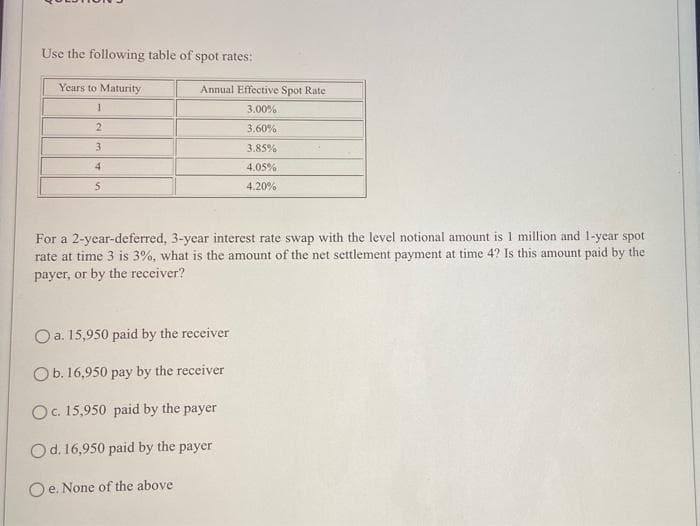

Use the following table of spot rates: Years to Maturity Annual Effective Spot Rate 1 3.00% 2 3.60% 3. 3.85% 4. 4.05% 4.20% For a 2-year-deferred, 3-year interest rate swap with the level notional amount is 1 million and 1-year spot rate at time 3 is 3%, what is the amount of the net settlement payment at time 4? Is this amount paid by the payer, or by the receiver?

Q: What is the present value of a $90 annual annuity for 10 years with an additional $1000 received at ...

A: Present value of annuity Annuity is a series of equal payments at equal interval till a specified pe...

Q: A loan should be fully repaid in 30 monthly installments of Rp3.750.000. If the loan is Rp100.000.00...

A: Flat interest rate is simple interest rate without considering the impact of the compounding and add...

Q: Inflation can have significant effects on income statements and balance sheets, and therefore on the...

A: Inflation It arises when average prices in the entire country go up . Value of money is decreased o...

Q: what is the stock market, and why is it important?

A: Stock Market: Stock markets are platforms where the sellers & buyers meet for the exchange of e...

Q: Not use of the excel Q)A car loan of $36601 is to be repaid by making payments each month for 3 yea...

A: Loans are paid by the monthly payment that carry the interest payment and payment for the principal ...

Q: a. Discuss two technical points that can affect short selling. b. Do your own research on ASX. What ...

A: a) Short selling occurs when an investor borrows a security and sells it on the open market with the...

Q: . In order for Linda to reach her saving goal. How much will Linda need to save each money b. Overal...

A: Future Value of Annuity: It represents the future value of the present annuity cash flow stream. It...

Q: 4. TSE company sells an old piece of equipment for $15,000 cash. At the same moment, it buys a new t...

A: Sale of equipment = $15000 Purchase of new truck = $25000 Payment of dividend = $2000

Q: The interest rate in Japan is 1%. The yen to dollar spot exchange rate is ¥100 per dollar and the f...

A: Covered Interest rate parity It provides relationships among interest rates and exchange rates (spo...

Q: The balance on Taylor's credit card is $2000. It has an interest rate of 12.5%. She wants to compare...

A: Interest refers to the amount paid by the borrower to bank on the amount borrowed at a fixed or fluc...

Q: Question 1 A 5-year project will require an investment of $100 million. This comprises of plant and...

A: 1) To Calculate the Cost of Equity for this project Cost of Equity = Risk-Free Rate of Return + Beta...

Q: 19. Firm X has a Return on Equity (ROE) equal to 10%, a total debt ratio equal to 0.6. If the firm h...

A: Note: Hi! Thank you for the question, as per the honour code, we are allowed to answer one question ...

Q: (b) A trader buys one May2022 futures contracts on frozen orange juice. Each contract is for the del...

A: Margin call is made in a situation where due to change in market price, the margin balance falls bel...

Q: You can buy a carton of three 32-ounce bottles of shower cleaner on sale for $5.00. The 64-ounce "re...

A: Price of a carton of three 32-ounce bottles of shower cleaner = $ 5.00Price of 64-ounce "refill" siz...

Q: In the equation the original amount for the investment is $840,000. Why in the first step of the sol...

A: Investment = $840,000 Profit = 1,500,000

Q: Laurel Enterprises expects earnings next year of $4.00 per share and has a 40% retention rate, whi...

A: A stock (also called equity) is a financial instrument that represents ownership of a portion of a c...

Q: stock. The required return on this stock is 13 percent. What will your capital gain and capital gain...

A: The capital gain is the increase in price of stock due to the dividend and dividend growth rate and ...

Q: is trend analysis helpful in analyzing ratio

A: Trend analysis the patterns going on within the industry in different ratios and help in comparison ...

Q: Bob Katz would like to save $250,000 over the next 25 years. If Bob knows today that he will be give...

A: Amount likely to be saved is $250,000 Interest rate is 4% Inheritance received in year -15 is $150,0...

Q: An investment of $100,000 in safe 10-year corporate bonds yields an average of 9% per year, payable ...

A: Time value of money (TVM) is used to measure the value of money at different point of time in the fu...

Q: Explain why the weighted average cost of capital (WACC) is used in capital budgeting.

A: WACC = multiplying the cost of each capital source (debt and equity) by its relevant weight by marke...

Q: A 90-day put option for 10,000 ABC ordinary shares has an exercise price of 32 per share. The curren...

A: Exercise price is 32 per share Risk-free rate is 5% Market Value per share is 30 Total number of sha...

Q: Q)suppose your child is 10 years old now and you decided to start an education fund your child next ...

A: Here we will use the concept of time value of money. Essentially this is the case of a growing annui...

Q: The appropriate price the investor could receive in 12 months by means of a forward contract would b...

A: Given i=9% Appropriate price the investor could receive in 9months time = Asset worth*(1+risk fr...

Q: Find the amount (future value) of the ordinary annuity. (Round your answer to the nearest cent.) $1...

A:

Q: what is the average EAR on an investment that earns 6% APR with monthly compounding for 5 years, fol...

A: The EAR is calculated for the compounded interest which shows the single rate that will provide same...

Q: (the Scream Machine) at a theme park. Alternative A required a $300,000 investment, produced after-t...

A: Future worth analysis is one of the methods used to make a cost benefit analysis of alternative proj...

Q: Supposing we the contract entered in is at the price of $285. We would like to evaluate our position...

A: Here, Spot price = $285. Time of contract = 4 months Forward price = $293.15. To Find: Gain or loss ...

Q: If the accounts receivable turnover ratio is decreasing, what will be happening to the average colle...

A: Accounts receivable turnover ratio is an important activity ratio. This ratio shows how many times a...

Q: Emily Dao, 27, just received a promotion at work that increased her annual salary to $37,000. She is...

A: Concept. Present value is calculated by formula Pv = Fv ÷[ ( 1+ r) n ] Where Pv = present value Fv ...

Q: hat was the amount of each payment

A: Simple interest refers to the amount paid by the borrower to bank on the amount borrowed at a fixed ...

Q: 2. A friend who owns a perpetuity that promises to pay $1,000 at the end of each year, forever, come...

A: Present value of a perpetuity amount With interest rate (i) and the perpetuity amount (A), the prese...

Q: 18. TSE has an equity multiplier of 1.88, and its assets are financed with some combinations of long...

A: Equity multiplier = 1.88

Q: You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner. The s...

A: Tax shield on depreciation =(6,300,000/4)*(0.36) 567000 After tax lease payment = 1745000*(1-0.36)...

Q: 1. Jefferson and Rio Morales are trying to decide on an account to help save for college for their n...

A: Since you have asked multiple questions, we will solve the first question for you. If you want any s...

Q: 5. Assuming making four annual deposits of ($ 1000), and the first payment occurs at the end of the ...

A: Annuity can be defined as a series of payments or receipts of equal amounts of money at equal interv...

Q: how much is in the account at the end of 45 years? (Round your answer to the nearest cent.)

A: Time value of money (TVM) is used to measure the value of money at different point of time in the fu...

Q: Contributions of $146.30 are made at the beginning of every three months into an RRSP for 17 years. ...

A: Future worth is the amount that an investor expects from the cash flows in each period. Future worth...

Q: A borrower is purchasing a property for $325,000. She is considering the following three loans: Loan...

A: EMI or monthly mortgage payments are the fixed amount paid by the borrower to the lender that includ...

Q: The VSE Corporation currently pays no dividend because of depressed earnings. A recent change in man...

A: The price of stock is equal to the present value of all future dividends and the future price of sto...

Q: What is the monthly interest rate for a fixed interest rate of 12% per annum? Choices: 1% 12% ...

A: Annual Interest rate = 12%

Q: firm considering the installation of an automatic data processing unit to handle some of its account...

A: The equipment can be purchased by cash payment but may be leased also by payment of lease which give...

Q: If an individual stock's beta is higher than 1, that stock is riskier than the market

A: If individual stocks beta greater than 1 has risker than market and more volatile. CAPM cost of equ...

Q: ABC Corp. issued new shares with a par value of P1,000, issue price of P1,200 and net proceeds of 1,...

A: We need to use constant or Gordon growth model to calculate the cost of retained earning. The equati...

Q: Question: What type of Annuity is indicated in the problem above?

A: Annuity Due: It represents the annuity where the periodic payments are made at the beginning of eac...

Q: Mick plans to start saving money for retirement. By taking 10% of monthly gross income. Mick is able...

A: We can use the concept of time value of money here. As per the concept of time value of money the wo...

Q: Which of the following is part of the journal entry to backflushes costs to inventory accounts?

A: RIP= units * cost per unit + RM

Q: The scenario is designed to help you determine and evaluate the payment amount of a car loan and a m...

A: Given in this question, Monthly income = $3,000 Maximum car payment each month = 10% of the monthly ...

Q: Explain 1-2 sentences Financial Risk Interest Rates Volatility Foreign Currency Liquidity Derivati...

A: Financial risk is a type of risk that can lead to the loss of stakeholder capital. For the governmen...

Q: An engineer wishes to set up a special fund by making uniform semiannual end-of-period deposits for ...

A: The net amount of cash and cash equivalents being transferred in and out of a company is referred to...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Consider a one-year interest rate swap with semi-annual payments, based on 30/360 day count convention. The term structure of LIBOR spot rates is given as follows: 6-month LIBOR at 7.2%, and 12-month LIBOR at 8.0%. What is the annualized fixed rate on the swap? A. 7.42%. B. 7.93% C. 7.84%. D. 7.56%.Suppose the 1-year and 2-year OIS rates are 2% and 4%, respectively. Consider an OIS swap with two years to maturity where you receive 3% and pay the floating reference rate with principal 1 million. If the payments are made annually with annual compounding the value of the swap is (a)−558.4 (b)−188.5 (c) 0 (d) 188.5 (e) 558.4OIS rates are 3.4% for all maturities. What is the value of an OIS swap with two years to maturity where 3% is received and the floating reference rate is paid. Assume annual compounding, annual payments, and $100 million principal.

- A plain vanilla 2-year interest rate swap with annual payments has a notional principal of $1 million. 5 month(s) into the swap, the term structure of interest rates is flat at 4.70%. The first floating-rate payment has already been set to 5.00%. The fixed payments are 5.29%. What is the value of this swap? Please show steps Answer: -8310An interest rate swap has three years of remaining life. Payments are exchanged annually. Interest at 5% is paid and 12-month LIBOR is received. An exchange of payments has just taken place. The one-year, two-year and three-year LIBOR/swap zero rates are 4%, 5% and 6%. All rates are annually compounded. What is the value of the swap as a percentage of the principal ($100) when OIS and LIBOR rates are the same? (Continuously compounded LIBOR rates per annum for 6, 12, and 18-months are given in the table below. The 2-year swap rate is 3% per annum with payments made semiannually. What is the 2-year LIBOR/swap zero rate for 2 years? Use LIBOR discounting 0.5 - 2.0% 1.0 - 2.4% 1.5 - 2.6% 2.0 - ?

- Suppose we are pricing a five-year Libor-based interest rate swap with annual resets (30/360 day count). The estimated present value factors are given below: Maturity(years) Present ValueFactors1 0.9900992 0.9778763 0.9651364 0.9515295 0.937467 What is the fixed rate of the swap? Answer in 4 decimal placesAn interest rate swap has three years of remaining life. Payments are exchanged annually. Interest at 2% is paid and 12-month LIBOR is received. An exchange of payments has just taken place. The one-year, two-year and three-year LIBOR/swap zero rates are 2%, 3% and 5%. All rates are annually compounded. What is the value of the swap as a percentage of the $100 principal value?A2) A semi-annual pay interest rate swap where the fixed rate is 6.00% (with semi-annual compounding) has a remaining life of eight months. The six-month LIBOR rate observed four months ago was 5.00% with semi-annual compounding. Today’s two and eight month LIBOR rates are 5.5% and 5.75% (continuously compounded) respectively. Assume that OIS and LIBOR rates are the same. If the swap has a principal value of $100,000, the value of the swap to the party receiving a fixed rate of interest is closest to which of the following ?

- An interest rate swap has three years of remaining life. Payments are exchanged annually. Interest at 3% is paid and 12-month LIBOR is received. An exchange of payments has just taken place. The one-year, two-year, and three-year LIBOR/swap zero rates are 2%, 3%, and 4% with continuous compounding. What is the value of the swap as a percentage of the principal when LIBOR discounting is used assuming that the principal is $100? (Note: You are expected to use continuous compounding/discounting. If you use discrete discounting the answer will be close) a. None of the other answers provided is correct. b. 2.88% c. 1.05% d. 0.00% e. 1.00%A $100,000 interest rate swap has a remaining life of 10 months. Under the terms of the swap, six-month LIBOR is exchanged for 4% per annum (compounded semi-annually). Six-month LIBOR forward rates for all maturities are 3.3% (compounded semi-annually). The six-month LIBOR rate was 2.6% two months ago. The risk free rate is 2.7% (cont. comp) for all maturities. What is the value of the swap to the party paying floating? (Required precision: 0.01 +/- 1)Let's imagine that the OIS rates for one year and two years are 2% and 4% respectively. Now, let's examine an OIS swap set to mature in two years, where you receive a fixed rate of 3% and pay the floating reference rate. The principal amount involved is 1 million. If payments are made annually with annual compounding, what is the value of the swap? (a)−558.4 (b) −188.5 (c) 0 (d)188.5 (e) 558.4