Use the On January 1, 20x1, the BTr issues a 5-year, 5%, P3,000,000 bonds for P 2,640,656. Interest payments are due every December 31 but the principal is due only at maturity date. The effective interest rate is 8%, questions: The entry on December 31, 20x1 to recognize interest expense

Use the On January 1, 20x1, the BTr issues a 5-year, 5%, P3,000,000 bonds for P 2,640,656. Interest payments are due every December 31 but the principal is due only at maturity date. The effective interest rate is 8%, questions: The entry on December 31, 20x1 to recognize interest expense

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 5P: Bats Corporation issued 800,000 of 12% face value bonds for 851,705.70. The bonds were dated and...

Related questions

Question

show me the solutions for 7,8,9 thankiessss....

Transcribed Image Text:d. Answer cannot be determined due to insufficient data.

C. Entity A recognizes neither gain nor loss on the

recogniz

ces nei

either gain nor loss on the

retirement.

Answer cannot be determined due to insufficient data.

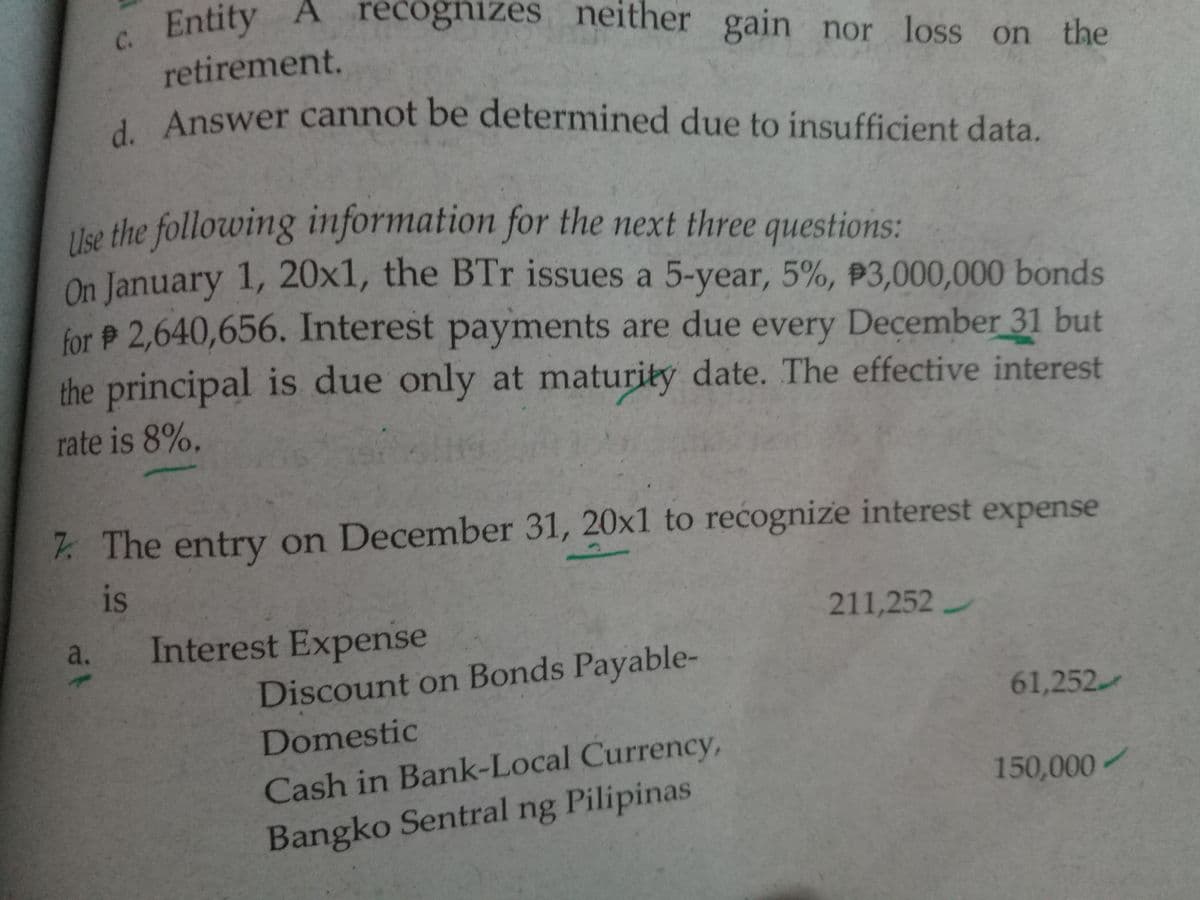

Use the following information for the next three questions:

On January 1, 20x1, the BTr issues a 5-year, 5%, P3,000,000 bonds

for 2,640,656. Interest payments are due every December 31 but

the principal is due only at maturity date. The effective interest

rate is 8%.

7 The entry on December 31, 20x1 to recognize interest expense

is

211,252

a.

Interest Expense

Discount on Bonds Payable-

61,252

Domestic

Cash in Bank-Local Currency,

150,000/

Bangko Sentral ng Pilipinas

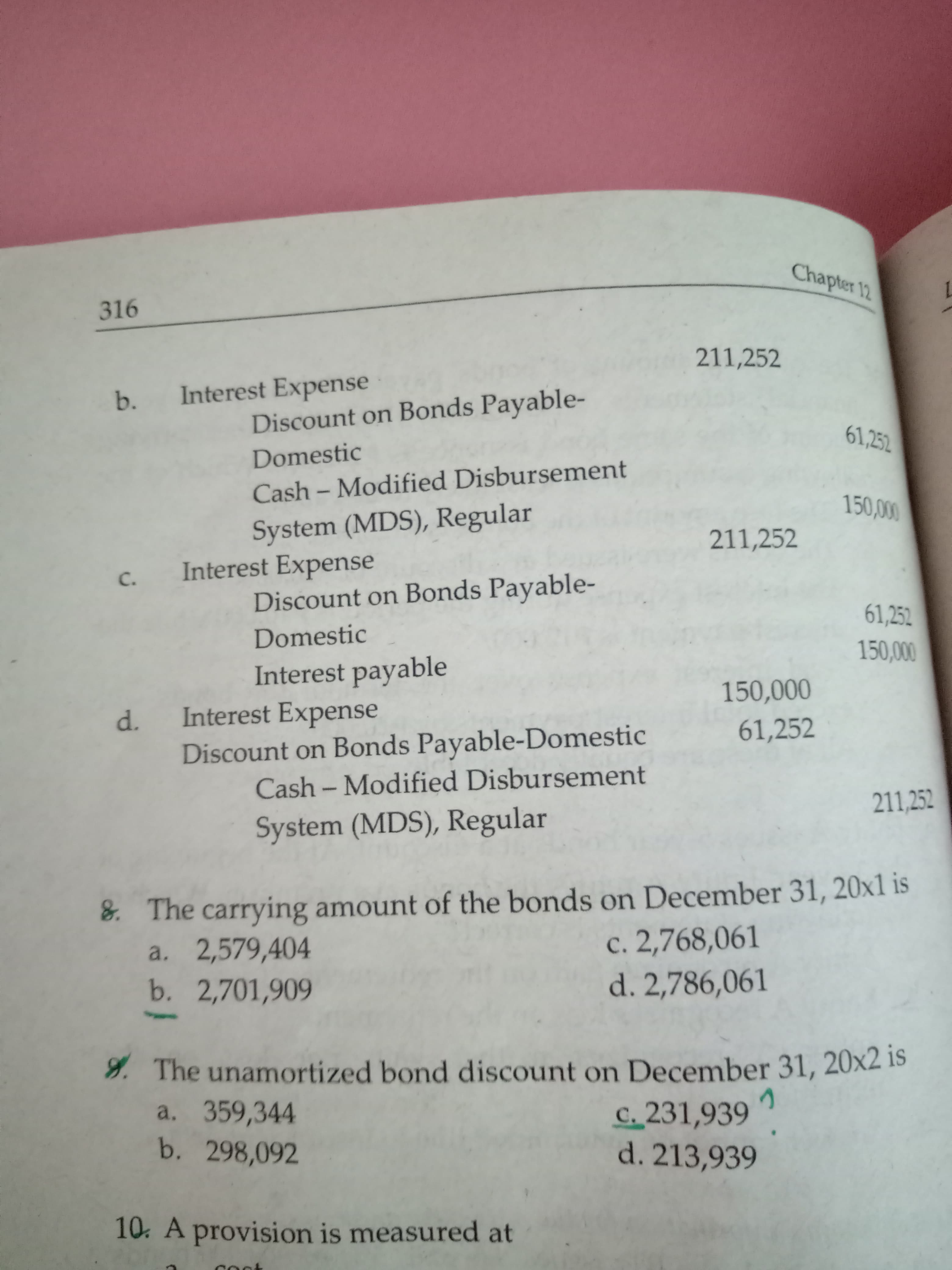

Transcribed Image Text:Chapter 12

316

211,252

Interest Expense

Discount on Bonds Payable-

b.

61,252

Domestic

Cash – Modified Disbursement

-

150,000

System (MDS), Regular

Interest Expense

Discount on Bonds Payable-

211,252

C.

61,252

Domestic

150,000

Interest payable

Interest Expense

Discount on Bonds Payable-Domestic

Cash - Modified Disbursement

150,000

d.

61,252

211,252

System (MDS), Regular

8. The carrying amount of the bonds on December 31, 20x1 is

a. 2,579,404

b. 2,701,909

c. 2,768,061

d. 2,786,061

9. The unamortized bond discount on December 31, 20×2 1s

a. 359,344

b. 298,092

c. 231,939 "

d. 213,939

10. A provision is measured at

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College