Ashely's CFO wants to use P/E ratio to value the stock's terminal value in year 4. The CFO forecasts the industry P/E ratio in y (year 0)? O A. $6.98 B. $12.56

Ashely's CFO wants to use P/E ratio to value the stock's terminal value in year 4. The CFO forecasts the industry P/E ratio in y (year 0)? O A. $6.98 B. $12.56

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter26: Mergers And Corporate Control

Section: Chapter Questions

Problem 1P: Hasting Corporation is interested in acquiring Vandell Corporation. Vandell has 1 million shares...

Related questions

Question

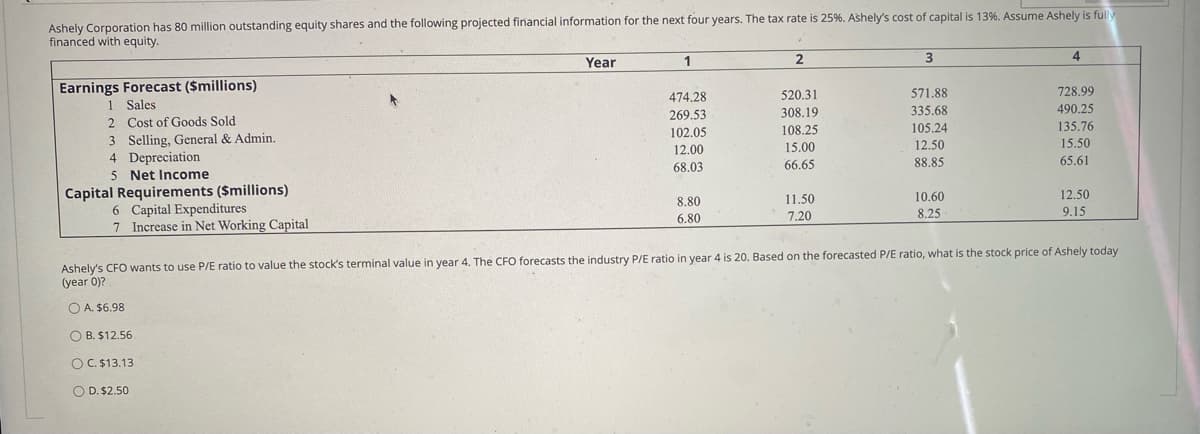

Transcribed Image Text:Ashely Corporation has 80 million outstanding equity shares and the following projected financial information for the next four years. The tax rate is 25%. Ashely's cost of capital is 13%. Assume Ashely is full

financed with equity.

Year

1

4

Earnings Forecast ($millions)

1 Sales

474.28

520.31

571.88

728.99

2 Cost of Goods Sold

269.53

308.19

335.68

490.25

3 Selling, General & Admin.

4 Depreciation

5 Net Income

Capital Requirements ($millions)

6 Capital Expenditures

7 Increase in Net Working Capital

102,05

108.25

105.24

135.76

12.00

15.00

12,50

15.50

68.03

66.65

88.85

65.61

8.80

11.50

10.60

12.50

6.80

7.20

8.25

9.15

Ashely's CFO wants to use P/E ratio to value the stock's terminal value in year 4. The CFO forecasts the industry P/E ratio in year 4 is 20. Based on the forecasted P/E ratio, what is the stock price of Ashely today

(year 0)?

O A. $6.98

O B. $12.56

OC. $13.13

O D. $2.50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning