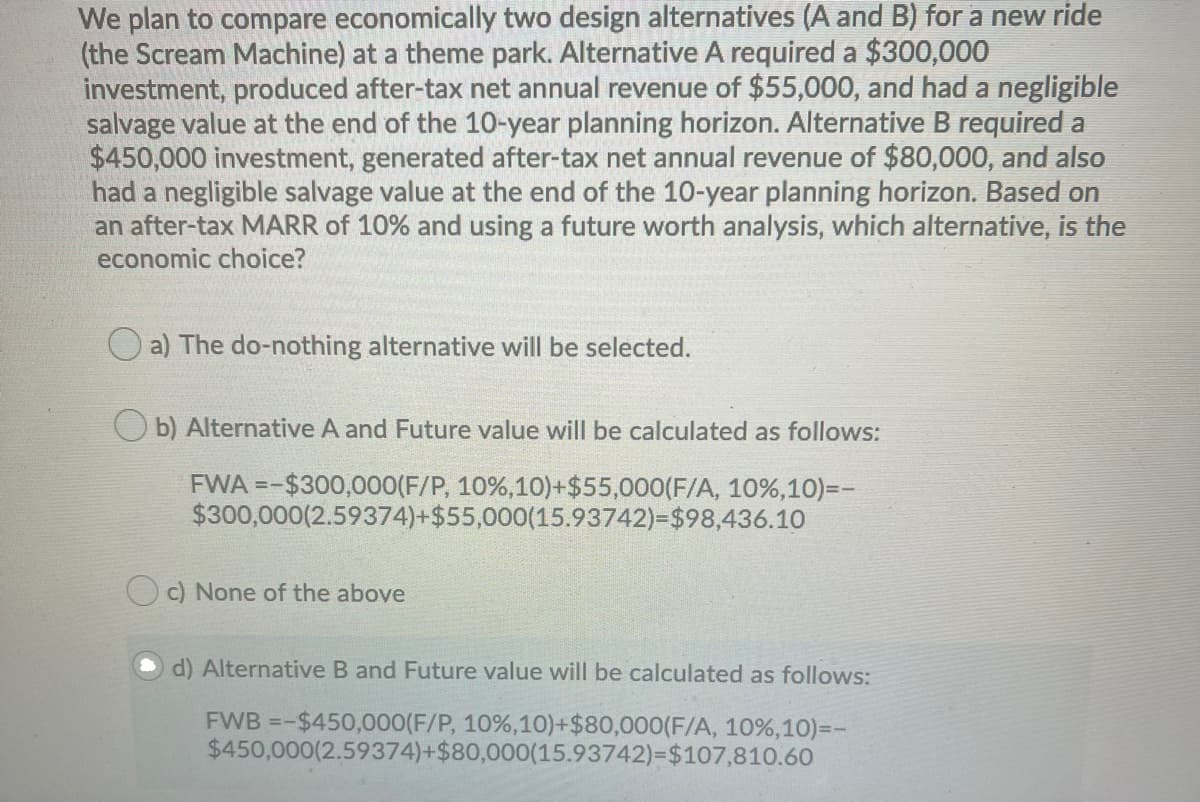

(the Scream Machine) at a theme park. Alternative A required a $300,000 investment, produced after-tax net annual revenue of $55,000, and had a negligible salvage value at the end of the 10-year planning horizon. Alternative B required a $450,000 investment, generated after-tax net annual revenue of $80,000, and also had a negligible salvage value at the end of the 10-year planning horizon. Based on an after-tax MARR of 10% and using a future worth analysis, which alternative, is the economic choice? O a) The do-nothing alternative will be selected. b) Alternative A and Future value will be calculated as follows: FWA =-$300,000(F/P, 10%,10)+$55,000(F/A, 10%,10)=- $300,000(2.59374)+$55,000(15.93742)=$98,436.10 c) None of the above d) Alternative B and Future value will be calculated as follows: FWB =-$450,000(F/P, 10%,10)+$80,000(F/A, 10%,10)=- $450,000(2.59374)+$80,000(15.93742)=$107,810.60

(the Scream Machine) at a theme park. Alternative A required a $300,000 investment, produced after-tax net annual revenue of $55,000, and had a negligible salvage value at the end of the 10-year planning horizon. Alternative B required a $450,000 investment, generated after-tax net annual revenue of $80,000, and also had a negligible salvage value at the end of the 10-year planning horizon. Based on an after-tax MARR of 10% and using a future worth analysis, which alternative, is the economic choice? O a) The do-nothing alternative will be selected. b) Alternative A and Future value will be calculated as follows: FWA =-$300,000(F/P, 10%,10)+$55,000(F/A, 10%,10)=- $300,000(2.59374)+$55,000(15.93742)=$98,436.10 c) None of the above d) Alternative B and Future value will be calculated as follows: FWB =-$450,000(F/P, 10%,10)+$80,000(F/A, 10%,10)=- $450,000(2.59374)+$80,000(15.93742)=$107,810.60

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1fM

Related questions

Question

Can some one please help me to answer each question correctly? please and thank you.

Transcribed Image Text:We plan to compare economically two design alternatives (A and B) for a new ride

(the Scream Machine) at a theme park. Alternative A required a $300,000

investment, produced after-tax net annual revenue of $55,000, and had a negligible

salvage value at the end of the 10-year planning horizon. Alternative B required a

$450,000 investment, generated after-tax net annual revenue of $80,000, and also

had a negligible salvage value at the end of the 10-year planning horizon. Based on

an after-tax MARR of 10% and using a future worth analysis, which alternative, is the

economic choice?

a) The do-nothing alternative will be selected.

O b) Alternative A and Future value will be calculated as follows:

FWA =-$300,000(F/P, 10%,10)+$55,000(F/A, 10%,10)=-

$300,000(2.59374)+$55,000(15.93742)=$98,436.10

c) None of the above

d) Alternative B and Future value will be calculated as follows:

FWB =-$450,000(F/P, 10%,10)+$80,000(F/A, 10%,10)=-

$450,000(2.59374)+$80,000(15.93742)=$107,810.60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT