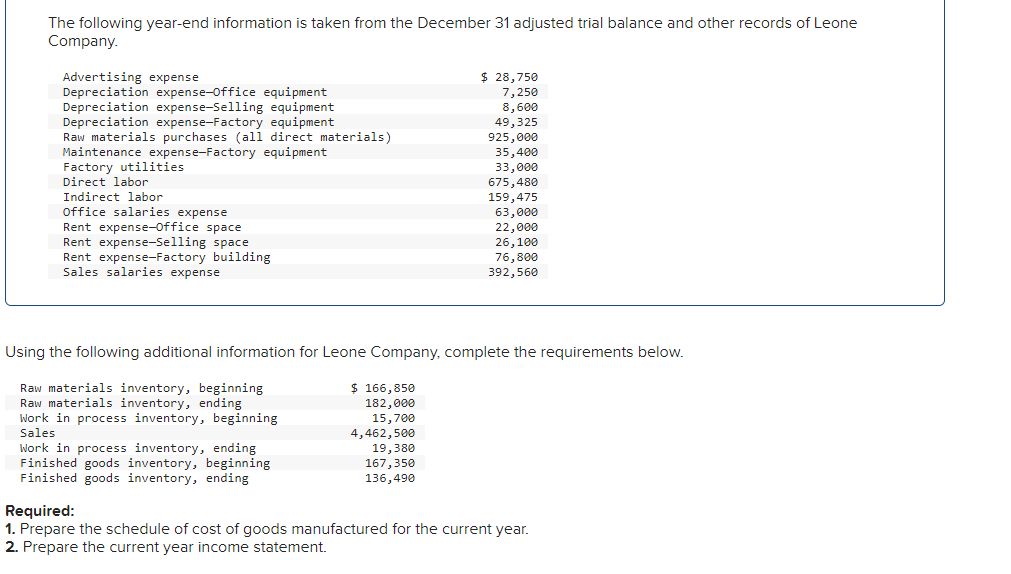

The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone Company. Advertising expense Depreciation expense-Office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Raw materials purchases (all direct materials) Maintenance expense-Factory equipment Factory utilities Direct labor Indirect labor Office salaries expense Rent expense-Office space Rent expense-Selling space Rent expense-Factory building Sales salaries expense Work in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending Using the following additional information for Leone Company, complete the requirements below. Raw materials inventory, beginning Raw materials inventory, ending Work in process inventory, beginning Sales $ 166,850 182,000 15,700 4,462,500 $ 28,750 7,250 8,600 49,325 925,000 35,400 33,000 675,480 159,475 63,000 19,380 167,350 136,490 22,000 26,100 76,800 392,560 Required: 1. Prepare the schedule of cost of goods manufactured for the current year. 2. Prepare the current year income statement.

The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone Company. Advertising expense Depreciation expense-Office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Raw materials purchases (all direct materials) Maintenance expense-Factory equipment Factory utilities Direct labor Indirect labor Office salaries expense Rent expense-Office space Rent expense-Selling space Rent expense-Factory building Sales salaries expense Work in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending Using the following additional information for Leone Company, complete the requirements below. Raw materials inventory, beginning Raw materials inventory, ending Work in process inventory, beginning Sales $ 166,850 182,000 15,700 4,462,500 $ 28,750 7,250 8,600 49,325 925,000 35,400 33,000 675,480 159,475 63,000 19,380 167,350 136,490 22,000 26,100 76,800 392,560 Required: 1. Prepare the schedule of cost of goods manufactured for the current year. 2. Prepare the current year income statement.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter4: Adjusting Entries And The Work Sheet

Section: Chapter Questions

Problem 4PB: The trial balance for Harris Pitch and Putt on June 30 is as follows: Data for month-end adjustments...

Related questions

Question

Please Complete Answer With Explanation And do not give solution in images format

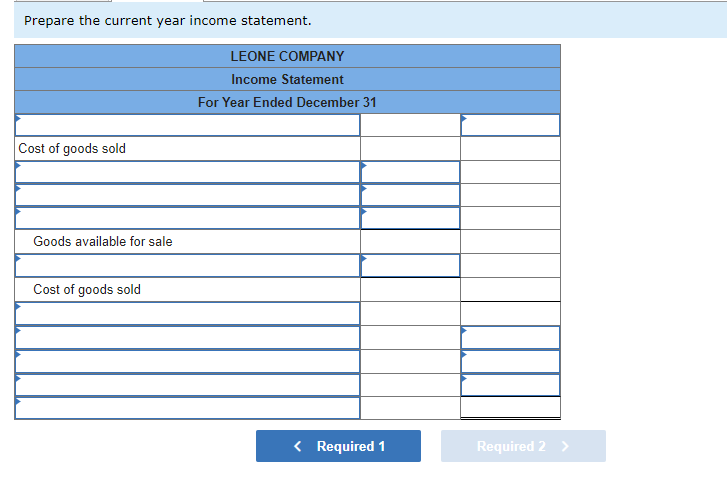

Transcribed Image Text:Prepare the current year income statement.

Cost of goods sold

Goods available for sale

Cost of goods sold

LEONE COMPANY

Income Statement

For Year Ended December 31

< Required 1

Required 2

Transcribed Image Text:The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone

Company.

Advertising expense

Depreciation expense-Office equipment

Depreciation expense-Selling equipment

Depreciation expense-Factory equipment

Raw materials purchases (all direct materials)

Maintenance expense-Factory equipment

Factory utilities

Direct labor

Indirect labor

Office salaries expense

Rent expense-Office space

Rent expense-Selling space

Rent expense-Factory building

Sales salaries expense

$ 28,750

7,250

8,600

49,325

925,000

35,400

33,000

675,480

159,475

63,000

22,000

26,100

76,800

392,560

Using the following additional information for Leone Company, complete the requirements below.

Raw materials inventory, beginning

Raw materials inventory, ending

Work in process inventory, beginning

Sales

Work in process inventory, ending

Finished goods inventory, beginning

Finished goods inventory, ending

$ 166,850

182,000

15,700

4,462,500

19,380

167,350

136,490

Required:

1. Prepare the schedule of cost of goods manufactured for the current year.

2. Prepare the current year income statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning