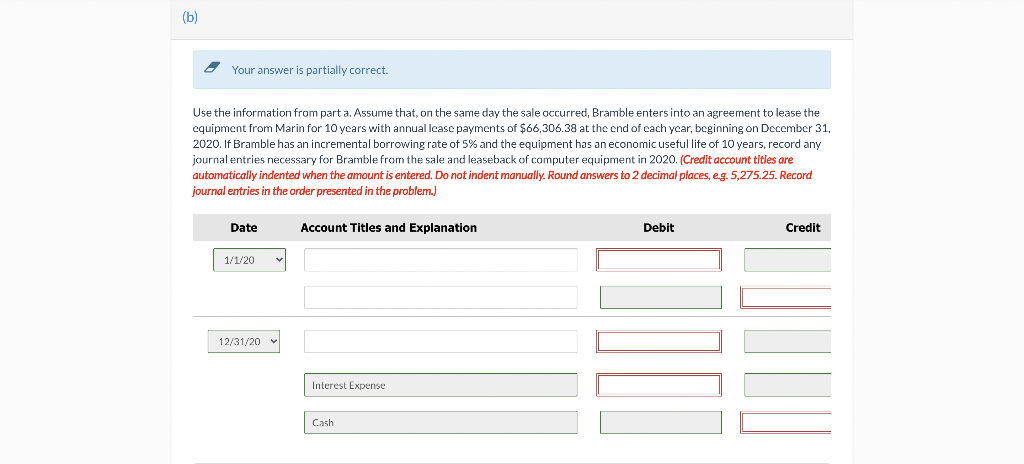

Use the information from part a. Assume that, on the same day the sale occurred, Bramble enters into an agreement to lease the equipment from Marin for 10 ycars with annual lcase payments of $66,306.38 at the end of cach ycar, beginning on December 31, 2020. If Bramble has an incremental borrowing rate of 5% and the equipment has an economic useful life of 10 years, record any journal entries necessary for Bramble from the sale and leaseback of computer equipment in 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 2 decimal places, eg. 5,275.25. Record journal entries in the order presented in the problem.)

Use the information from part a. Assume that, on the same day the sale occurred, Bramble enters into an agreement to lease the equipment from Marin for 10 ycars with annual lcase payments of $66,306.38 at the end of cach ycar, beginning on December 31, 2020. If Bramble has an incremental borrowing rate of 5% and the equipment has an economic useful life of 10 years, record any journal entries necessary for Bramble from the sale and leaseback of computer equipment in 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 2 decimal places, eg. 5,275.25. Record journal entries in the order presented in the problem.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 9P: During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the...

Related questions

Question

Transcribed Image Text:(b)

2 Your answer is partially correct.

Use the information from part a. Assume that, on the same day the sale occurred, Bramble enters into an agreement to lease the

equipment from Marin for 10 years with annual lcase payments of $66,306.38 at the end of cach ycar, beginning on December 31,

2020. If Bramble has an incremental borrowing rate of 5% and the equipment has an economic useful life of 10 years, record any

journal entries necessary for Bramble from the sale and leaseback of computer equipment in 2020. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. Round answers to 2 decimal places, eg. 5,275.25. Record

journal entries in the order presented in the problem.)

Date

Account Titles and Explanation

Debit

Credit

1/1/20

12/31/20

Interest Expense

Cash

Transcribed Image Text:Respond to the requirements in each situation.

Click here to view factor tables.

(For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

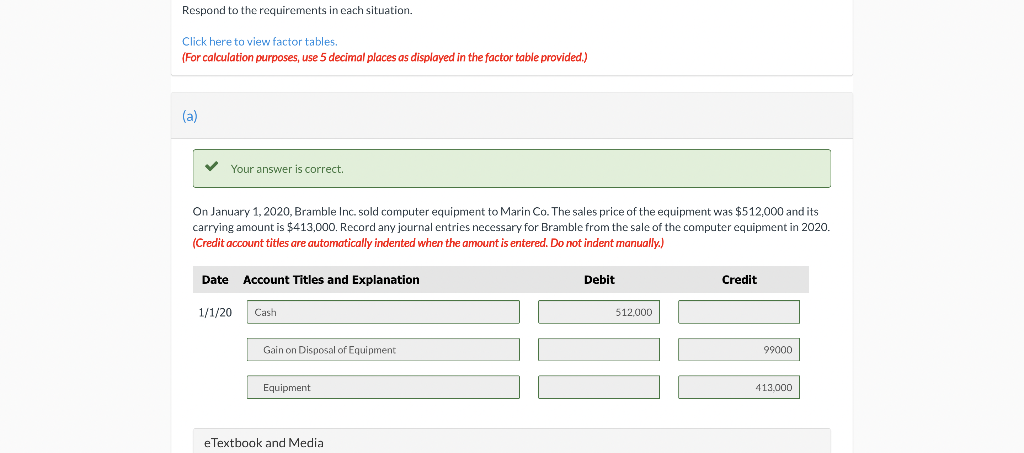

(a)

V Your answer is correct.

On January 1, 2020, Bramble Inc. sold computer equipment to Marin Co. The sales price of the equipment was $512,000 and its

carrying amount is $413,000. Record any journal entries necessary for Bramble from the sale of the computer equipment in 2020.

(Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

1/1/20

Cash

512,000

Gain on Disposal of Equipment

99000

Equipment

413,000

eTextbook and Media

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning