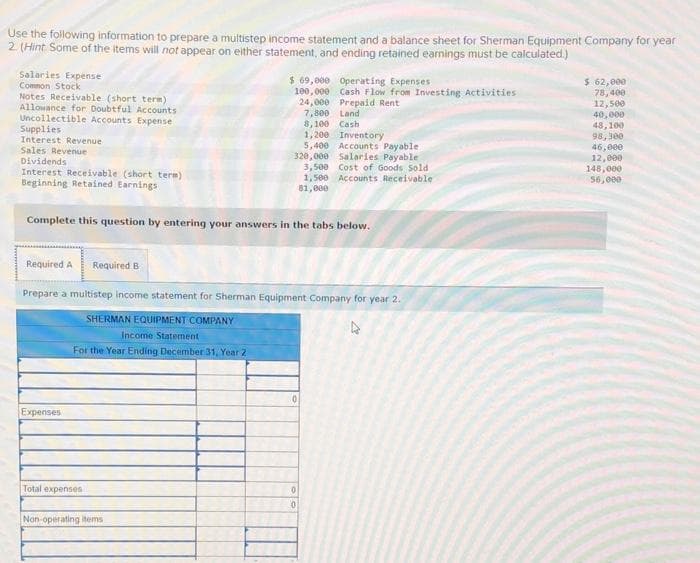

Use the following information to prepare a multistep income statement and a balance sheet for Sherman Equipment Company for year 2 (Hint Some of the items will not appear on either statement, and ending retained earnings must be calculated.) Salaries Expense Common Stock Notes Receivable (short term) Allowance for Doubtful Accounts Uncollectible Accounts Expense Supplies Interest Revenue Sales Revenue $ 69,000 Operating Expenses 100,000 Cash Flow from Investing Activities 24,000 Prepaid Rent Required A Required B 7,800 Land 8,100 Cash 1,200 Inventory 5,400 Accounts Payable 320,000 Salaries Payable 3,500 Cost of Goods Sold 1,500 Accounts Receivable 81,000 Dividends Interest Receivable (short tere) Beginning Retained Earnings Complete this question by entering your answers in the tabs below. Prepare a multistep income statement for Sherman Equipment Company for year 2. $ 62,000 78,400 12,500 40,000 48,100 98,300 46,000 12,000 148,000 56,000

Use the following information to prepare a multistep income statement and a balance sheet for Sherman Equipment Company for year 2 (Hint Some of the items will not appear on either statement, and ending retained earnings must be calculated.) Salaries Expense Common Stock Notes Receivable (short term) Allowance for Doubtful Accounts Uncollectible Accounts Expense Supplies Interest Revenue Sales Revenue $ 69,000 Operating Expenses 100,000 Cash Flow from Investing Activities 24,000 Prepaid Rent Required A Required B 7,800 Land 8,100 Cash 1,200 Inventory 5,400 Accounts Payable 320,000 Salaries Payable 3,500 Cost of Goods Sold 1,500 Accounts Receivable 81,000 Dividends Interest Receivable (short tere) Beginning Retained Earnings Complete this question by entering your answers in the tabs below. Prepare a multistep income statement for Sherman Equipment Company for year 2. $ 62,000 78,400 12,500 40,000 48,100 98,300 46,000 12,000 148,000 56,000

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 1Q: Define each of the following terms:

Annual report; balance sheet; income statement

Common...

Related questions

Question

Do not give answer in image

Solve both

Transcribed Image Text:Use the following information to prepare a multistep income statement and a balance sheet for Sherman Equipment Company for year

2. (Hint Some of the items will not appear on either statement, and ending retained earnings must be calculated.)

Salaries Expense

Common Stock

Notes Receivable (short term)

Allowance for Doubtful Accounts

Uncollectible Accounts Expense

Supplies

Interest Revenue

Sales Revenue

Dividends

Interest Receivable (short term)

Beginning Retained Earnings

Required A Required B

Complete this question by entering your answers in the tabs below.

Expenses

$ 69,000 Operating Expenses

100,000 Cash Flow from Investing Activities

24,000 Prepaid Rent

7,800

Total expenses

Prepare a multistep income statement for Sherman Equipment Company for year 2.

SHERMAN EQUIPMENT COMPANY

4

Income Statement

For the Year Ending December 31, Year 2

Non-operating items

8,100

1,200 Inventory

5,400 Accounts Payable

320,000 Salaries Payable.

3,500 Cost of Goods Sold

1,500 Accounts Receivable

81,000

Land

Cash

0

0

0

$ 62,000

78,400

12,500

40,000

48,100

98,300

46,000

12,000

148,000

56,000

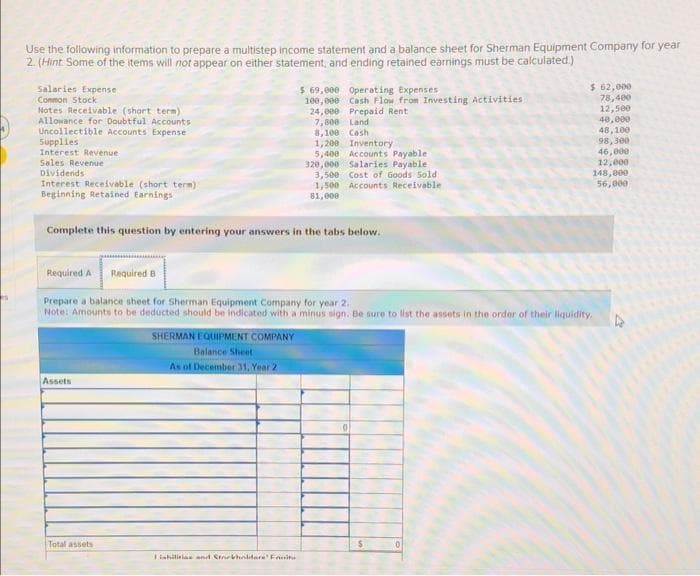

Transcribed Image Text:Use the following information to prepare a multistep income statement and a balance sheet for Sherman Equipment Company for year

2. (Hint Some of the items will not appear on either statement, and ending retained earnings must be calculated.)

Salaries Expense

Common Stock

Notes Receivable (short term)

Allowance for Doubtful Accounts

Uncollectible Accounts Expense

Supplies

Interest Revenue

Sales Revenue

Dividends

Interest Receivable (short term)

Beginning Retained Earnings

Assets

Complete this question by entering your answers in the tabs below.

Total assets

$ 69,000 Operating Expenses

100,000 Cash Flow from Investing Activities

24,000 Prepaid Rent

7,800 Land

SHERMAN EQUIPMENT COMPANY

Balance Sheet

As of December 31, Year 2

8,100 Cash.

1,200 Inventory

5,400 Accounts Payable

Salaries Payable

Cost of Goods Sold

Listilities and Storkholdere Fanitu

320,000

3,500

1,500 Accounts Receivable

81,000

Required A Required B

Prepare a balance sheet for Sherman Equipment Company for year 2.

Note: Amounts to be deducted should be indicated with a minus sign. Be sure to list the assets in the order of their liquidity.

0

$ 62,000

78,400

12,500

40,000

48,100

98,300

46,000

$

12,000

148,000

56,000

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning