Use the accompanying payoff table with event probabilities to answer parts (a) through (h). Question content area bottom Part 1 a. Calculate the expected monetary value (EMV) for actions A and B. EMV(A)=$enter your response here EMV(B)=$enter your response here (Type integers or decimals.) Part 2 b. Calculate the expected opportunity loss (EOL) for actions A and B. EOL(A)=$enter your response here EOL(B)=$enter your response here (Type integers or decimals.) Part 3 c. Explain the meaning of the expected value of perfect information (EVPI) in this problem. Select the correct choice below and fill in the answer box to complete your choice. (Type an integer or a decimal.) A. The EVPI value of $enter your response here represents the maximum amount that you should be willing to pay for perfect information.

Use the accompanying payoff table with event probabilities to answer parts (a) through (h). Question content area bottom Part 1 a. Calculate the expected monetary value (EMV) for actions A and B. EMV(A)=$enter your response here EMV(B)=$enter your response here (Type integers or decimals.) Part 2 b. Calculate the expected opportunity loss (EOL) for actions A and B. EOL(A)=$enter your response here EOL(B)=$enter your response here (Type integers or decimals.) Part 3 c. Explain the meaning of the expected value of perfect information (EVPI) in this problem. Select the correct choice below and fill in the answer box to complete your choice. (Type an integer or a decimal.) A. The EVPI value of $enter your response here represents the maximum amount that you should be willing to pay for perfect information.

College Algebra (MindTap Course List)

12th Edition

ISBN:9781305652231

Author:R. David Gustafson, Jeff Hughes

Publisher:R. David Gustafson, Jeff Hughes

Chapter8: Sequences, Series, And Probability

Section8.7: Probability

Problem 9E: An ordinary die is rolled. Find the probability of each event. Rolling a 2

Related questions

Question

Use the accompanying payoff table with event probabilities to answer parts (a) through (h).

Question content area bottom

Part 1

a. Calculate the expected monetary value (EMV) for actions A and B.

EMV(A)=$enter your response here

EMV(B)=$enter your response here

(Type integers or decimals.)

Part 2

b. Calculate the expected opportunity loss (EOL) for actions A and B.

EOL(A)=$enter your response here

EOL(B)=$enter your response here

(Type integers or decimals.)

Part 3

c. Explain the meaning of the expected value of perfect information (EVPI) in this problem. Select the correct choice below and fill in the answer box to complete your choice.

(Type an integer or a decimal.)

The EVPI value of

$enter your response here

represents the maximum amount that you should be willing to pay for perfect information.The EVPI value of

$enter your response here

represents the minimum amount that you should be willing to pay for perfect information.The EVPI value of

$enter your response here

is the difference between the maximum expected opportunity loss and the minimum expected opportunity loss.The EVPI value of

$enter your response here

is the difference between the maximum expected monetary value and the minimum expected monetary value.Part 4

d. Based on the results of (a) or (b), which action would you choose?

Action

A

is better because it has the higher expected monetary value and the lower expected opportunity loss.Action

A

is better because it has the the lower expected monetary value and the lower expected opportunity loss.Action

B

is better because it has the lower expected monetary value and the higher expected opportunity loss.Action

B

is better because it has the higher expected monetary value and the higher expected opportunity loss.Part 5

e. Calculate the coefficient of variation (CV) for each action.

CVA=enter your response here%

CVB=enter your response here%

(Round to three decimal places as needed.)

Part 6

f. Calculate the return-to-risk ratio (RTRR) for each action.

RTRR(A)=enter your response here

RTRR(B)=enter your response here

(Round to three decimal places as needed.)

Part 7

g. Based on the results of (e) and (f), what action would you choose?

Action

A

is better because it has the lower return-to-risk ratio.Action

A

is better because it has the higher return-to-risk ratio.Action

B

is better because it has the lower return-to-risk ratio.Action

B

is better because it has the higher return-to-risk ratio.Part 8

h. Compare the results of (d) and (g) and explain any differences. Choose the correct answer below.

The results

are the same even though

the criteria used in (d) select for low average payoffs and high average losses while ignoring variation, and the criterion used in (g) selects for high average values and low variation.The results

are the same even though

the criteria used in (d) select for low average payoffs and high average losses while ignoring variation, and the criterion used in (g) selects for high average values and high variation.The results

are different because

the criteria used in (d) select for high average payoffs and low average losses while ignoring variation, and the criterion used in (g) selects for high average values and high variation.The results

are different because

the criteria used in (d) select for high average payoffs and low average losses while ignoring variation, and the criterion used in (g) selects for high average values and low variation.

Transcribed Image Text:Use the accompanying payoff table with event probabilities to answer parts (a) through (h).

E Click the icon to view the payoff table with probabilities.

a. Calculate the expected monetary value (EMV) for actions

and B.

EMV(A) = S

EMV(B) = $

(Type integers or decimals.)

b. Calculate the expected opportunity loss (EOL) for actions A and B.

EOL(A) = S

EOL(B) = S

(Type integers or decimals.)

c. Explain the meaning of the expected value of perfect information (EVPI) in this problem. Select the correct choice below and fill in the answer box to complete your choice.

(Type an integer or a decimal.)

O A. The EVPI value of $ represents the maximum amount that you should be willing to pay for perfect information.

O B. The EVPI value of $ represents the minimum amount that you should be willing to pay for perfect information.

O C. The EVPI value of $ is the difference between the maximum expected opportunity loss and the minimum expected opportunity loss.

O D. The EVPI value of $ is the difference between the maximum expected monetary value and the minimum expected monetary value.

d. Based on the results of (a) or (b), which action would you choose?

O A. Action A is better because it has the higher expected monetary value and the lower expected opportunity loss.

O B. Action A is better because it has the the lower expected monetary value and the lower expected opportunity loss.

O C. Action B is better because it has the lower expected monetary value and the higher expected opportunity loss.

O D. Action B is better because it has the higher expected monetary value and the higher expected opportunity loss.

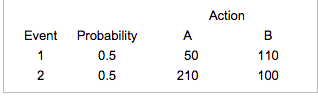

Transcribed Image Text:Action

Event Probability

A

B

1

0.5

50

110

0.5

210

100

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill