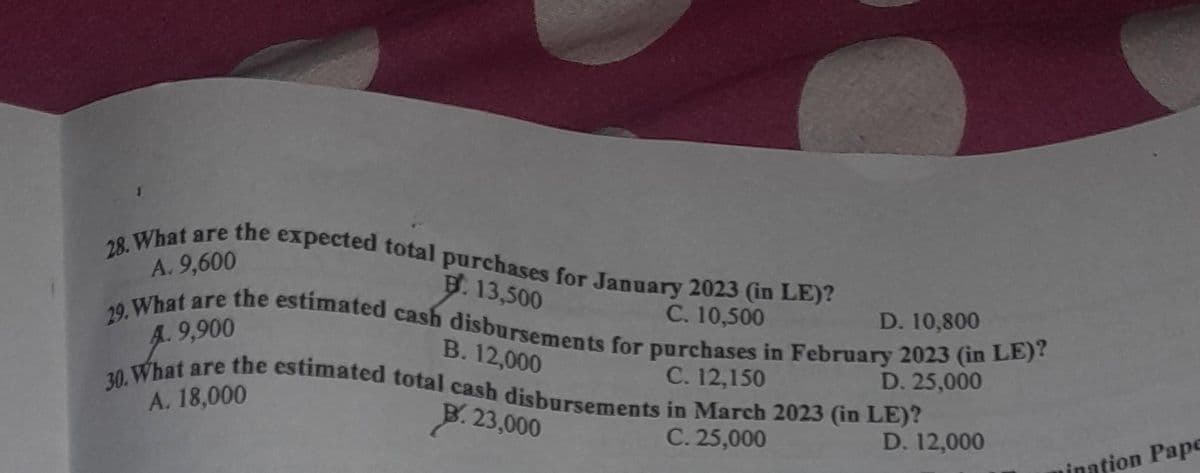

Use the following information to answer questions 20 to 201 ABC Co. is preparing a cash budget for the first quarter of 2023 (in LV): 21. Total cash available in January is: A. LE 514,000 Beginning cash balance Minimum cash balance Total Cash collections 587,000 Total Cash payments and Disbursements The company can borrow (if necessary) and repay as promptly as possible. Borrowing occurs at the beginning of the month(s) and repayment occurs at the end of the month(s). Annual interest rate is 12% and it is paid when the related loans is repaid. Borrowing and repayment of loan principal are in multiples of LE 5,000. B. LE 850,000 22. Total cash needed in January in: A. LE 805,000 23. Beginning cash balance LE 60,000 January February 140,000 60,000 60,000 380,000 481,000 B. LE 642,000 of February is: B. LE 62,000 March 7 60,000 790,000 766,250 LE 520,000 C. LE 1,863,000 C. LE 64,000 D. LE 1,760,000 $. LE 541,000 D. LE (45,000)

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Ma2.

Step by step

Solved in 3 steps