Use the 2021 tax rates to find Social Security and Medicare deductions for the following problems. 13. Philip earned $1,589 last week, and had year-to-date earnings of $108,894 for the yea 14. Bill earned $3,592 on his last biweekly check, and had year-to-date earnings of $107,841.

Use the 2021 tax rates to find Social Security and Medicare deductions for the following problems. 13. Philip earned $1,589 last week, and had year-to-date earnings of $108,894 for the yea 14. Bill earned $3,592 on his last biweekly check, and had year-to-date earnings of $107,841.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.11EX: Payroll tax entries According to a summary of the payroll of Mountain Streaming Co., 120,000 was...

Related questions

Question

Transcribed Image Text:Exercise 9.1 163

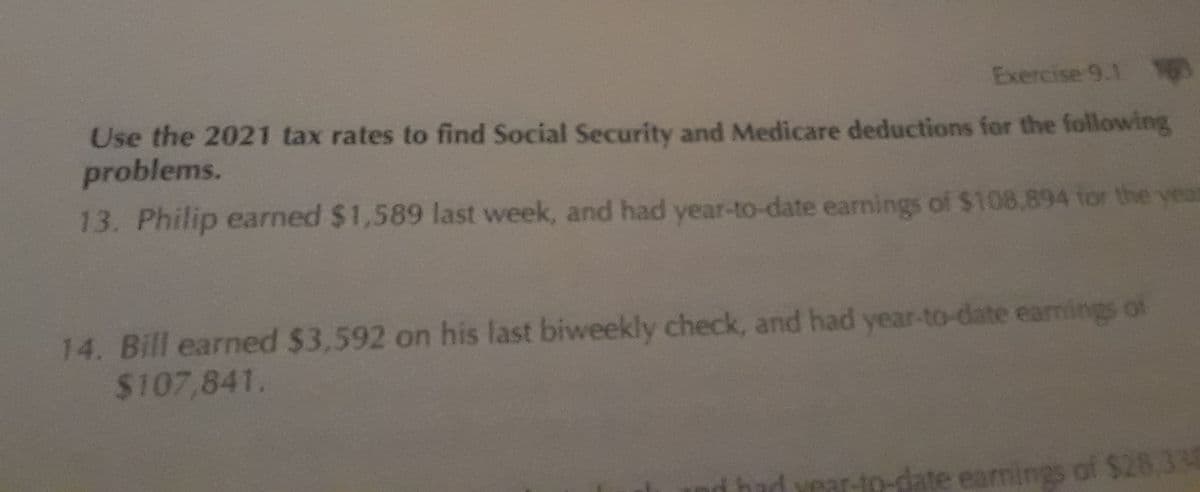

Use the 2021 tax rates to find Social Security and Medicare deductions for the following

problems.

13. Philip earned $1,589 last week, and had year-to-date earnings of $108,894 for the year

14. Bill earned $3,592 on his last biweekly check, and had year-to-date earnings of

$107,841.

r-to-date earnings of $28,338

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning