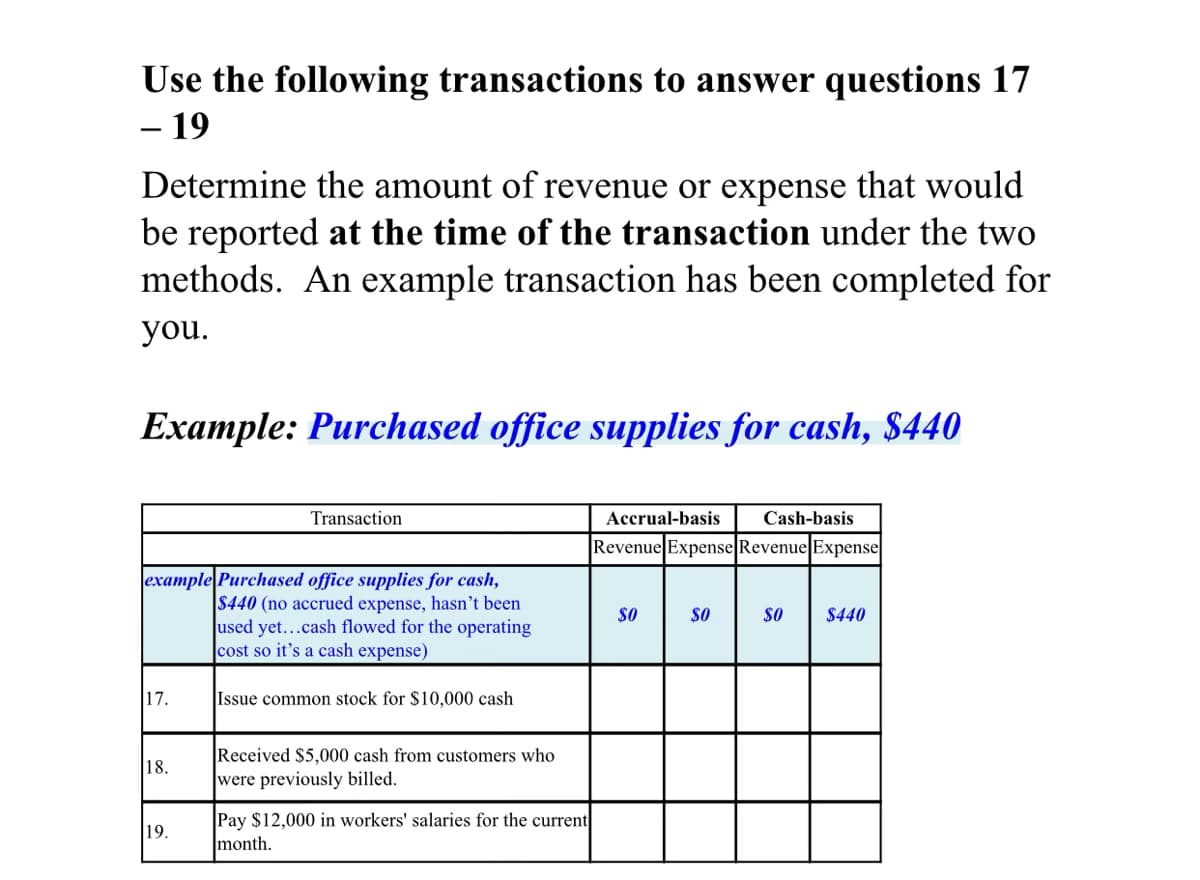

Use the following transactions to answer questions 17 - 19 Determine the amount of revenue or expense that would be reported at the time of the transaction under the two methods. An example transaction has been completed fo you. Example: Purchased office supplies for cash, $440 Transaction Accrual-basis Cash-basis Revenue Expense Revenue Expense example Purchased office supplies for cash, $440 (no accrued expense, hasn't been used yet...cash flowed for the operating cost so it's a cash expense) SO SO SO $440 17. Issue common stock for $10,000 cash Received $5,000 cash from customers who were previously billed. 18. Pay $12,000 in workers' salaries for the current month. 19.

Use the following transactions to answer questions 17 - 19 Determine the amount of revenue or expense that would be reported at the time of the transaction under the two methods. An example transaction has been completed fo you. Example: Purchased office supplies for cash, $440 Transaction Accrual-basis Cash-basis Revenue Expense Revenue Expense example Purchased office supplies for cash, $440 (no accrued expense, hasn't been used yet...cash flowed for the operating cost so it's a cash expense) SO SO SO $440 17. Issue common stock for $10,000 cash Received $5,000 cash from customers who were previously billed. 18. Pay $12,000 in workers' salaries for the current month. 19.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 2SEQ: On January 24, 20Y8, Niche Consulting collected $5,700 it had hilled its clients for services...

Related questions

Question

Transcribed Image Text:Use the following transactions to answer questions 17

- 19

Determine the amount of revenue or expense that would

be reported at the time of the transaction under the two

methods. An example transaction has been completed for

you.

Example: Purchased office supplies for cash, $440

Transaction

Accrual-basis

Cash-basis

Revenue Expense Revenue Expense

example Purchased office supplies for cash,

$440 (no accrued expense, hasn't been

used yet...cash flowed for the operating

cost so it's a cash expense)

$O

$440

17.

Issue common stock for $10,000 cash

Received $5,000 cash from customers who

were previously billed.

18.

Pay $12,000 in workers' salaries for the current

month.

19.

Expert Solution

Step 1

The accrual method is where revenue or an expense is recorded at the occurrence of the transaction and when actual cash is not received or paid, as the case may be.

The cash method records the transaction only when actual cash is either paid or received.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,