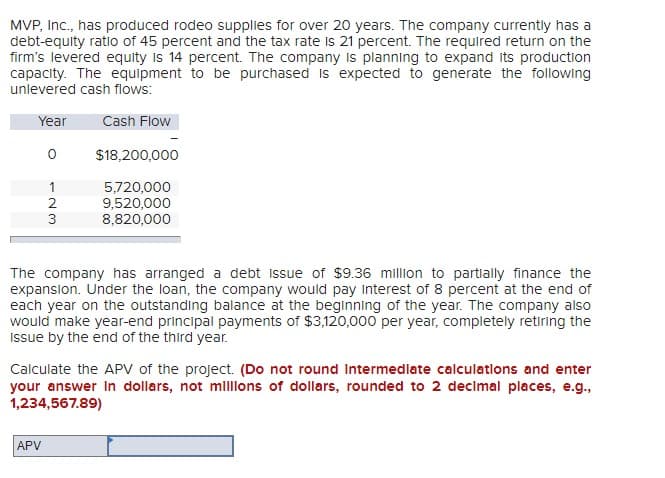

MVP, Inc., has produced rodeo supplies for over 20 years. The company currently has a debt-equity ratio of 45 percent and the tax rate is 21 percent. The required return on the firm's levered equity is 14 percent. The company is planning to expand its production capacity. The equipment to be purchased is expected to generate the following unlevered cash flows: Year Cash Flow о $18,200,000 123 3 5,720,000 9,520,000 8,820,000 The company has arranged a debt Issue of $9.36 million to partially finance the expansion. Under the loan, the company would pay interest of 8 percent at the end of each year on the outstanding balance at the beginning of the year. The company also would make year-end principal payments of $3,120,000 per year, completely retiring the Issue by the end of the third year. Calculate the APV of the project. (Do not round Intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) APV

MVP, Inc., has produced rodeo supplies for over 20 years. The company currently has a debt-equity ratio of 45 percent and the tax rate is 21 percent. The required return on the firm's levered equity is 14 percent. The company is planning to expand its production capacity. The equipment to be purchased is expected to generate the following unlevered cash flows: Year Cash Flow о $18,200,000 123 3 5,720,000 9,520,000 8,820,000 The company has arranged a debt Issue of $9.36 million to partially finance the expansion. Under the loan, the company would pay interest of 8 percent at the end of each year on the outstanding balance at the beginning of the year. The company also would make year-end principal payments of $3,120,000 per year, completely retiring the Issue by the end of the third year. Calculate the APV of the project. (Do not round Intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) APV

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 9E: Each of the following scenarios is independent. All cash flows are after-tax cash flows. Required:...

Related questions

Question

Radhubhai

Transcribed Image Text:MVP, Inc., has produced rodeo supplies for over 20 years. The company currently has a

debt-equity ratio of 45 percent and the tax rate is 21 percent. The required return on the

firm's levered equity is 14 percent. The company is planning to expand its production

capacity. The equipment to be purchased is expected to generate the following

unlevered cash flows:

Year

Cash Flow

о

$18,200,000

123

3

5,720,000

9,520,000

8,820,000

The company has arranged a debt Issue of $9.36 million to partially finance the

expansion. Under the loan, the company would pay interest of 8 percent at the end of

each year on the outstanding balance at the beginning of the year. The company also

would make year-end principal payments of $3,120,000 per year, completely retiring the

Issue by the end of the third year.

Calculate the APV of the project. (Do not round Intermediate calculations and enter

your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g.,

1,234,567.89)

APV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning