Use the information provided below to prepare the pro forma statement of comprehensive income for the year ended 31 December 2023. (Note the statement must reflect the gross profit,operating profit, profit before tax and profit after tax

Use the information provided below to prepare the pro forma statement of comprehensive income for the year ended 31 December 2023. (Note the statement must reflect the gross profit,operating profit, profit before tax and profit after tax

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 1RE: Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of...

Related questions

Question

Use the information provided below to prepare the pro forma statement of comprehensive income for the year ended 31 December 2023. (Note the statement must reflect the gross profit,operating profit, profit before tax and profit after tax

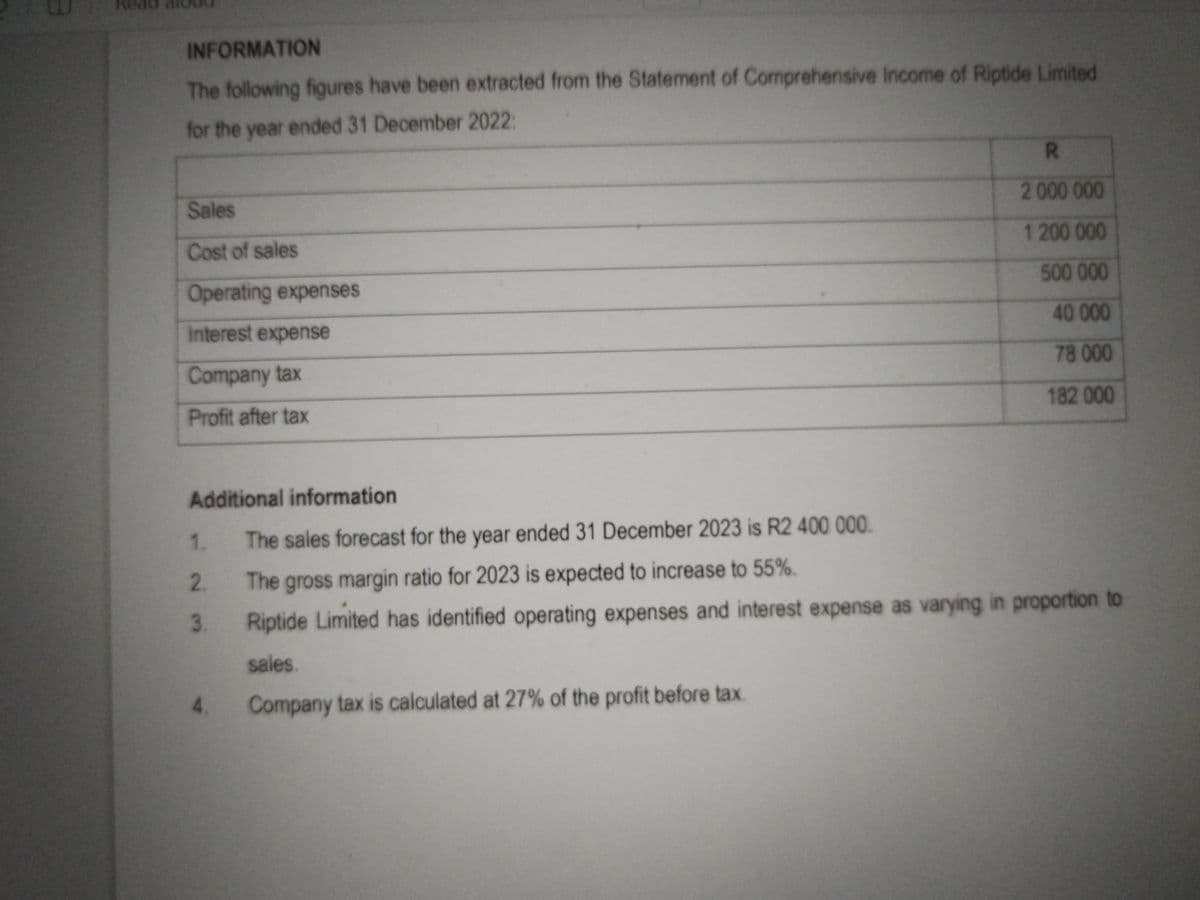

Transcribed Image Text:INFORMATION

The following figures have been extracted from the Statement of Comprehensive Income of Riptide Limited

for the year ended 31 December 2022:

Sales

Cost of sales

Operating expenses

Interest expense

Company tax

Profit after tax

R

2 000 000

1 200 000

500 000

40 000

78 000

182 000

Additional information

The sales forecast for the year ended 31 December 2023 is R2 400 000.

The gross margin ratio for 2023 is expected to increase to 55%.

Riptide Limited has identified operating expenses and interest expense as varying in proportion to

sales.

Company tax is calculated at 27% of the profit before tax.

1.

2.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning