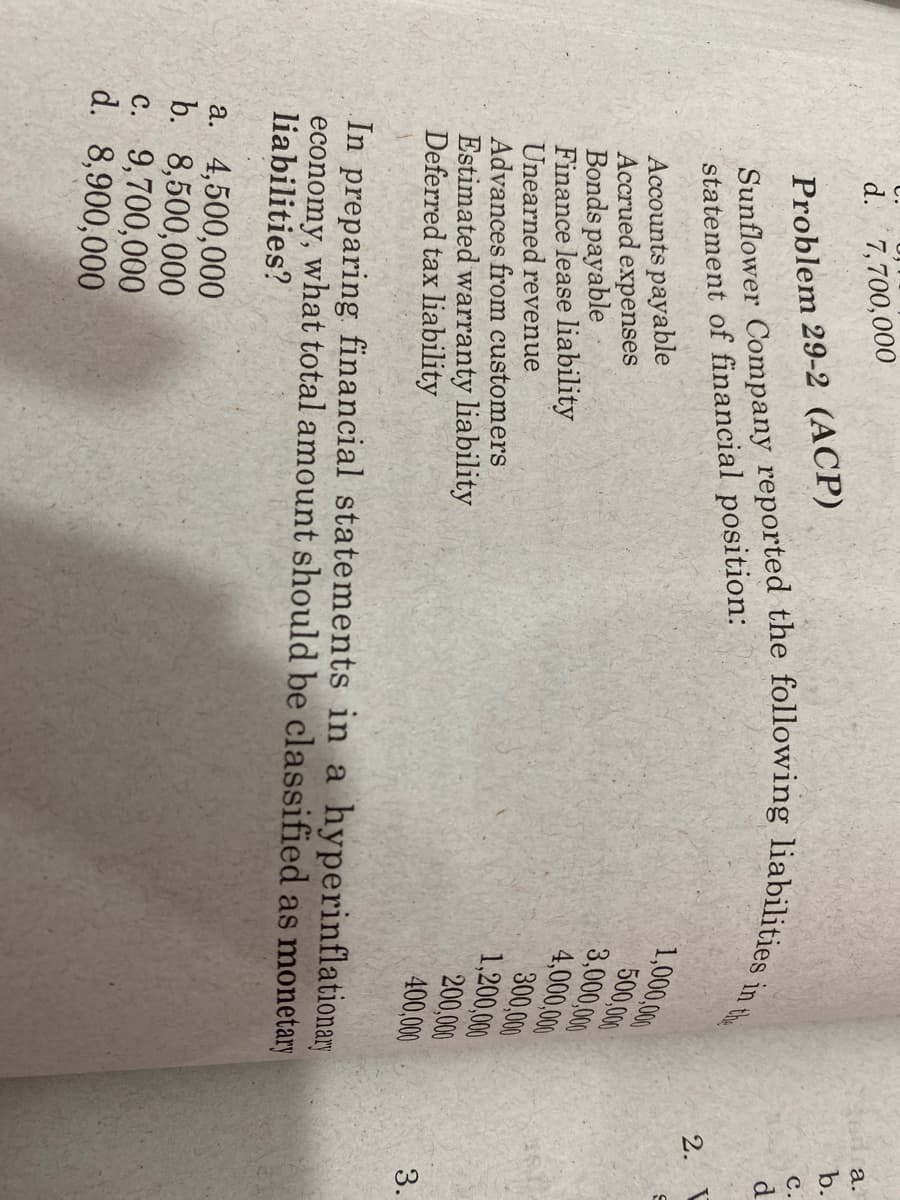

d. 7,700, Sunflower Company reported the following liabilities in the Problem 29-2 (ACP) statement of financial position: 1,000,000 500,000 Accounts payable Accrued expenses Bonds payable 300,000 Finance lease liability Unearned revenue 1,200,000 200,000 Advances from customers Estimated warranty liability Deferred tax liability 400,000 In preparing financial statements in a hyperinflationary economy, what total amount should be classified as monetary liabilities? a. 4,500,000 b. 8,500,000 c. 9,700,000 d. 8,900,000 3,000,000 4,000,000

d. 7,700, Sunflower Company reported the following liabilities in the Problem 29-2 (ACP) statement of financial position: 1,000,000 500,000 Accounts payable Accrued expenses Bonds payable 300,000 Finance lease liability Unearned revenue 1,200,000 200,000 Advances from customers Estimated warranty liability Deferred tax liability 400,000 In preparing financial statements in a hyperinflationary economy, what total amount should be classified as monetary liabilities? a. 4,500,000 b. 8,500,000 c. 9,700,000 d. 8,900,000 3,000,000 4,000,000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

Transcribed Image Text:d. 7,700,000

Sunflower Company reported the following liabilities in the

Problem 29-2 (ACP)

statement of financial position:

1,000,000

Accounts payable

Accrued expenses

Bonds payable

300,000

Finance lease liability

Unearned revenue

1,200,000

200,000

Advances from customers

Estimated warranty liability

Deferred tax liability

400,000

In preparing financial statements in a hyperinflationary

economy, what total amount should be classified as monetary

liabilities?

a. 4,500,000

b. 8,500,000

c. 9,700,000

d. 8,900,000

500,000

3,000,000

4,000,000

2.

a.

b.

C.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning