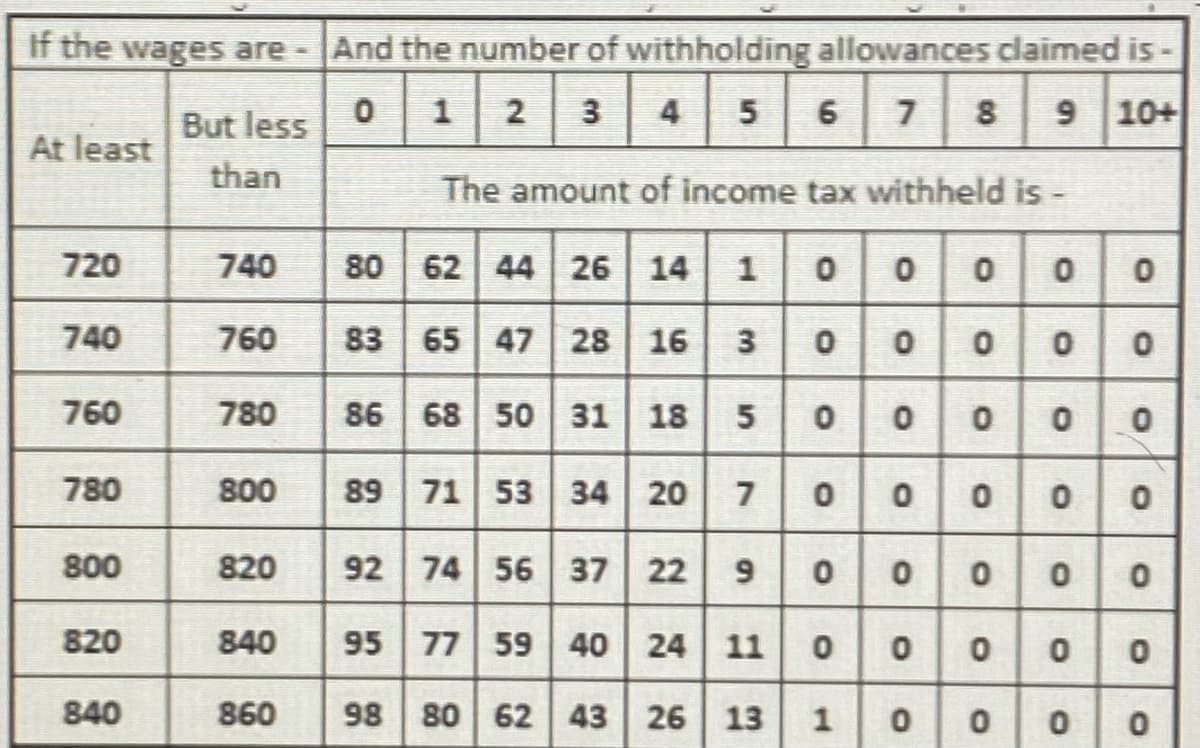

Use the following federal tax table for biweekly earnings of a single person to help answer the question below. Emeril has gross biweekly earnings of $784.21. By claiming 1 more withholding allowance, Emeril would have $13 more in his take home pay. How many withholding allowances does Emeril currently claim? a. 3 b. 4 c. 5 d. 6

Use the following federal tax table for biweekly earnings of a single person to help answer the question below. Emeril has gross biweekly earnings of $784.21. By claiming 1 more withholding allowance, Emeril would have $13 more in his take home pay. How many withholding allowances does Emeril currently claim? a. 3 b. 4 c. 5 d. 6

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 20Q: Use Figure 12.15 as a reference to answer the following questions. A. If an employee makes $1,400...

Related questions

Question

Use the following federal tax table for biweekly earnings of a single person to help answer the question below.

Emeril has gross biweekly earnings of $784.21. By claiming 1 more withholding

allowance, Emeril would have $13 more in his take home pay. How many

withholding allowances does Emeril currently claim?

a. 3

b. 4

c. 5

d. 6

Transcribed Image Text:If the wages are-

And the number of withholding allowances claimed is-

12 3 4

5 6

9 10+

7

But less

At least

than

The amount of income tax withheld is -

720

740

0 0 0 0

83 65 47 28 16 3 00000

86 68 50 31 18 5 00000

89 71 53 34 20 70000 o

92 74 56 37 22 900000

95 77 59 40 24 11 o0000

98 80 62 43 26 13 1 0 o

740

760

760

780

780

800

800

820

820

840

840

860

00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT