Use the 2019 U.S. federal tax rates in the table to calculate answers to the questions below. Give all answers to two decimals. If you have a taxable income of $289,980.00, what is your top marginal tax rate? % total tax bill? $ average tax rate? %

Q: Where can the data of a Balance Sheet be useful?

A: Balance sheet is a financial statements which shows the financial position of the company. It shows…

Q: Allison is 29 years old and plans to retire at age 65 with $1,470,000 in her retirement account.…

A: Present Value- Present value is the conception that states a total of money today is value more than…

Q: On January 1 , 2021, Gray Co. issued its 10%, 4-year convertible debt instrument with a face amount…

A: Above question is based on Compounded Financial Instrument. In these type of instrument, two…

Q: What Could Go Wrong t assertion(s) Purchase order is inappropriate because: the purchase order does…

A: The answer is stated below

Q: Parker corp which operates on a calendar year, expects to sell 6000 units in october and expects…

A: A budget is used to estimate the future expected revenue or expenses. The budgeted revenue can be…

Q: -the book value at the end of (4th ) year using sum of year digits method. -If the vehicle sold…

A: Answer:

Q: a. Generally describe what provisions the partnership agreement will have to contain in order for…

A: A and B form a partnership on January 1 of Year 1. Each makes a cash contribution to the partnership…

Q: On October 20, 2018, Toffeenut Project Company purchased all the assets and assumed all the…

A: Goodwill is an intangible asset that is recognized during the process of a company buying another…

Q: Adjusting entry: On 1 February 2021, Design Thinking Pty Ltd obtained a three year bank loan of…

A: Bank loan is a long term liability for Design Thinking Pty Ltd The tenure is for 3 years The…

Q: ten empty packs returned to Brownie, customer will receive an attractive food container. The company…

A: Estimated liability (EL) refers to the obligation against which there is no definitive amount but…

Q: 3. An Con any selis IIS

A: In Cost Volume Profit analysis we always try to see that how…

Q: A and B form a partnership on January 1 of Year 1. Each makes a cash contribution to the partnership…

A: A and B form a partnership on January 1 of Year 1. Each makes a cash contribution to the…

Q: in valu ought it nomina

A: Given: Particulars Amount Invested $5,000 Year 20 Mortgage $10,000 Interest rate…

Q: Accounts Payable Accounts Receivable Accumulated depreciation, Equipment Accumulated depreciation,…

A: No. Account Titles and Explanation Debit Credit 1 Revenue $263,200 Income Summary $263,200…

Q: Relana corporation owned 75% of Shan company and in 25/6/2005 Relana. Shon company.

A: Relana owned 75% of Shan Co. which means Relana Co is holding…

Q: Unit IV question 11

A: Statement of cash flow have the following three activities: Operating activities Investing…

Q: Preferred shares, $4.55 non-cumulative, 52,000 shares authorized and issued* $ 3,328,000…

A: Cumulative Preference Shares: In the case of missing dividend payments in the past, cumulative…

Q: AJ is a 30% partner in the Trane partnership, a calendar year end entity. On January 1, AJ has an…

A: 1) AJ must first ascertain his Trane basis as of the distribution. His base is $73,000 at the start…

Q: Compute the sales of toys using the naive forecasting method.

A: Month No of Toys Sold Forecast Forecast Error Absolute value of Forecast Error Squared…

Q: Salaries payable Accounts payable Employees' income tax payable Estimated warranty payable 450,000…

A: Current liabilities includes the amounts which are obligated for a period of 1 year or less than it.…

Q: any started op n and the com e market. As a n

A: Auditing is the method which has been carried out by the auditor and during the process auditor…

Q: his answ

A: Given as,

Q: How many shares of common stock were outstanding at the end of the period? How many shares of…

A: 1. When common stock is issued for cash, cash, and common stock increase. Cash XXXX…

Q: Three different lease transactions are presented below for Carla Vista Enterprises. Assume that all…

A: GIVEN Three different lease transactions are presented below for Carla Vista Enterprises. Assume…

Q: 1. What amount should be capitalized initially as cost of the right of use asset? 2. What amount…

A: Red Velvet Company- Leasee lease payment 1000000 lease period 10 years Economic…

Q: Woody Ltd sold inventory items to its subsidiary Buzz Lightyear Ltd and had the following…

A: Consolidated Financial Statement A consolidated financial statement presents the financial…

Q: Which of the following is a variable cost? O Acost that is $26,000 when production is 65,000, and…

A: There are primarily two types of cost namely fixed cost and variable cost Fixed costs are those…

Q: Cash on hand and in bank 5,960 1,200 8,000 1,100 1,000 1,800 4,000 300 600 32,000 4,500 48,630 820…

A: Formula: Net income = revenues - expenses

Q: a. Prepare a comparative, classified balance sheet for Carnell Inc. b. Perform horizontal and…

A: 2012 2011 Accounts Payable 75500 35035 Accounts Receivable 50000 85065 Bond Payable…

Q: The following selected accounts are taken from ABC Company on Dec. 31, 2022: Accounts…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: Balloon Ltd (Balloon) purchased an item of equipment on 1 July 2015 for $2 million. At that time che…

A: The answer is stated below:

Q: Presented below is an aging schedule for Splish Brothers Inc. at December 31, 2021.…

A: Bad debt expense is the amount that the company does not expect to be recovered from the customer…

Q: Greener Pastures Corporation borrowed $1,250,000 on November 1, 2021. The note carried a 9 percent…

A: Since basic accounts equal is Assets = Liabilities + Owners equity

Q: 1. A business has an asset with data shown in the table. S 2,300 Compute the asset depreciation…

A: Depreciation is an expense recorded as consumption of fixed asset during that year. In Sum of years…

Q: 15. Use the following information for questions 15 to 17 Rodel's Car Repair Shop started the year…

A: A partnership is a legally binding contract between two or more persons to manage and operate a…

Q: An amount of money was deposited in the savings fund with an annual interest of -1 (8%), calculated…

A: 1. Amount of Money is been deposited in the saving account with 8% semi annually. Needs to calculate…

Q: The statement of financial position of L, M, and N just before liquidation shows the following:Cash…

A: Partnership characteristics includes: Existence of an agreement Existence of business Sharing of…

Q: From the practice on page 10-4 of the VLN, how many of shares of common stock were issued?_____

A: Common stock: Common stock is a part of the total stock held by a corporation which are divided into…

Q: On July 31, 202O, Teal Company engaged Minsk Tooling Company to construct a special-purpose piece of…

A: The question is based on the concept of Financial Accounting.

Q: eBook Show Me How Asset turnover A company reports the following: Sales $1 Average total assets…

A: Formula to calculate Asset Turnover Ratio. = Sales / Average Total Assets

Q: Granite Company purchased a machine with cost of $90,000 and salvage value of $6,000. The life of…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: At what amount should the land be recorded? b.At what amount should the new office building be…

A: Sandhill Chrome Bumpers bought two acres of land with an old office building on it that was deemed…

Q: The going concern assumption is inappropriate when: Select one: а. liquidation appears likely. b.…

A: Going concern assumption states that business will be continued for indefinite period of time. So…

Q: nmon Stock l-in-Capital in Excess of Par Value

A: Stockholders equity refers to the sum value of money invested by the owner in its business.

Q: The "one time good deal" Cash-For-Clunkers program offered by the federal government proved a…

A: Rebate- A rebate is a payment back to a purchaser of a segment of the full acquire price of a good…

Q: rigold Company has the following iventory information July 1 Beginning Iinventory 30 units at $80…

A: Solution: Under perpetual inventory system, inventory is updated with each and every movement based…

Q: a baker calculated the cost of ingredients for a bran muffin at S0.37 and wanted a 40% food…

A: Pricing is an important decision in every field of business. In restaurants, the selling price of…

Q: Which statement is false concerning a comparison of a parent's books and the consolidated financial…

A: Consolidation is the process of combining the assets, liabilities, and other financial elements of…

Q: How much was cash was distributed to the partners?

A: Dissolution of partnership is the process by which the relationship between the partners is…

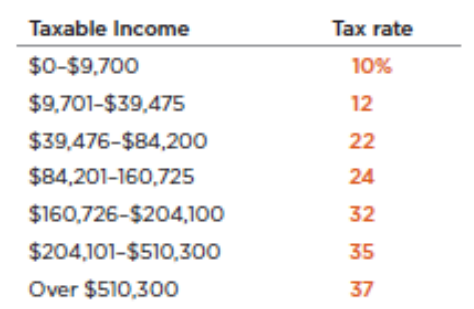

Use the 2019 U.S. federal tax rates in the table to calculate answers to the questions below. Give all answers to two decimals.

If you have a taxable income of $289,980.00, what is your

top marginal tax rate? %

total tax bill? $

average tax rate? %

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

- taxable income : 1225000 income taxes payable: 245000Amount in excess of P490,000.00 taxable income is to be multiplied to_______to compute for the graduated tax due a. 30% b. 32% c. 35%Taxable Income (income tax brackets) Tax rates 15% on the first $50,197 of taxable income, plus20.5% on the next $50,195 of taxable income (on the portion of taxable income over 50,197 up to $100,392), plus 26% on the next $55,233 of taxable income (on the portion of taxable income over $100,392 up to $155,625), plus 29% on the next $66,083 of taxable income (on the portion of taxable income over 155,625 up to $221,708), plus 33% of taxable income over $221,708 a) Danny had a taxable income of $126,500. How much federal income tax should he report? (assuming tax rates remain the same) b) Danny expects his taxable income to increase by 25%. How much federal tax should he expect to pay the following year (assuming tax rates remain the same).

- NCF practice a) What is the ncf from the sale of this asset - purchased for $250,000, 7-year property, sold at end of year 6 for $50,000, tax rate = 21%? basis = MACRS depreciation (as decimal) * sale price step 1: sales price - basis = gain/loss step 2: gain * loss tax rate = tax step 3: sales price - tax = ncfIf Your Taxable Income Is Up to $19,050 $19,050 $77,400 $77,400 $165,000 $165,000 $315,000 $315,000 - $400,000 $400,000 - $600,000 Over $600,000 2018 Individual Tax Rates Single Individuals If Your Taxable Income Is Up to $9,525 $9,525 $38,700 $38,700 $82,500 $82,500 $157,500 $157,500 $200,000 $200,000 $500,000 Over $500,000 Standard deduction for individual: $12,000 You Pay This Amount on the Base of the Bracket $ $0 952.50 4,453.50 14,089.50 32,089.50 45,689.50 150,689.50 Married Couples Filing Joint Returns Plus This Percentage on the Excess over the Base (Marginal Rate) 10.0% 12.0 22.0 24.0 32.0 35.0 37.0 You Pay This Amount on the Base of the Bracket Plus This Percentage on the Excess over the Base (Marginal Rate) 10.0% 12.0 22.0 24.0 32.0 35.0 37.0 $0 1,905.00 8,907.00 28,179.00 64,179.00 91,379.00 161,379.00 Average Tax Rate at Top of Bracket 10.0% 11.5 17.1 20.4 22.8 30.1 37.0 Average Tax Rate at Top of Bracket 10.0% 11.5 17.1 20.4 22.8 26.9 37.0 Standard deduction for married…1. A VAT-registered business makes a sale of P10,000, inclusive of VAT. The VAT on the sale can be computed asa. P10,000 x 12%b. P10,000 12%.c. P10,000 x 12%/112%d. P10,000 -12%/112%2. A Non-VAT registered business makes total sales of P110.000 during a taxable period.The percentage tax can be computed asa. P110,000 x 3%.b. P110,000 3%.c. P110,000 x 3%/103%d. P110,000 3%/103%3. A VAT-registered business makes a sale of P34,500, inclusive of VAT. The amount of sale that was reported in the statement of comprehensive income can be computed asa. P34,500 x 112%.b. P34,500 112%.c. P34,500 x 12%/112%d. P34,500 12%/112%4. A VAT-registered business has total sales of P62,720 and total purchases of P25,088, both inclusive of VAT. How much is the net VAT payable to the BIR?a. 1,882 b. 4,032 c. 4,516 d. 5,2245. A Non-VAT business has total sales of P200,720. How much is the sales tax payable to the BIR?a. 2,007b. 4,015c. 4,516d. 6,022

- E18-4 Single Temporary Difference: Multiple Rates At the end of 2019, Fulhage Company reported taxable income of $9,000 and pretax financial income of $10,600. The difference is due to depreciation for tax purposes in excess of depreciation for financial reporting purposes. The income tax rate for the current year is 40%, but Congress has enacted tax rates of 35% for 2020 and 30% for 2021 and beyond. Fulhage has calculated the excess of its financial depreciation over its tax depreciation for future years as follows: 2020, $600; 2021, $700; and 2022, $300. Prior to 2019, the company had no deferred tax liability or asset. Required: Prepare Fulhage’s income tax journal entry at the end of 2019.How much is the net taxable income using itemized deductions? a. 1,070,000 b. 1,550,000 c. 1,550,000 d. 2,000,000Compute for the tax due (A,B,C) for the below taxable income based on the Income Tax Tables: TAXABLE INCOME (Annual) TAX DUE P300,000 A P500,000 B P800,000 C .

- E18-11 Multiple Tax Rates For the year ended December 31, 2019, Nelson Co.’s income statement showed income of $435,000 before income, tax expense. To compute taxable income, the following differences were noted: Income from tax-exempt municipal bonds $60,000 Depreciation deducted for tax purposes in excess of depreciation recorded on the books $120,000 Proceeds received from life insurance on death of an insured employee $100,00 Corporate tax rate for 2019 30% Enacted tax rate for future periods 35% Required: 1. Calculate taxable income and tax payable for tax purposes. 2. Prepare Nelson’s income tax journal entry at the end of 2019.Multiple-choice question Compute for the Income tax Given: Taxpayer is a proprietary educational institution. Taxable period is 2021. Financial data: Related Activities Unrelated Activities Gross Income P 15,000,000 P 25,000,000 Expenses 5,000,000 11,000,000 Net 10,000,000 14,000,000 A. P140,000 B. P240,000 C. P3,500,000 D. P6,000,000revenue $878,412.00 general & administrative expense $352,666.00 depreciation expense $131,455.00 leasing expense $108,195.00 interest expense $78,122.00 if average tax rate is 3.4%, what is its net income after taxes? $878,412.00 minus $352,666.00 $131,455.00 $108,195.00 $78,122.00 $207,974.00 minus 3.4% *207974 $7,071.12 incom after tax $200,902.88 what is the cash flow?