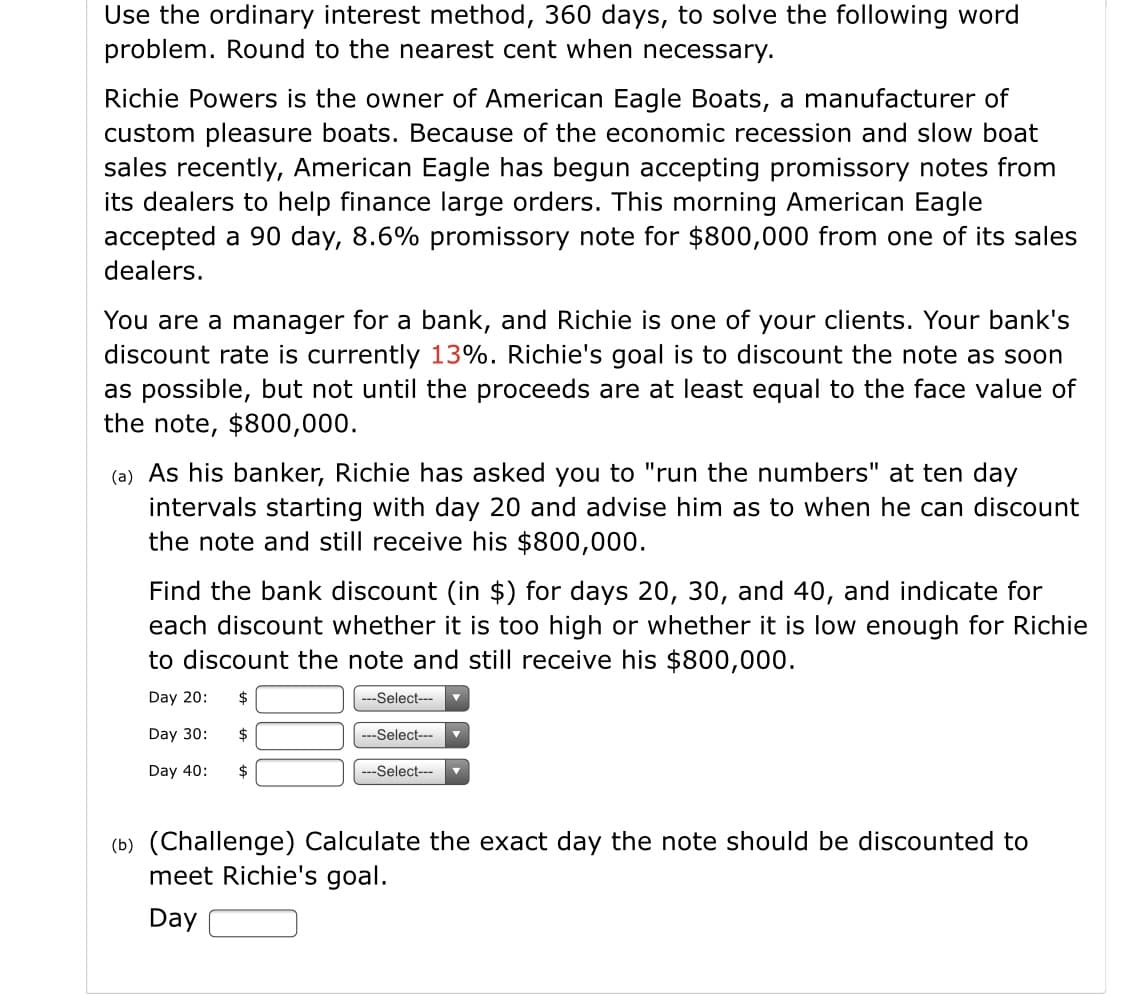

Use the ordinary interest method, 360 days, to solve the following word problem. Round to the nearest cent when necessary. Richie Powers is the owner of American Eagle Boats, a manufacturer of custom pleasure boats. Because of the economic recession and slow boat sales recently, American Eagle has begun accepting promissory notes from its dealers to help finance large orders. This morning American Eagle accepted a 90 day, 8.6% promissory note for $800,000 from one of its sales dealers. You are a manager for a bank, and Richie is one of your clients. Your bank's discount rate is currently 13%. Richie's goal is to discount the note as soon as possible, but not until the proceeds are at least equal to the face value of the note, $800,000. (a) As his banker, Richie has asked you to "run the numbers" at ten day intervals starting with day 20 and advise him as to when he can discount the note and still receive his $800,000. Find the bank discount (in $) for days 20, 30, and 40, and indicate for each discount whether it is too high or whether it is low enough for Richie to discount the note and still receive his $800,000. Day 20: $ ---Select-- Day 30: 2$ --Select--- Day 40: ---Select--- (b) (Challenge) Calculate the exact day the note should be discounted to meet Richie's goal. Day

Use the ordinary interest method, 360 days, to solve the following word problem. Round to the nearest cent when necessary. Richie Powers is the owner of American Eagle Boats, a manufacturer of custom pleasure boats. Because of the economic recession and slow boat sales recently, American Eagle has begun accepting promissory notes from its dealers to help finance large orders. This morning American Eagle accepted a 90 day, 8.6% promissory note for $800,000 from one of its sales dealers. You are a manager for a bank, and Richie is one of your clients. Your bank's discount rate is currently 13%. Richie's goal is to discount the note as soon as possible, but not until the proceeds are at least equal to the face value of the note, $800,000. (a) As his banker, Richie has asked you to "run the numbers" at ten day intervals starting with day 20 and advise him as to when he can discount the note and still receive his $800,000. Find the bank discount (in $) for days 20, 30, and 40, and indicate for each discount whether it is too high or whether it is low enough for Richie to discount the note and still receive his $800,000. Day 20: $ ---Select-- Day 30: 2$ --Select--- Day 40: ---Select--- (b) (Challenge) Calculate the exact day the note should be discounted to meet Richie's goal. Day

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 29P

Related questions

Concept explainers

Risk and return

Before understanding the concept of Risk and Return in Financial Management, understanding the two-concept Risk and return individually is necessary.

Capital Asset Pricing Model

Capital asset pricing model, also known as CAPM, shows the relationship between the expected return of the investment and the market at risk. This concept is basically used particularly in the case of stocks or shares. It is also used across finance for pricing assets that have higher risk identity and for evaluating the expected returns for the assets given the risk of those assets and also the cost of capital.

Question

Transcribed Image Text:Use the ordinary interest method, 360 days, to solve the following word

problem. Round to the nearest cent when necessary.

Richie Powers is the owner of American Eagle Boats, a manufacturer of

custom pleasure boats. Because of the economic recession and slow boat

sales recently, American Eagle has begun accepting promissory notes from

its dealers to help finance large orders. This morning American Eagle

accepted a 90 day, 8.6% promissory note for $800,000 from one of its sales

dealers.

You are a manager for a bank, and Richie is one of your clients. Your bank's

discount rate is currently 13%. Richie's goal is to discount the note as soon

as possible, but not until the proceeds are at least equal to the face value of

the note, $800,000.

(a) As his banker, Richie has asked you to "run the numbers" at ten day

intervals starting with day 20 and advise him as to when he can discount

the note and still receive his $800,000.

Find the bank discount (in $) for days 20, 30, and 40, and indicate for

each discount whether it is too high or whether it is low enough for Richie

to discount the note and still receive his $800,000.

Day 20:

--Select---

Day 30:

$

---Select---

Day 40:

$

-Select---

(b) (Challenge) Calculate the exact day the note should be discounted to

meet Richie's goal.

Day

Expert Solution

Step 1

Answer a)

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning