Use the appropriate formula located on Illustration 10-1 on page 209 to solve the problem. Bob deposits $5000 at the end of each 6 months for 14 years in an account paying 6% interest compounded semiannually A) Find the amount he will have on deposit at maturity. B) How much interest did Bob earn? Hint: Find the total amount that was deposited by multiplying the total number deposits with amount of each deposit and then subtracting this from the future value. Show the use of the appropriate formulas for each part by indicating the evaluation of the formula with information and provide th answers. Be sure to parts using the provided letters and organize your work neatly.

Use the appropriate formula located on Illustration 10-1 on page 209 to solve the problem. Bob deposits $5000 at the end of each 6 months for 14 years in an account paying 6% interest compounded semiannually A) Find the amount he will have on deposit at maturity. B) How much interest did Bob earn? Hint: Find the total amount that was deposited by multiplying the total number deposits with amount of each deposit and then subtracting this from the future value. Show the use of the appropriate formulas for each part by indicating the evaluation of the formula with information and provide th answers. Be sure to parts using the provided letters and organize your work neatly.

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 24P

Related questions

Question

100%

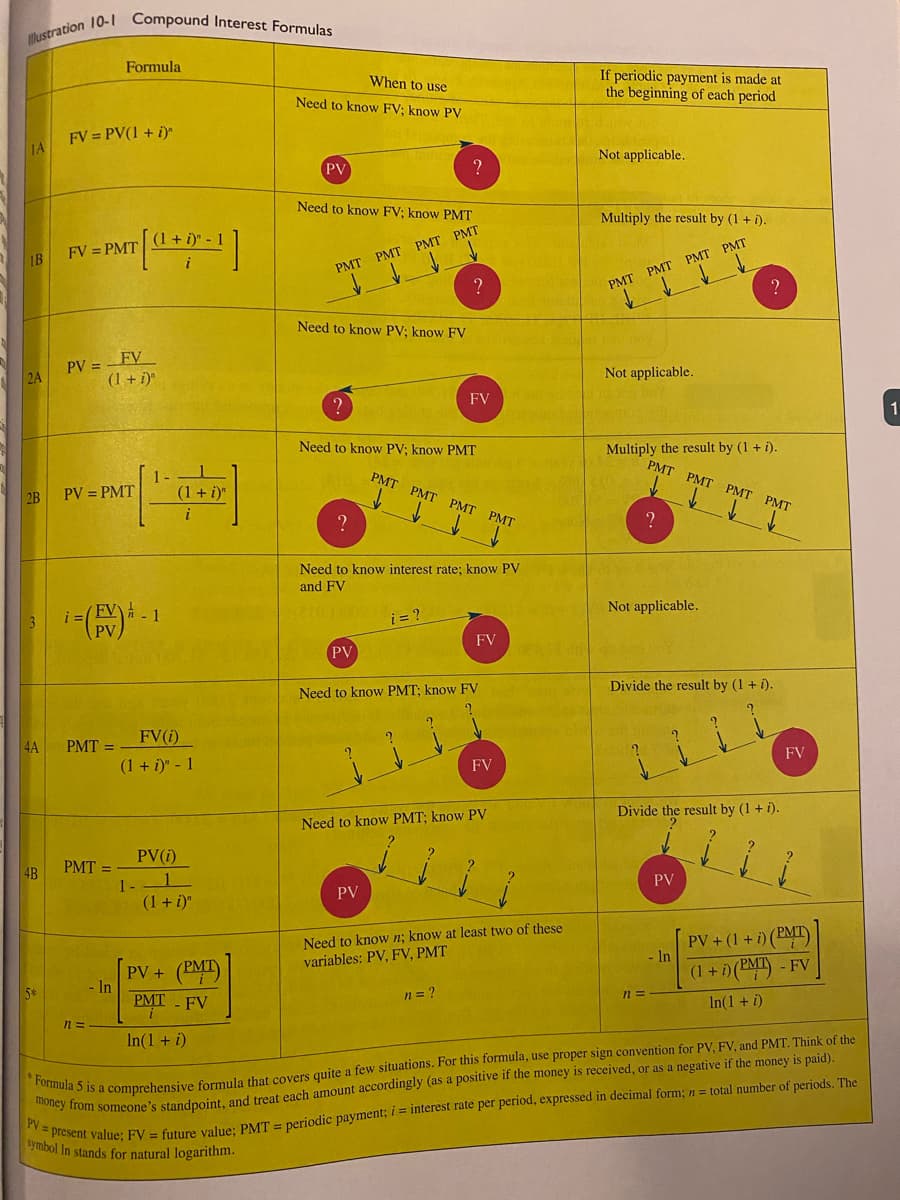

Transcribed Image Text:llustration 10-1 Compound Interest Formulas

Formula

If periodic payment is made at

the beginning of each period

When to use

Need to know FV; know PV

FV = PV(1 + i)

IA

Not applicable.

PV

Need to know FV; know PMT

Multiply the result by (1 + i).

(1 + i) -

FV = PMT

IB

PMT PMT PMT PMT

РМТ РМТ РМТ РМТ

Need to know PV; know FV

PV =FV

2A

Not applicable.

(1 + i)

FV

Multiply the result by (1 + i).

PMT PMT PMT PMT

Need to know PV; know PMT

PMT PMT PMT PMT

2B

PV = PMT

(1 + i)"

?

Need to know interest rate; know PV

and FV

FV

- 1

i = ?

Not applicable.

i =

FV

PV

Divide the result by (1 + i).

Need to know PMT; know FV

FV(i)

4A

PMT =

FV

(1 + i)" - 1

FV

Divide the result by (1 + i).

Need to know PMT; know PV

PV(i)

4B

PMT

PV

1-

(1 + i)"

PV

Need to know n; know at least two of these

variables: PV, FV, PMT

PV + (1 + i) (PMT)

- In

(PMI)

(1 + i) (PMT) - FV

PV +

- In

PMT -FV

5*

n= ?

n =

In(1 + i)

n =

In(1 + i)

esent value; FV = future value: PMT = periodic payment; i = interest rate per period, expressed in decimal form; n = total number of periods. The

ymbol In stands for natural logarithm.

Dona S is a comprehensive formula that covers quite a few situations. For this formula, use proper sign convention for PV, FV, and PMT. Think of the

PV

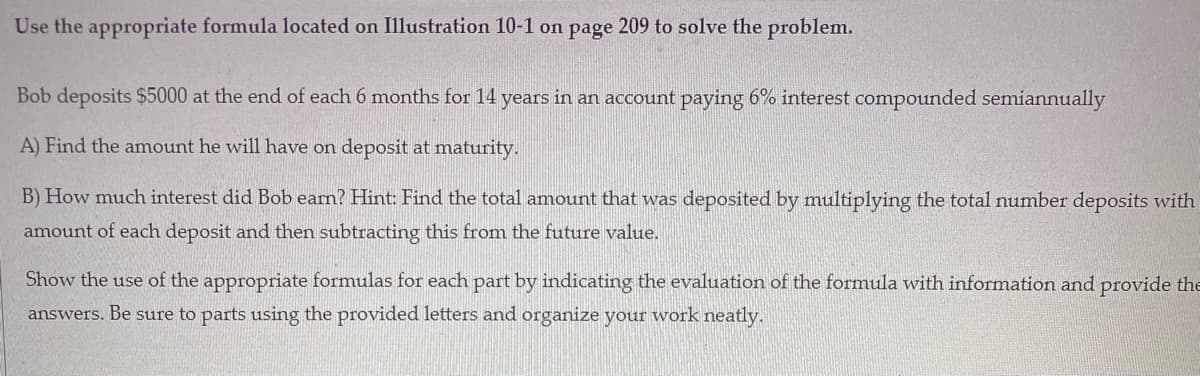

Transcribed Image Text:Use the appropriate formula located on Illustration 10-1 on page 209 to solve the problem.

Bob deposits $5000 at the end of each 6 months for 14 years in an account paying 6% interest compounded semiannually

A) Find the amount he will have on deposit at maturity.

B) How much interest did Bob earn? Hint: Find the total amount that was deposited by multiplying the total number deposits with

amount of each deposit and then subtracting this from the future value.

Show the use of the appropriate formulas for each part by indicating the evaluation of the formula with information and provide the

answers. Be sure to parts using the provided letters and organize your work neatly.

Expert Solution

Step 1

Given:

Semi-annual contribution : $5,000

Annual Interest Rate: 6%

Compounding: Semi-Annual

Number of years over which the contributions are made: 14

Required:

- The Future Value of the annuity

- The total interest earned on the deposit.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College