0.76947 0.74316 3 0.83962 0.79383 0.75131 0.71178 0.67497 0.64066 4 0.79209 0.73503 0.68301 0.63552 0.59208 0.55229 5 0.74726 0.68058 0.62092 0.56743 0.51937 0.47611 6 0.70496 0.63017 0.56447 0.50663 0.45559 0.41044 7 0.66506 0.58349 0.51316 0.45235 0.39964 0.35383 8 0.62741 0.54027 0.46651 0.40388 0.35056 0.30503 9 0.59190 0.50025 0.42410 0.36061 0.30751 0.26295 10 0.55839 0.46319 0.38554 0.32197 0.26974 0.22668 Present value of an annuity of $1 Periods 6% 8% 10% 12% 14% 16% 1 0.94340 0.92593 0.90909 0.89286 0.87719 0.86207 2 1.83339 1.78326 1.73554 1.69005 1.64666 0.74316 3 2.67301 2.57710 2.48685 2.40183 2.32163 0.64066 4 3.46511 3.31213 3.16987 3.03735 2.91371 0.55229 5 4.21236 3.99271 3.79079 3.60478 3.43308 0.47611 6 4.91732 4.62288 4.35526 4.11141 3.88867 0.41044 7 5.58238 5.20637…Present and future value tables of $1 at 3% are presented below: N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.91347 4 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 7 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 9 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12.8078 9.25262 13.1920 9.53020 12 1.42576 0.70138 14.1920 9.95400 14.6178 10.25262 13 1.46853 0.68095 15.6178 10.63496 16.0863 10.95400 14 1.51259 0.66112 17.0863 11.29607 17.5989 11.63496 15 1.55797 0.64186 18.5989 11.93794 19.1569 12.29607 16 1.60471 0.62317 20.1569 12.56110 20.7616 12.93794 Today, Thomas deposited $100,000 in a three-year,…Present and future value tables of $1 at 3% are presented below: N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.91347 4 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 7 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 9 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12.8078 9.25262 13.1920 9.53020 12 1.42576 0.70138 14.1920 9.95400 14.6178 10.25262 13 1.46853 0.68095 15.6178 10.63496 16.0863 10.95400 14 1.51259 0.66112 17.0863 11.29607 17.5989 11.63496 15 1.55797 0.64186 18.5989 11.93794 19.1569 12.29607 16 1.60471 0.62317 20.1569 12.56110 20.7616 12.93794 Shelley wants to cash in her winning lottery…

- N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.91347 4 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 7 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 9 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12.8078 9.25262 13.1920 9.53020 12 1.42576 0.70138 14.1920 9.95400 14.6178 10.25262 13 1.46853 0.68095 15.6178 10.63496 16.0863 10.95400 14 1.51259 0.66112 17.0863 11.29607 17.5989 11.63496 15 1.55797 0.64186 18.5989 11.93794 19.1569 12.29607 16 1.60471 0.62317 20.1569 12.56110 20.7616 12.93794 On January 1, 2021, you are considering making an investment that will pay three annual payments of $10,000. The first…https://cxp-cdn.cengage.info/protected/prod/assets/f0/e/f0ed7b87-70a8-4a94-ad45-3346ee92c25e.pdf?__gda__=st=1643560979~exp=1644165779~acl=%2fprotected%2fprod%2fassets%2ff0%2fe%2ff0ed7b87-70a8-4a94-ad45-3346ee92c25e.pdf*~hmac=991ee6f51bff0d022f629582b30b2e8c66862c42d5d9631354ab7ca624cd24b4Question is attached thx for the hlep lh23pl24ph24phy4y2490i623096i2309y23iy0923yu3209yu3209yu320y932uy320930 29g9