Using T accounts for Cash, Accounts Payable, Purchases, Purchases Returns and Allowances, Purchases Discounts, and Freight-In, enter the following purchase transactions. Identify each transaction with its corresponding letter. 1. Purchase of merchandise with cash. Post the transactions in the given order. Merchandise is purchased for cash, $1,100. Merchandise listed at $3,500, less a trade discount of 15%, is purchased for cash. Cash ________ | _______ ________ | _______ Purchases ______ | ______ ______ | ______ 2. uploded picture 3. up loaded picture

Purchase Transactions and T Accounts

Using T accounts for Cash, Accounts Payable, Purchases, Purchases Returns and Allowances, Purchases Discounts, and Freight-In, enter the following purchase transactions. Identify each transaction with its corresponding letter.

1. Purchase of merchandise with cash.

Merchandise is purchased for cash, $1,100.

Merchandise listed at $3,500, less a trade discount of 15%, is purchased for cash.

Cash

________ | _______

________ | _______

Purchases

______ | ______

______ | ______

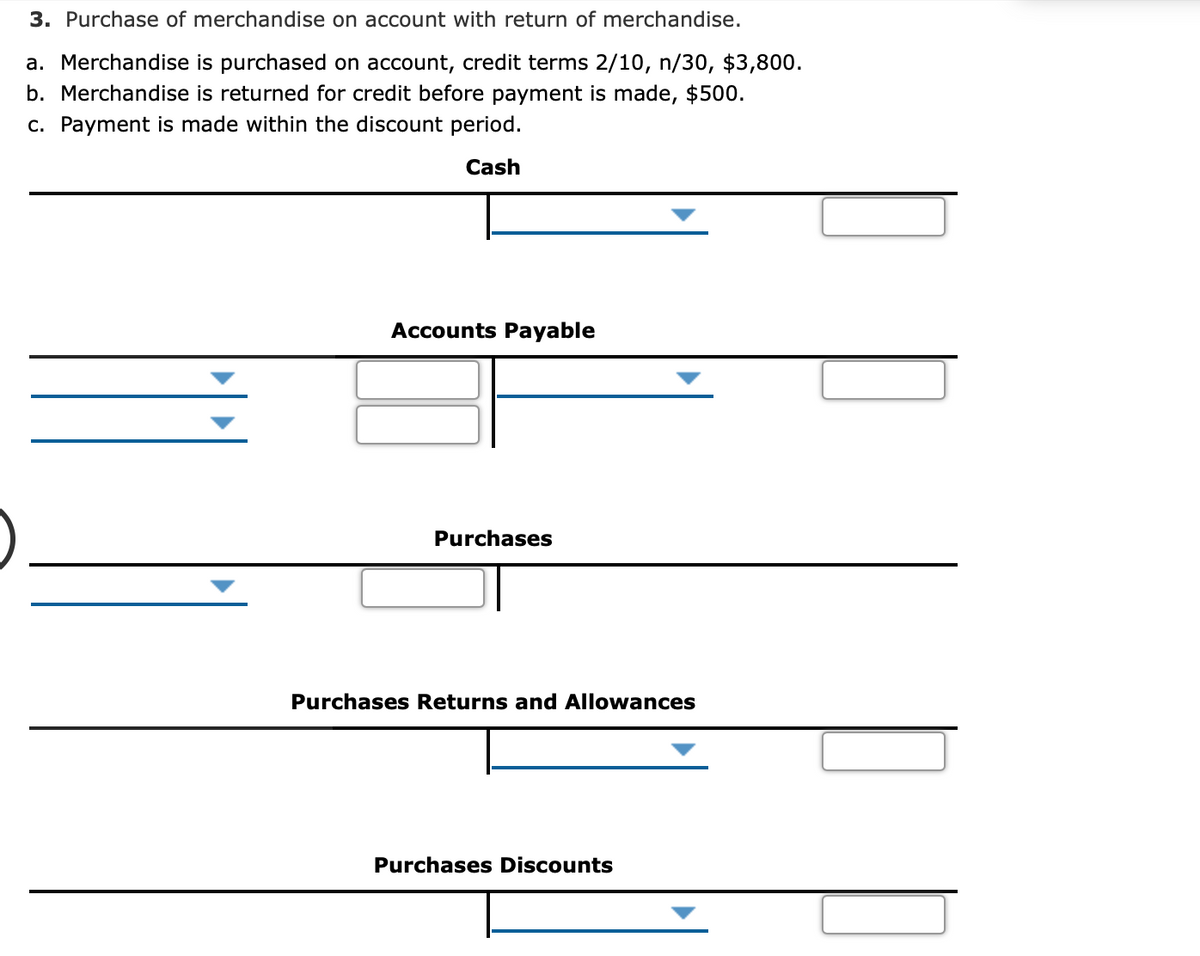

2. uploded picture

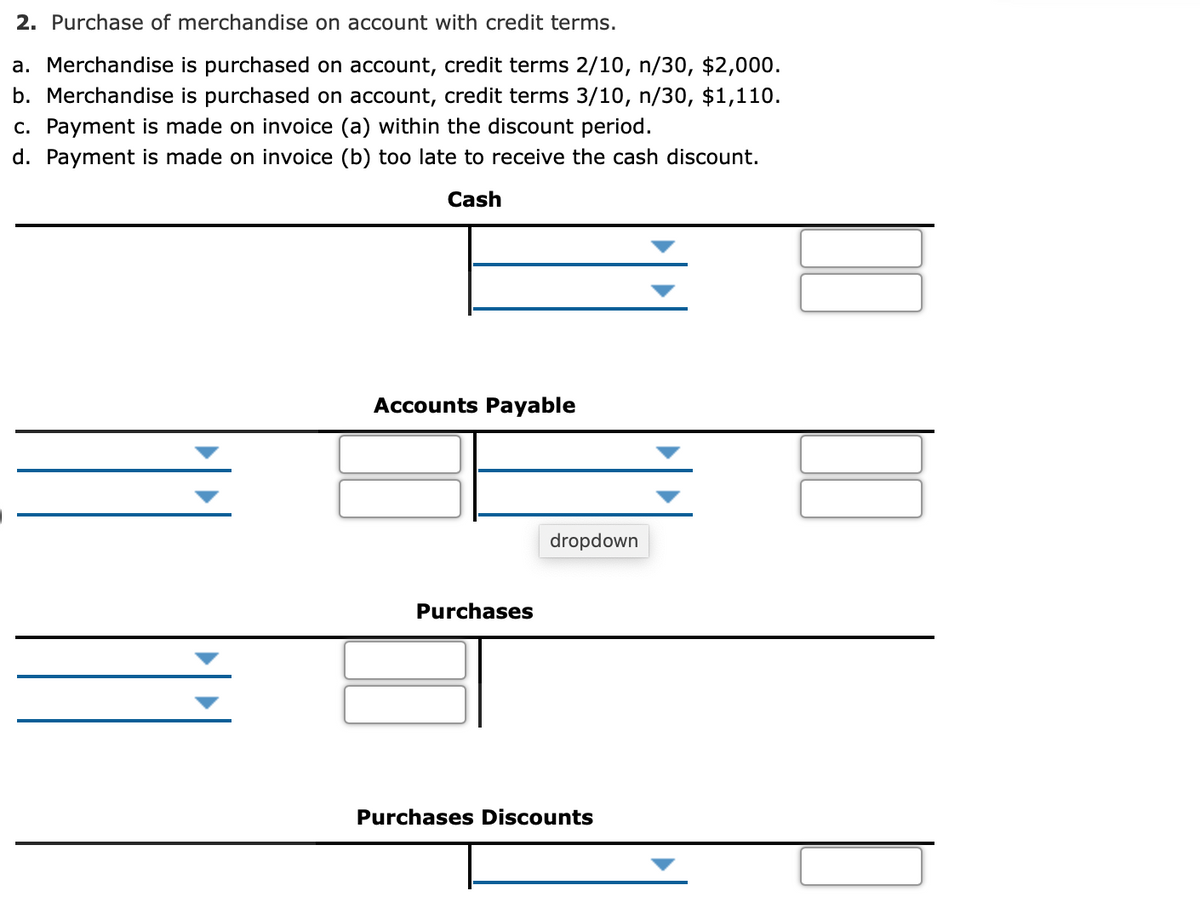

3. up loaded picture

4. Purchase of merchandise with freight-in.

A. Merchandise is purchased on account, $2,300 plus freight charges of $100. Terms of the sale were FOB shipping point.

B. Payment is made for the cost of the merchandise and the freight charge.

Cash

Accounts Payable

Purchases

Freight- In

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images