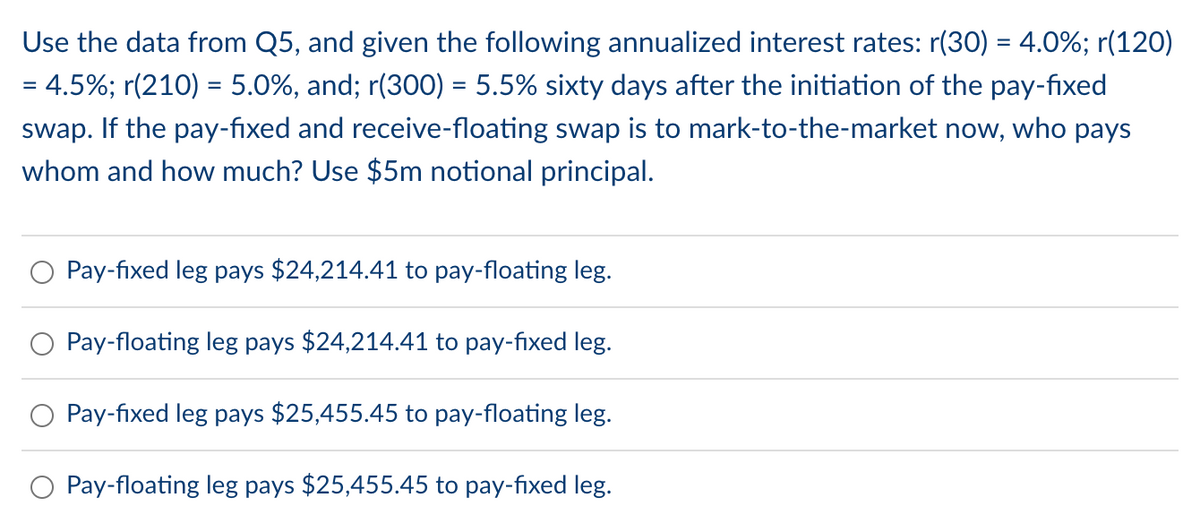

Use the data from Q5, and given the following annualized interest rates: r(30) = 4.0%; r(120) = 4.5%; r(210) = 5.0%, and; r(300) = 5.5% sixty days after the initiation of the pay-fixed swap. If the pay-fixed and receive-floating swap is to mark-to-the-market now, who pays whom and how much? Use $5m notional principal. Pay-fixed leg pays $24,214.41 to pay-floating leg. Pay-floating leg pays $24,214.41 to pay-fixed leg. Pay-fixed leg pays $25,455.45 to pay-floating leg. Pay-floating leg pays $25,455.45 to pay-fixed leg.

Use the data from Q5, and given the following annualized interest rates: r(30) = 4.0%; r(120) = 4.5%; r(210) = 5.0%, and; r(300) = 5.5% sixty days after the initiation of the pay-fixed swap. If the pay-fixed and receive-floating swap is to mark-to-the-market now, who pays whom and how much? Use $5m notional principal. Pay-fixed leg pays $24,214.41 to pay-floating leg. Pay-floating leg pays $24,214.41 to pay-fixed leg. Pay-fixed leg pays $25,455.45 to pay-floating leg. Pay-floating leg pays $25,455.45 to pay-fixed leg.

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:Use the data from Q5, and given the following annualized interest rates: r(30) = 4.0%; r(120)

= 4.5%; r(210) = 5.0%, and; r(300) = 5.5% sixty days after the initiation of the pay-fixed

swap. If the pay-fixed and receive-floating swap is to mark-to-the-market now, who pays

whom and how much? Use $5m notional principal.

Pay-fixed leg pays $24,214.41 to pay-floating leg.

Pay-floating leg pays $24,214.41 to pay-fixed leg.

Pay-fixed leg pays $25,455.45 to pay-floating leg.

Pay-floating leg pays $25,455.45 to pay-fixed leg.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT