Use the following information for the next three questions: Entity A determines an indication that its investment property might be impaired. Entity A then gathers the following information: Carrying amount of investment property Fair value less costs to sell P1,000,000 900,000 880,000 Use the follow Entity A detern gathers the fol Carrying amou Fair value less Value in use Following the impairment, Entity A revises its estimate of residual value to 5% of the recoverable amount and the remaining useful life to 10 years. alue in use 7. How much is the impairment loss? Following the 120.000

Use the following information for the next three questions: Entity A determines an indication that its investment property might be impaired. Entity A then gathers the following information: Carrying amount of investment property Fair value less costs to sell P1,000,000 900,000 880,000 Use the follow Entity A detern gathers the fol Carrying amou Fair value less Value in use Following the impairment, Entity A revises its estimate of residual value to 5% of the recoverable amount and the remaining useful life to 10 years. alue in use 7. How much is the impairment loss? Following the 120.000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 9C

Related questions

Question

100%

Based on question no. 7. thankiess

Transcribed Image Text:»artleby

Q Search for textbooks, step-by-step explanations to homework questions,.

Ask an Expert

«A Library

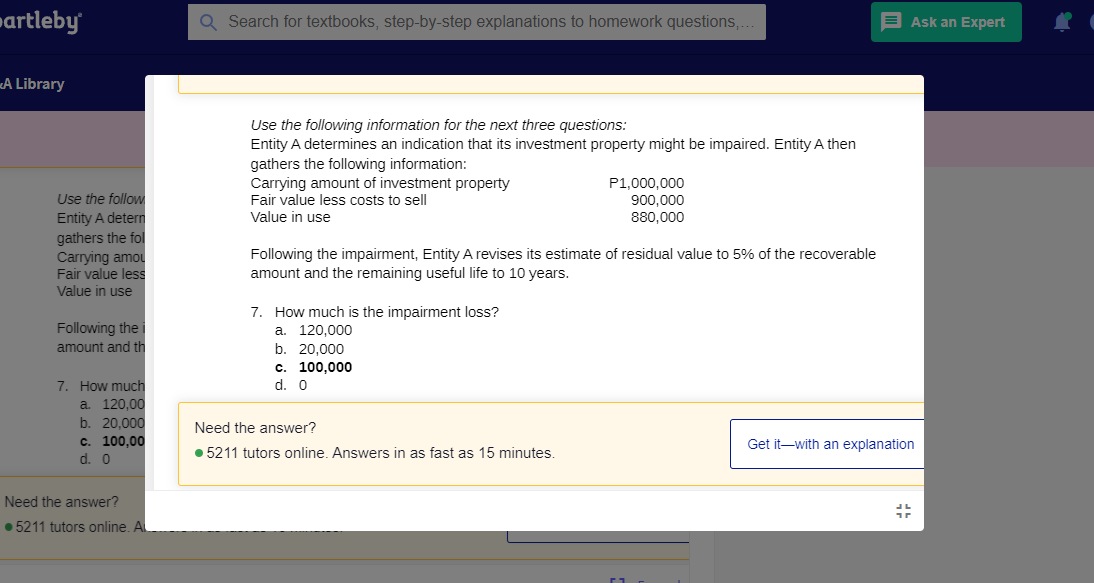

Use the following information for the next three questions:

Entity A determines an indication that its investment property might be impaired. Entity A then

gathers the following information:

Carrying amount of investment property

Fair value less costs to sell

Value in use

P1,000,000

900,000

Use the follow

Entity A detern

gathers the fol

Carrying amou

Fair value less

Value in use

880,000

Following the impairment, Entity A revises its estimate of residual value to 5% of the recoverable

amount and the remaining useful life to 10 years.

7. How much is the impairment loss?

a. 120.000

b. 20.000

c. 100,000

d. 0

Following the i

amount and th

7. How much

a 120,00

b. 20,000

c. 100,00

d. 0

Need the answer?

Get it-with an explanation

• 5211 tutors online. Answers in as fast as 15 minutes.

Need the answer?

• 5211 tutors online. Al

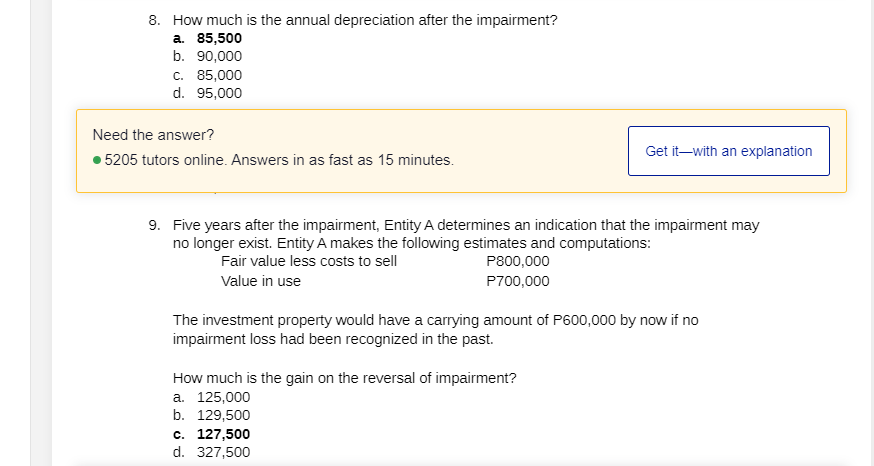

Transcribed Image Text:8. How much is the annual depreciation after the impairment?

a. 85,500

b. 90,000

c. 85,000

d. 95,000

Need the answer?

Get it-with an explanation

• 5205 tutors online. Answers in as fast as 15 minutes.

9. Five years after the impairment, Entity A determines an indication that the impairment may

no longer exist. Entity A makes the following estimates and computations:

Fair value less costs to sell

P800,000

Value in use

P700,000

The investment property would have a carrying amount of P600,000 by now if no

impairment loss had been recognized in the past.

How much is the gain on the reversal of impairment?

a. 125,000

b. 129,500

c. 127,500

d. 327,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning