Q: ecrease the per-share book value of the stock held by shareholders b. To increase the per-share p...

A: A share repurchase may have an impact on a company's BVPS. Because BVPS is used to calculate the pri...

Q: Discuss the advantages and disadvantages of using (a) payback, (b) net present value and (c ) intern...

A: Payback Period: It refers to the period in which the project's or investment's initial cost is reco...

Q: Internal rate of return % If the required return is 15 percent, should the firm accept the project?

A: IRR is the rate of return at which the NPV of the project becomes zero. If the required return from ...

Q: A company has a 12% WACC and is considering two mutually exclusive investments (that cannot be repea...

A: Honor Code: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answe...

Q: Ten years ago you borrowed $300,000 to finance the purchase of a $350,000 house. The interest rate o...

A: Let's find the initial monthly payment first. Let X = Initial monthly payment Initial loan (L) = $30...

Q: The matrix below contains payoffs and their associated probabilities for four alternative investment...

A: We need to find the addition of probabilities with payoff matrix for all investments to find the exp...

Q: If someone computes for the MARR using AW Method and AW becomes positive at a certain fixed interest...

A: The minimum acceptable rate of return (MARR) is the minimum rate of return on an investment that is ...

Q: You are required to assess whether the decision to renovate will be profitable by using a BCR.

A: Benefit-cost ratio (BCR) refers to the ratio which shows the relationship between present value of b...

Q: You are considering a loan with an annual rate of 8%. The mortgage is $130,000 with 180 monthly paym...

A: Payment Number Interest Payable Principal Payment Balance of Loan 1 ($130000.00*8%*1/12) ($1242.35...

Q: Anna loaned P450,000 at 10% compounded annually. She signed a contract to repay the loan in 20 equal...

A: Loan amount (PV) = P450,000 Number of annual payment (n) = 20 Interest rate (r) = 10%

Q: you would like to buy shares of Sirius Satellite Radio (SIRI). The current ask and bid quotes are $3...

A: Ask rate is market selling rate. Bid rate is the rate at which market buys.

Q: Discuss the issues encountered in Worldcom scandal how the Sarbanes Oxley Act addressed those issues...

A: What was the WorldCom scandal? It was the major Accounting related scandal in history in 2002 at W...

Q: You invest in a 55 month $5,163 zero-coupon corporate bond at a simple discount rate of 9.73 per yea...

A: Simple discount is straight discount on bond and that deduction from face value would give the price...

Q: Is estate tax a type of debt? What happens if a person doesn't pay estate tax?

A: The estate tax is a tax imposed after a person's death on the transfer of property and other assets....

Q: Procter and Gamble (PG) paid an annual dividend of $2.79 in 2018. You expect PG to increase its div...

A: Share prices fluctuate on a regular basis due to market factors and internal factors. Interest rate,...

Q: A piece of machinery costs $7000 and has an anticipated $1200 salvage value at the end of its five-y...

A: Depreciation is the allocation of cost of asset over the useful life of the asset, because fixed ass...

Q: Acme Food Co. Ltd. is considering the introduction of a new product Smackers. The firm has gathered ...

A: NPV Net present value (NPV) is the present value of all cash inflows less the present value of cash ...

Q: An rrsp is now worth $229,000 after contributions of $3000 at the beginning of every six months for ...

A: Worth of rrsp"Future Value" is $229,000 Paymant type is begining of the period. Semi annual Contribu...

Q: Required: Compute the following: (For Requirements 1 to 4, enter your percentage answers rounded to ...

A: As per Bartleby Honor Code, when a question with multiple sub-parts has been asked, the expert is re...

Q: IL PROBLEM SOLVING 1. An equipment costing P250. 000 has an estimated life of 15 years with a bok va...

A: Declining balance method of depreciation It is one of the depreciation method to compute annual depr...

Q: st rates in the U.S. andeuro are 4% and 6% respectively and the spot rate for Euro ($/€) is $1.1550,...

A: According to interest rate parity the forward rate and spot exchange rate both should be in equilibr...

Q: During four years of college, Nolan MacGregor's student loans are S4,300, S4,300, S4,200, and $3,800...

A: Time Period 4 1st Loan Amount $ 4,300.00 2nd Loan Amount $ ...

Q: I and Mrs. Dafoe are doing some estimates of the amount of funds they purchase an annuity paying S50...

A: Present value of monthly annuity would be the amount required to purchase the annuity considering ti...

Q: Recommend wl decisions.

A: Profitability index is a calculation that divides the current value of expected anticipated cash str...

Q: Wally and Paolo are bestfriends. Wally desires Paolo to receive 200000 in twelve years. What should ...

A: We need to use future value formula to calculate the amount to be invested today. PV =FV(1+r)n wher...

Q: You are planning to save for retirement over the next 35 years. To do this you will invest $710 per ...

A: The deposits of $710 and $310 made in two accounts will be considered annuity as amount is same over...

Q: risk transformtion in banks

A: Risk is a term that is used for defining the uncertainty arising in the future from changes in expec...

Q: The rabbit population at the city park increases by 9% per year. If there are intially 276 rabbits i...

A: Initial rabbit population is 276 rabbits Growth rate in population is 9% per year To Find: Model fo...

Q: Mega lotteries in country X pay out $1 million jackpots in the form of ordinary annuity of $5,000 ov...

A: Ordinary Annuity = $5,000 Time period = 2000 months Lump sum = $600,000 Discount rate = 8% APR

Q: What is a stock's realized abnormal return if the stock had a 3% return and the stock had a Beta=1.2...

A: Realized return Realized return is referred to as the actual return earned by the stock and is also ...

Q: Calculate the Forward Contract Value of an asset with the following data points: • Current Spot Pric...

A: The spot price plus carrying cost and interest is known as forward price. Under forward contracts lo...

Q: A company has a 12% WACC and is considering two mutually exclusive investments (that cannot be repea...

A: Given, Project A and Project B with the cash flows. The WACC is 12%.

Q: During the month of January, direct labor cost totaled PhP850,000 and direct labor cost was 60% of p...

A: Labor cost = Php 850,000 Labor cost ratio in prime cost = 60% Prime cost = 850,000/0.60 = Php. 14166...

Q: Which of the following statements is TRUE? When EBIT and total assets both increase by 25%, the basi...

A: The question is related to identifying the true Statement.

Q: Seven years ago the Templeton Company issued 15-year bonds with an 11% annual coupon rate at their $...

A: The return that investor can gets from keeping a bond in his portfolio till the issuer redeems it be...

Q: Charmaine has just purchased an apartment at a price of $10 million. She made a down- payment of $4 ...

A: Loan amount (L) = $6 million n = 15 years = 180 months r = 3% per annum = 0.25% per month Let M = Mo...

Q: Four years ago, Vulcan Ltd. issued a 20-year $1000 par value bond that pays $40 semi-annual coupon p...

A: Solution:- Bonds are the debts raised by the coupon. Bond holders are paid a fixed coupon periodical...

Q: ERR

A: ERR refers to the interest rate at which the cash outflows and cash inflows of the project discounte...

Q: hat type of financial challenges is most important for Chief Financial Officers (CFOs) to address im...

A: CFOs of different companies are regularly grappling with some or the other types of financial challe...

Q: The number of stock exchange/s in the Philippines. Zero O One O Two Five

A: Stock exchange is a market where stock are brought and sold.

Q: The principal P is borrowed at a simple interest rate r for a period of time t. Find the simple inte...

A: We need to use simple interest formula to calculate the simple interest. The formula is Simple inter...

Q: Do you think investors should practice dollar cost averaging when investing their money? Why or why ...

A: Dollar-Cost Averaging: Dollar-Cost averaging is an investment approach that involves investing an an...

Q: Q2. X Company has the following receivables classified into individually significant and all other r...

A: Impairment in assets is the condition where the market value of the assets is less than the value pr...

Q: a. What is Ambeon's weighted average cost of capital? b. If Ambeon's stock price were to rise such t...

A: Weighted average cost of capital capital can be defined as average rate of return from all the sourc...

Q: What is the equivalent effective rate of minal rate is 14.5%?

A: Nominal interest rate is interest rate without the impact of compounding but effective interest rate...

Q: Suppose you plan to go on a dream vacation for your anniversary in 7 years from today and you plan t...

A: We need to use future value of ordinary annuity formula to calculate monthly payment to reach goal. ...

Q: the anhulty of the money which has fUture Wo ed monthly at the rate of 11%?

A: The future value of annuity includes the annuity amount deposited and interest accumulated over the ...

Q: A firm borrows 2000 for 6 years at 8%. at the end of 6 years, it renews the loan for the amount due ...

A: A loan is an amount borrowed on which a certain interest is to be paid. The lumpsum due is computed ...

Q: Consider the below three investment projects generating cash flows as follows: Project 1 2 3 4 A 1,0...

A: Here, Cost of capital =10% To Find: IRR =? MIRR =?

Q: you expect EUR to appreciate or depreciate over the next 12 months? Explain

A: Appreciation or depreciation of currency depends on the inflation and interest rate and overall econ...

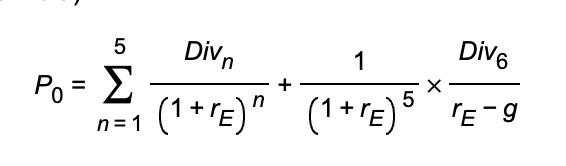

Procter and Gamble (PG) paid an annual dividend of $2.79 in 2018. You expect PG to increase its dividends by 7.9% per year for the next five years (through 2023), and thereafter by 2.7% per year. If the appropriate equity cost of capital for Procter and Gamble is 8.9% per year, use the dividend-discount model to estimate its value per share at the end of 2018.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Present and future values of $1 at 3% are presented below: N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.91347 4 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 7 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 9 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12.8078 9.25262 13.1920 9.53020 12 1.42576 0.70138 14.1920 9.95400 14.6178 10.25262 13 1.46853 0.68095 15.6178 10.63496 16.0863 10.95400 14 1.51259 0.66112 17.0863 11.29607 17.5989 11.63496 15 1.55797 0.64186 18.5989 11.93794 19.1569 12.29607 16 1.60471 0.62317 20.1569 12.56110 20.7616 12.93794 Rosie's Florist borrows $300,000 to be paid off in six…1. see image for the question and statmentchoices: a. 176,000b. 263,000c. 204,000d. 321,000$1,000×6%2? square root of 2?Please clarify im confused of your calculation

- What is the value of (A/G, 3.3%, 10)? a. 3.3297 b. 4.2326 O c. 4.5050 d. 4.0220 e. 5.0117Present and future value tables of $1 at 3% are presented below: N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.91347 4 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 7 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 9 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12.8078 9.25262 13.1920 9.53020 12 1.42576 0.70138 14.1920 9.95400 14.6178 10.25262 13 1.46853 0.68095 15.6178 10.63496 16.0863 10.95400 14 1.51259 0.66112 17.0863 11.29607 17.5989 11.63496 15 1.55797 0.64186 18.5989 11.93794 19.1569 12.29607 16 1.60471 0.62317 20.1569 12.56110 20.7616 12.93794 Today, Thomas deposited $100,000 in a three-year,…Present and future value tables of $1 at 3% are presented below: N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.91347 4 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 7 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 9 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12.8078 9.25262 13.1920 9.53020 12 1.42576 0.70138 14.1920 9.95400 14.6178 10.25262 13 1.46853 0.68095 15.6178 10.63496 16.0863 10.95400 14 1.51259 0.66112 17.0863 11.29607 17.5989 11.63496 15 1.55797 0.64186 18.5989 11.93794 19.1569 12.29607 16 1.60471 0.62317 20.1569 12.56110 20.7616 12.93794 Shelley wants to cash in her winning lottery…