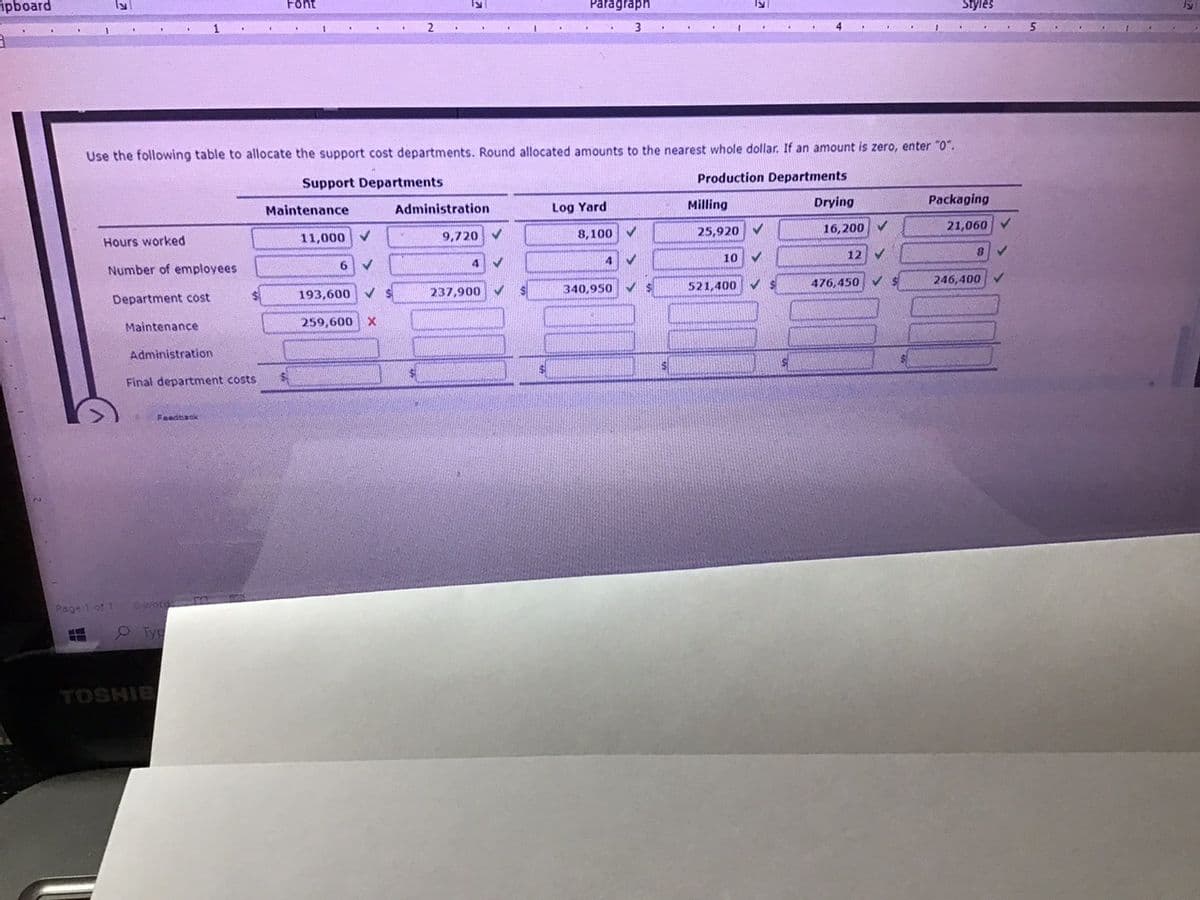

Use the following table to allocate the support cost departments. Round allocated amounts to the nearest whole dollar. If an amount is zero, enter "0". Production Departments Support Departments Log Yard Milling Drying Packaging Maintenance Administration 8,100 V 25,920 V 16,200 V 21,060 11,000V 9,720 Hours worked 10 12 6. Number of employees 246,400 340,950 521,400 476,450 24 193,600 237,900 Department cost Maintenançe 259,600 Administration Final department costs

Use the following table to allocate the support cost departments. Round allocated amounts to the nearest whole dollar. If an amount is zero, enter "0". Production Departments Support Departments Log Yard Milling Drying Packaging Maintenance Administration 8,100 V 25,920 V 16,200 V 21,060 11,000V 9,720 Hours worked 10 12 6. Number of employees 246,400 340,950 521,400 476,450 24 193,600 237,900 Department cost Maintenançe 259,600 Administration Final department costs

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter5: Support Department And Joint Cost Allocation

Section: Chapter Questions

Problem 1BE: Charlies Wood Works produces wood products (e.g., cabinets, tables, picture frames, and so on)....

Related questions

Question

Transcribed Image Text:ipboard

Font

Paragraph

Styles

2.

3.

Use the following table to allocate the support cost departments. Round allocated amounts to the nearest whole dollar. If an amount is zero, enter "0".

Support Departments

Production Departments

Maintenance

Administration

Log Yard

Milling

Drying

Packaging

Hours worked

11,000 V

9,720 v

8,100 V

25,920

16,200V

21,060

Number of employees

4.

4.

10

12

8.

Department cost

193,600 VS

237,900

340,950

521,400

476,450

246,400

Maintenance

259,600 X

Administration

Final department costs

Feedback

Page 1 of 1

word

m

O Tye

TOSHIB

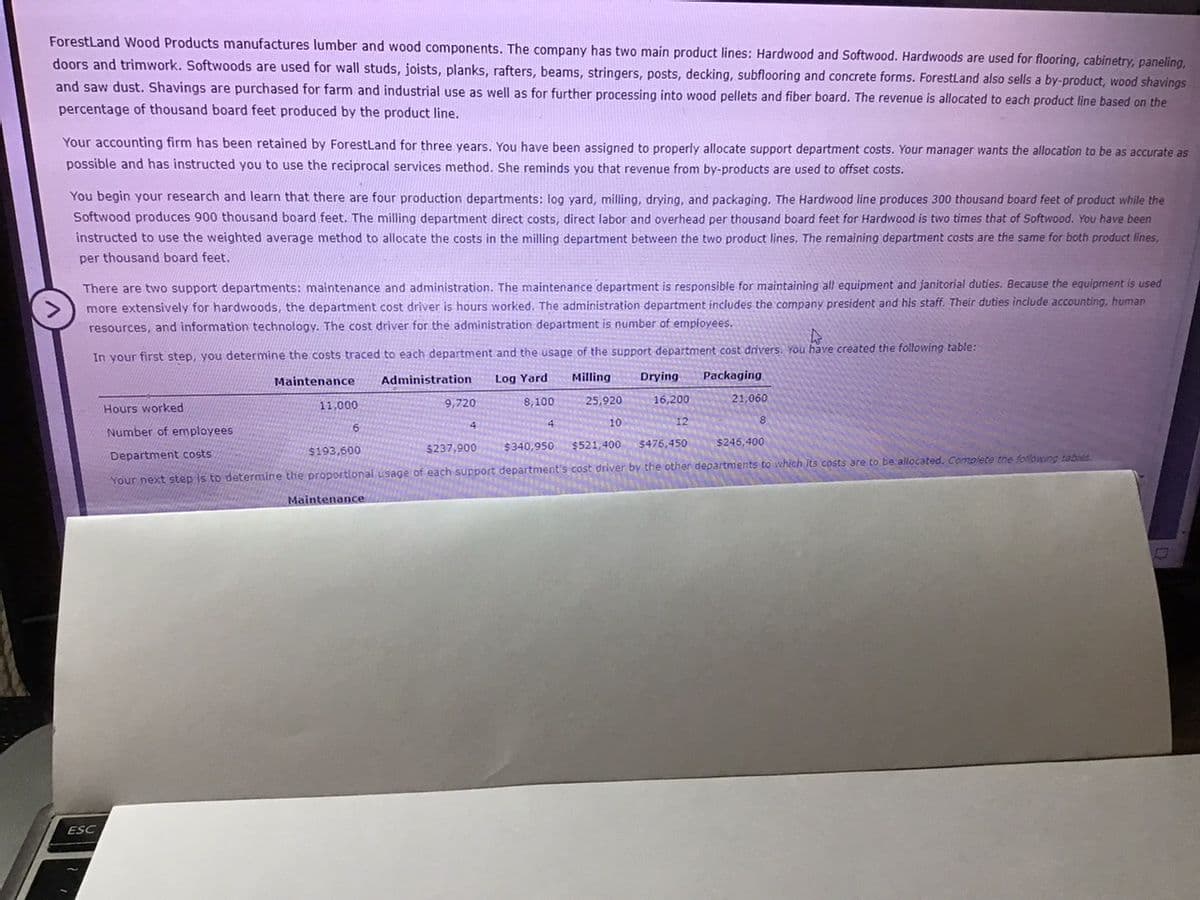

Transcribed Image Text:ForestLand Wood Products manufactures lumber and wood components. The company has two main product lines: Hardwood and Softwood. Hardwoods are used for flooring, cabinetry, paneling,

doors and trimwork. Softwoods are used for wall studs, joists, planks, rafters, beams, stringers, posts, decking, subflooring and concrete forms. ForestLand also sells a by-product, wood shavings

and saw dust. Shavings are purchased for farm and industrial use as well as for further processing into wood pellets and fiber board. The revenue is allocated to each product line based on the

percentage of thousand board feet produced by the product line.

Your accounting firm has been retained by Forestland for three years. You have been assigned to properly allocate support department costs. Your manager wants the allocation to be as accurate as

possible and has instructed you to use the reciprocal services method. She reminds you that revenue from by-products are used to offset costs.

You begin your research and learn that there are four production departments: log vard, milling, drving, and packaging, The Hardwood line produces 300 thousand board feet of product while the

Softwood produces 900 thousand board feet. The milling department direct costs, direct labor and overhead per thousand board feet for Hardwood is two times that of Softwood. You have been

instructed to use the weighted average method to allocate the costs in the milling department between the two product lines. The remaining department costs are the same for both product lines,

per thousand board feet.

There are two support departments: maintenance and administration. The maintenance department is responsible for maintaining all equipment and janitorial duties. Because the equipment is used

more extensively for hardwoods, the department cost driver is hours worked. The administration department includes the company president and his staff. Their duties include accounting, human

resources, and information technology. The cost driver for the administration department is number of employees.

In your first step, you determine the costs traced to each department and the usage of the support department cost drivers. You have created the following table:

Maintenance

Administration

Log Yard

Milling

Drying

Packaging

11,000

9,720

8,100

25,920

16,200

21,060

Hours worked

4

10

12

8

4

Number of employees

$237,900

$340,950

$521,400

$476,450

$246,400

Department costs

$193,600

Your next step is to determine the proportional usage of each support department's cost driver by the other departments to which its costs are to be allocated. Complete the foflowing tabies.

Maintenance

ESC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning