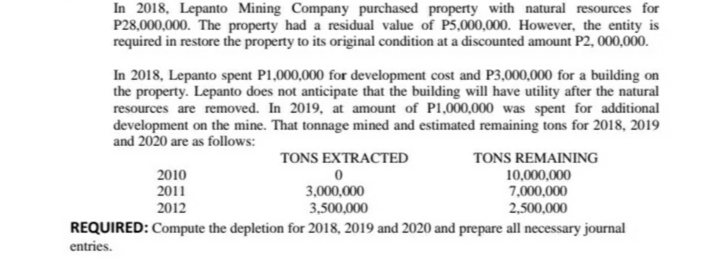

In 2018, Lepanto Mining Company purchased property with natural resources for P28,000,000. The property had a residual value of P5,000,000. However, the entity is required in restore the property to its original condition at a discounted amount P2, 000,000. In 2018, Lepanto spent P1,000,000 for development cost and P3,000,000 for a building on the property. Lepanto does not anticipate that the building will have utility after the natural resources are removed. In 2019, at amount of P1,000,000 was spent for additional development on the mine. That tonnage mined and estimated remaining tons for 2018, 2019 and 2020 are as follows:

In 2018, Lepanto Mining Company purchased property with natural resources for P28,000,000. The property had a residual value of P5,000,000. However, the entity is required in restore the property to its original condition at a discounted amount P2, 000,000. In 2018, Lepanto spent P1,000,000 for development cost and P3,000,000 for a building on the property. Lepanto does not anticipate that the building will have utility after the natural resources are removed. In 2019, at amount of P1,000,000 was spent for additional development on the mine. That tonnage mined and estimated remaining tons for 2018, 2019 and 2020 are as follows:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 7RE: Bliss Company owns an asset with an estimated life of 15 years and an estimated residual value of...

Related questions

Question

Transcribed Image Text:In 2018, Lepanto Mining Company purchased property with natural resources for

P28,000,000. The property had a residual value of P5,000,000. However, the entity is

required in restore the property to its original condition at a discounted amount P2, 000,000.

In 2018, Lepanto spent P1,000,000 for development cost and P3,000,000 for a building on

the property. Lepanto does not anticipate that the building will have utility after the natural

resources are removed. In 2019, at amount of P1,000,000 was spent for additional

development on the mine. That tonnage mined and estimated remaining tons for 2018, 2019

and 2020 are as follows:

TONS EXTRACTED

TONS REMAINING

2010

10,000,000

7,000,000

2011

2012

3,000,000

3,500,000

2,500,000

REQUIRED: Compute the depletion for 2018, 2019 and 2020 and prepare all necessary journal

entries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning