Use the following information to determine this company's cash flows from financing activities. a. Issued common stock for $40 cash. b. Paid $70 cash to retire a note payable at its $70 maturity value. c. Paid cash dividend of $15. d. Paid $5 cash to acquire its treasury stock. Ex 3: Cash flows from financing activities Cash received from issuance of common stock (from a). Cash paid to settle note payable (from b).. Cash paid for dividend (from c)... Cash paid to acquire treasury stock (from d) Net cash used by financing activities $ 40 (70) (15) (5) $(50) ... ...

Use the following information to determine this company's cash flows from financing activities. a. Issued common stock for $40 cash. b. Paid $70 cash to retire a note payable at its $70 maturity value. c. Paid cash dividend of $15. d. Paid $5 cash to acquire its treasury stock. Ex 3: Cash flows from financing activities Cash received from issuance of common stock (from a). Cash paid to settle note payable (from b).. Cash paid for dividend (from c)... Cash paid to acquire treasury stock (from d) Net cash used by financing activities $ 40 (70) (15) (5) $(50) ... ...

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.2DC

Related questions

Question

Help me do example 3- chapter 4

Transcribed Image Text:20:23

A Ims.uef.edu.vn

Ex 3:

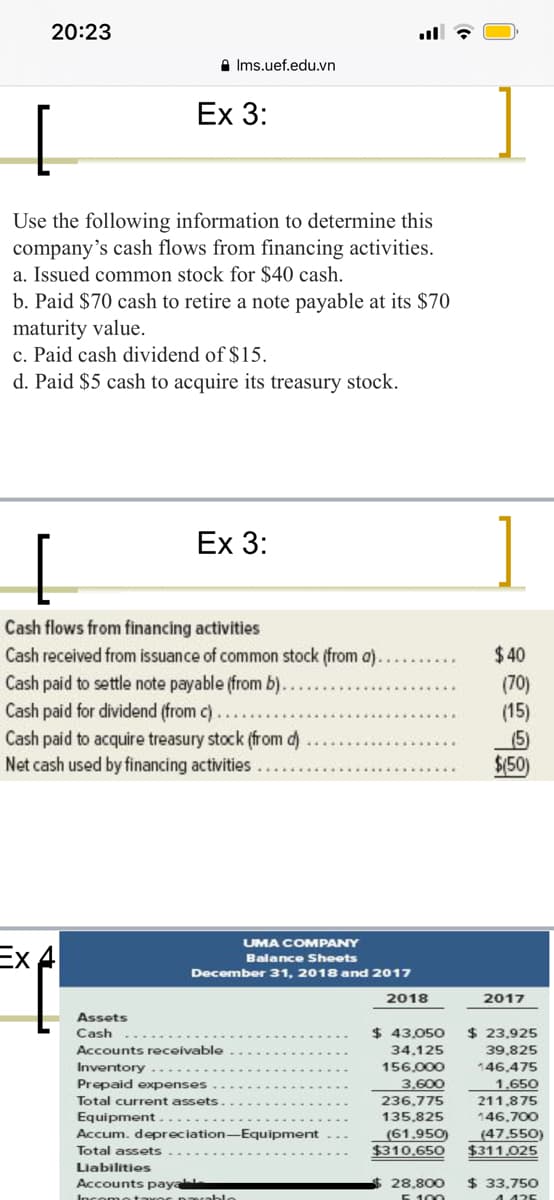

Use the following information to determine this

company's cash flows from financing activities.

a. Issued common stock for $40 cash.

b. Paid $70 cash to retire a note payable at its $70

maturity value.

c. Paid cash dividend of $15.

d. Paid $5 cash to acquire its treasury stock.

Ex 3:

Cash flows from financing activities

Cash received from issuance of common stock (from a).

Cash paid to settle note payable (from b).

Cash paid for dividend (from c).

Cash paid to acquire treasury stock (from d)

Net cash used by financing activities

$ 40

(70)

(15)

(5)

$(50)

UMA COMPANY

Ex A

Balance Sheets

December 31, 2018 and 2017

2018

2017

Assets

Cash

$ 43,050

$ 23,925

Accounts receivable

34,125

156.000

39,825

Inventory

146,475

Prepaid expenses

3,600

236,775

1,650

Total current assets

211.875

Equipment..

135,825

146,700

Accum. depreciation-Equipment

Total assets

(61.950)

$310,650

(47.550)

$311.025

Liabilities

Accounts paya

Incomotmror pmablo

28,800

5 100

$ 33,750

1. 425

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning