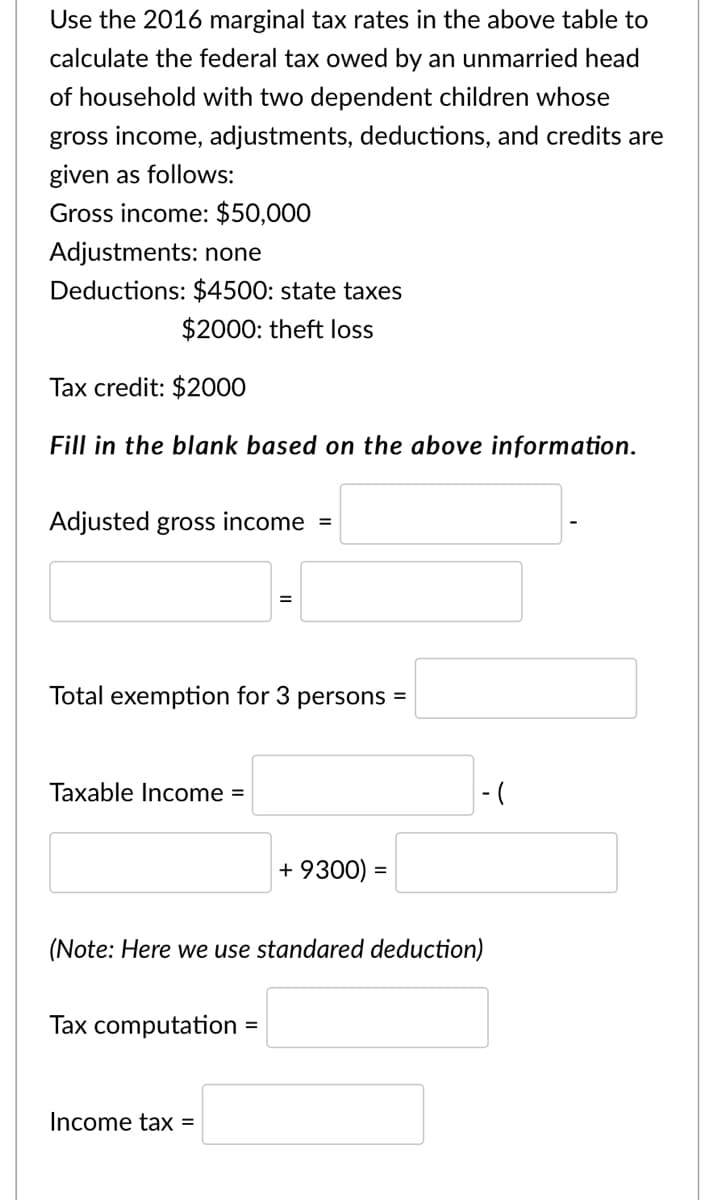

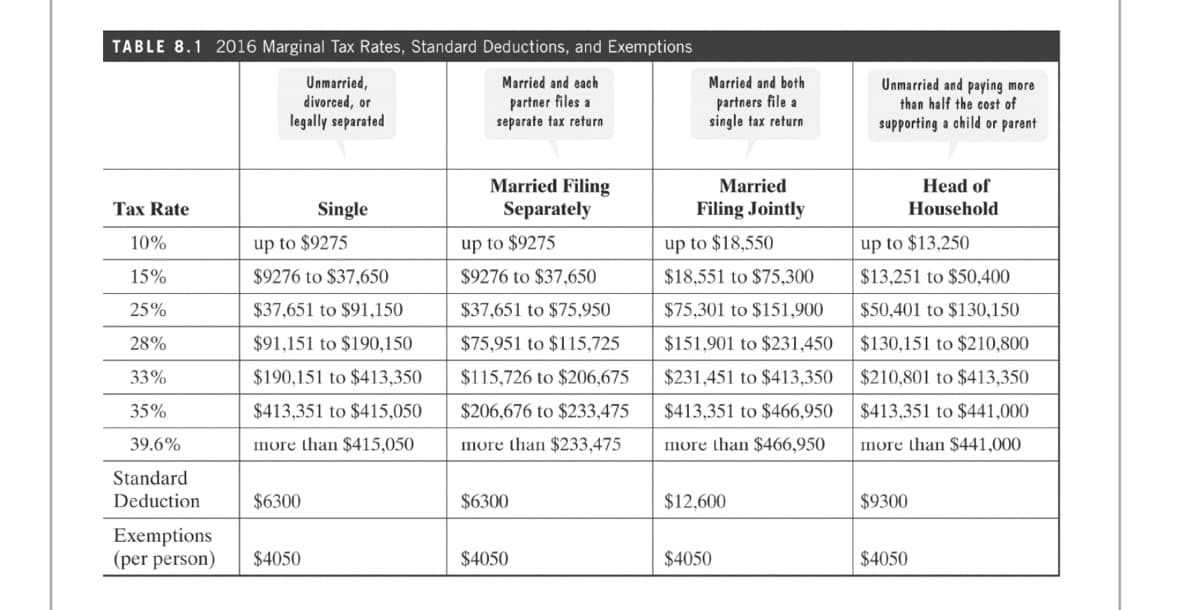

Use the 2016 marginal tax rates in the above table to calculate the federal tax owed by an unmarried head of household with two dependent children whose gross income, adjustments, deductions, and credits are given as follows: Gross income: $50,000 Adjustments: none Deductions: $4500: state taxes $2000: theft loss Tax credit: $2000 Fill in the blank based on the above information. Adjusted gross income = Total exemption for 3 persons = Taxable Income = - ( + 9300) = (Note: Here we use standared deduction) Tax computation Income tax = TABLE 8.1 2016 Marginal Tax Rates, Standard Deductions, and Exemptions Unmarried, divorced, or legally separated Married and each Married and both Unmarried and paying more than half the cost of partner files a separate tax return partners file a single tax return supporting a child or parent Married Filing Separately Married Head of Tax Rate Single Filing Jointly Household 10% up to $9275 up to $9275 up to $18,550 up to $13,250 15% $9276 to $37,650 $9276 to $37,650 $18,551 to $75,300 $13,251 to $50,400 25% $37,651 to $91,150 $37,651 to $75,950 $75,301 to $151,900 $50,401 to $130,150 28% $91,151 to $190,150 $75,951 to $115,725 $151,901 to $231,450 $130,151 to $210,800 33% $190,151 to $413,350 $115,726 to $206,675 $231,451 to $413,350 $210,801 to $413,350 35% $413,351 to $415,050 $206,676 to $233,475 $413,351 to $466,950 $413,351 to $441,000 39.6% more than $415,050 more than $233,475 mоre than $466,950 more than $441,000 Standard Deduction $6300 $6300 $12,600 $9300 Exemptions (per person) $4050 $4050 $4050 $4050

Use the 2016 marginal tax rates in the above table to calculate the federal tax owed by an unmarried head of household with two dependent children whose gross income, adjustments, deductions, and credits are given as follows: Gross income: $50,000 Adjustments: none Deductions: $4500: state taxes $2000: theft loss Tax credit: $2000 Fill in the blank based on the above information. Adjusted gross income = Total exemption for 3 persons = Taxable Income = - ( + 9300) = (Note: Here we use standared deduction) Tax computation Income tax = TABLE 8.1 2016 Marginal Tax Rates, Standard Deductions, and Exemptions Unmarried, divorced, or legally separated Married and each Married and both Unmarried and paying more than half the cost of partner files a separate tax return partners file a single tax return supporting a child or parent Married Filing Separately Married Head of Tax Rate Single Filing Jointly Household 10% up to $9275 up to $9275 up to $18,550 up to $13,250 15% $9276 to $37,650 $9276 to $37,650 $18,551 to $75,300 $13,251 to $50,400 25% $37,651 to $91,150 $37,651 to $75,950 $75,301 to $151,900 $50,401 to $130,150 28% $91,151 to $190,150 $75,951 to $115,725 $151,901 to $231,450 $130,151 to $210,800 33% $190,151 to $413,350 $115,726 to $206,675 $231,451 to $413,350 $210,801 to $413,350 35% $413,351 to $415,050 $206,676 to $233,475 $413,351 to $466,950 $413,351 to $441,000 39.6% more than $415,050 more than $233,475 mоre than $466,950 more than $441,000 Standard Deduction $6300 $6300 $12,600 $9300 Exemptions (per person) $4050 $4050 $4050 $4050

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 8P: PERSONAL TAXES Susan and Stan Britton are a married couple who file a joint income tax return, where...

Related questions

Question

Please do Taxable Income

type it out

Transcribed Image Text:Use the 2016 marginal tax rates in the above table to

calculate the federal tax owed by an unmarried head

of household with two dependent children whose

gross income, adjustments, deductions, and credits are

given as follows:

Gross income: $50,000

Adjustments: none

Deductions: $4500: state taxes

$2000: theft loss

Tax credit: $2000

Fill in the blank based on the above information.

Adjusted gross income =

Total exemption for 3 persons =

Taxable Income =

- (

+ 9300) =

(Note: Here we use standared deduction)

Tax computation

Income tax =

Transcribed Image Text:TABLE 8.1 2016 Marginal Tax Rates, Standard Deductions, and Exemptions

Unmarried,

divorced, or

legally separated

Married and each

Married and both

Unmarried and paying more

than half the cost of

partner files a

separate tax return

partners file a

single tax return

supporting a child or parent

Married Filing

Separately

Married

Head of

Tax Rate

Single

Filing Jointly

Household

10%

up to $9275

up to $9275

up to $18,550

up to $13,250

15%

$9276 to $37,650

$9276 to $37,650

$18,551 to $75,300

$13,251 to $50,400

25%

$37,651 to $91,150

$37,651 to $75,950

$75,301 to $151,900

$50,401 to $130,150

28%

$91,151 to $190,150

$75,951 to $115,725

$151,901 to $231,450

$130,151 to $210,800

33%

$190,151 to $413,350

$115,726 to $206,675

$231,451 to $413,350

$210,801 to $413,350

35%

$413,351 to $415,050

$206,676 to $233,475

$413,351 to $466,950

$413,351 to $441,000

39.6%

more than $415,050

more than $233,475

mоre than $466,950

more than $441,000

Standard

Deduction

$6300

$6300

$12,600

$9300

Exemptions

(per person)

$4050

$4050

$4050

$4050

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning