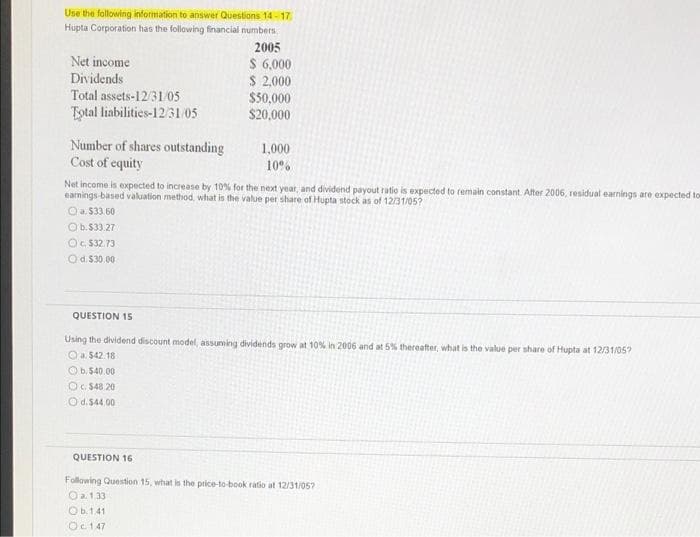

Use the following information to answer Questions 14-17. Hupta Corporation has the following financial numbers. 2005 $ 6,000 Net income Dividends $ 2,000 Total assets-12/31/05 $50,000 Total liabilities-12/31/05 $20,000 Number of shares outstanding 1,000 Cost of equity 10% Net income is expected to increase by 10% for the next year, and dividend payout ratio is expected to remain constant. After 2006, residual earnings are earnings-based valuation method, what is the value per share of Hupta stock as of 12/31/05? a. $33.60 Ob.$33.27 Oc. $32.73 Od. $30.00 QUESTION 15 Using the dividend discount model, assuming dividends grow at 10% in 2006 and at 5% thereafter, what is the value per share of Hupta at 12/31/05? a. $42.18 b. $40.00 Oc$48 20 Od. $44.00 QUESTION 16 Following Question 15, what is the price-to-book ratio at 12/31/05? Oa. 1.33 Ob.141 Q147

Use the following information to answer Questions 14-17. Hupta Corporation has the following financial numbers. 2005 $ 6,000 Net income Dividends $ 2,000 Total assets-12/31/05 $50,000 Total liabilities-12/31/05 $20,000 Number of shares outstanding 1,000 Cost of equity 10% Net income is expected to increase by 10% for the next year, and dividend payout ratio is expected to remain constant. After 2006, residual earnings are earnings-based valuation method, what is the value per share of Hupta stock as of 12/31/05? a. $33.60 Ob.$33.27 Oc. $32.73 Od. $30.00 QUESTION 15 Using the dividend discount model, assuming dividends grow at 10% in 2006 and at 5% thereafter, what is the value per share of Hupta at 12/31/05? a. $42.18 b. $40.00 Oc$48 20 Od. $44.00 QUESTION 16 Following Question 15, what is the price-to-book ratio at 12/31/05? Oa. 1.33 Ob.141 Q147

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 12RE: Given the following year-end information, compute Greenwood Corporations basic and diluted earnings...

Related questions

Question

Transcribed Image Text:Use the following information to answer Questions 14 - 17.

Hupta Corporation has the following financial numbers.

2005

$ 6,000

$ 2,000

$50,000

$20,000

Net income

Dividends

Total assets-12/31/05

Total liabilities-1231 o5

Number of shares outstanding

Cost of equity

1,000

10%

Net income is expected to increase by 10% for the next year, and dividend payout ratio is expected to remain constant. Alter 2006, residual earnings are expected tow

earnings-based valuation method, what is the value per share of Hupta stock as of 12/31/05?

Oa. 533.60

Ob.S33.27

OC 532.73

Od. $30.00

QUESTION 15

Using the dividend discount model, assuming dividends grow at 10% in 2006 and at 5% thereafter, what is the value per share of Hupta at 12/31/05?

Oa. 542.18

O b. $40.00

OG $48 20

O d.$44.00

QUESTION 16

Following Question 15, what is the price-to-book ratio at 12/31/05?

Oa 133

Ob.141

Oc147

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning