Use the following forecasted financials: (Certain cells were left intentionally blank by asker) You may need to use the CAPM model. Assume beta equals 1.09, the risk-free rate is 1.62%, and the market risk premium is 4.72%. d) Calculate the terminal value and the present value of the terminal value. Assume a long-term growth rate of 3%. e) Calculate Sherwin Williams value per share. The company has 263.3 million shares outstanding.

Use the following forecasted financials: (Certain cells were left intentionally blank by asker) You may need to use the CAPM model. Assume beta equals 1.09, the risk-free rate is 1.62%, and the market risk premium is 4.72%. d) Calculate the terminal value and the present value of the terminal value. Assume a long-term growth rate of 3%. e) Calculate Sherwin Williams value per share. The company has 263.3 million shares outstanding.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 30CE

Related questions

Question

100%

Use the following

You may need to use the CAPM model. Assume beta equals 1.09, the risk-free rate is 1.62%, and the market risk premium is 4.72%.

d) Calculate the terminal value and the present value of the terminal value. Assume a long-term growth rate of 3%.

e) Calculate Sherwin Williams value per share. The company has 263.3 million shares outstanding.

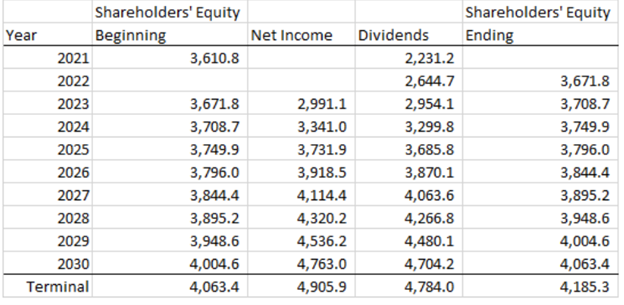

Transcribed Image Text:Shareholders' Equity

Shareholders' Equity

Year

Beginning

Net Income

Dividends

Ending

2021

3,610.8

2,231.2

2022

2,644.7

3,671.8

2023

3,671.8

2,991.1

2,954.1

3,708.7

2024

3,708.7

3,341.0

3,299.8

3,749.9

2025

3,749.9

3,731.9

3,685.8

3,796.0

2026

3,796.0

3,918.5

3,870.1

3,844.4

2027

3,844.4

4,114.4

4,063.6

3,895.2

2028

3,895.2

4,320.2

4,266.8

3,948.6

2029

3,948.6

4,536.2

4,480.1

4,004.6

2030

4,004.6

4,763.0

4,704.2

4,063.4

Terminal

4,063.4

4,905.9

4,784.0

4,185.3

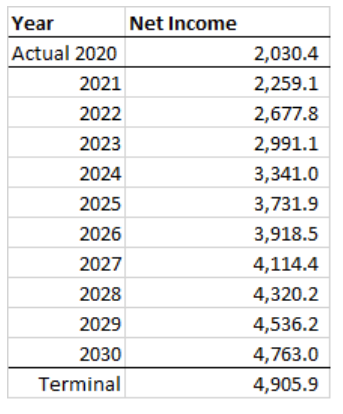

Transcribed Image Text:Year

Net Income

Actual 2020

2,030.4

2021

2,259.1

2022

2,677.8

2023

2,991.1

2024

3,341.0

2025

3,731.9

2026

3,918.5

2027

4,114.4

2028

4,320.2

2029

4,536.2

2030

4,763.0

Terminal

4,905.9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning