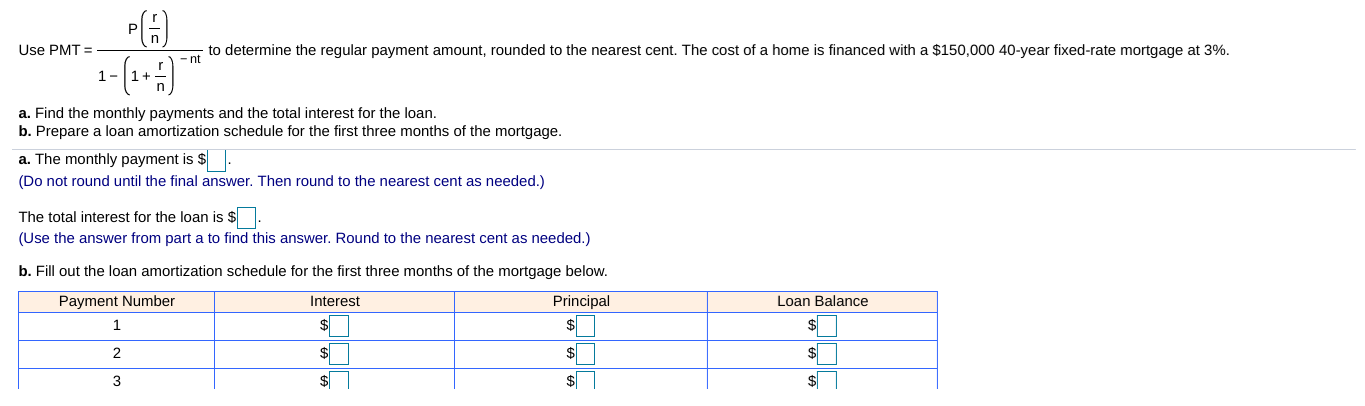

Use PMT to determine the regular payment amount, rounded to the nearest cent. The cost of a home is financed with a $150,000 40-year fixed-rate mortgage at 3% a. Find the monthly payments and the total interest for the loan. b. Prepare a loan amortization schedule for the first three months of the mortgage. a. The monthly payment is $ Do not round until the final answer. Then round to the nearest cent as needed.) The total interest for the loan is s (Use the answer fom part a to find this answer. Round to the nearest cent as needed.) b. Fill out the loan amortization schedule for the first three months of the mortgage below. Principal Loan Balance Payment Number Interest

Use PMT to determine the regular payment amount, rounded to the nearest cent. The cost of a home is financed with a $150,000 40-year fixed-rate mortgage at 3% a. Find the monthly payments and the total interest for the loan. b. Prepare a loan amortization schedule for the first three months of the mortgage. a. The monthly payment is $ Do not round until the final answer. Then round to the nearest cent as needed.) The total interest for the loan is s (Use the answer fom part a to find this answer. Round to the nearest cent as needed.) b. Fill out the loan amortization schedule for the first three months of the mortgage below. Principal Loan Balance Payment Number Interest

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 19P

Related questions

Topic Video

Question

on B (Use the answer from part a to find these answers. Round to the nearest cent as needed.)

Transcribed Image Text:Use PMT

to determine the regular payment amount, rounded to the nearest cent. The cost of a home is financed with a $150,000 40-year fixed-rate mortgage at 3%

a. Find the monthly payments and the total interest for the loan.

b. Prepare a loan amortization schedule for the first three months of the mortgage.

a. The monthly payment is $

Do not round until the final answer. Then round to the nearest cent as needed.)

The total interest for the loan is s

(Use the answer fom part a to find this answer. Round to the nearest cent as needed.)

b. Fill out the loan amortization schedule for the first three months of the mortgage below.

Principal

Loan Balance

Payment Number

Interest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning