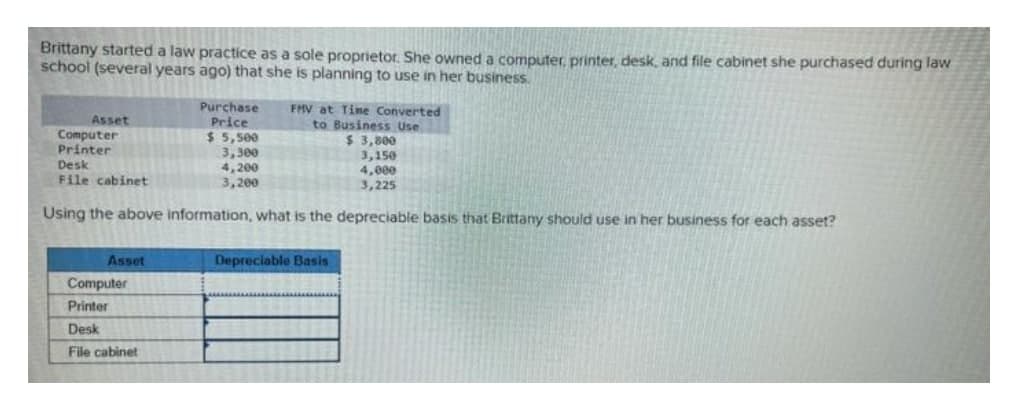

Using the above information, what is the depreciable basis that Brittany should use in her business for each asset? Asset Depreciable Basis Computer Printer Desk File cabinet

Q: In August 2021, a company's worker was injured in the factory in an accident partially the result of...

A: “Since you have asked multiple question, we will solve the first question for you. If you want any s...

Q: On June 30, the end of the first month of operations, Tudor Manufacturing Co. prepared the following...

A: The income statement is prepared to record revenue and expenses for the current period. The income s...

Q: Assume that Corn Co. sold 6,500 units of Product A and 3,500 units of Product B during the past year...

A: Answer) Calculation of Break-even point in units Break-even point in units = Total Fixed Costs/ Weig...

Q: AUBRRIS Trading was organized and began operations on May 1, 2021. 0n that date, Aubrey invested P1,...

A: In the context of the given question, we can compute the total share of Aubrey in the profit for the...

Q: To gather audit evidence about the proper credit approval of sales (i.e., valuation assertion), the ...

A: Audit is the detailed process of checking and verifying books of accounts and financial information ...

Q: 51: If the deposited money earns $20 interest income, the interest income is subject to 15% final ta...

A: Nicanor- Non Resident Citizen residing in United State of America Deposited $5000 in BPI, Morayt...

Q: of Of 10 years, an estimated residual value of $50,000, and were depreciated using straight-line dep...

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage a...

Q: ABD Company's manufacturing overhead is 20% of its total conversion costs. If direct labor is PhP2,2...

A: Lets understand the basics. Conversion cost is a cost to convert direct material into finished goods...

Q: 13. The capital balances of the partners on December 31, 200D would be: a. Tom, P 72,000; Jones, P 4...

A: The partners Tom and Jones are sharing profits and losses in the ratio of 6:4. Both the partners are...

Q: The following information summarizes the activities in the Sewing Department for the month of August...

A: The equivalent units are calculated on the basis of percentage of work completed during the period.

Q: If a broker quotes a price of 111.25 for a bond on September 10, what amount will a client pay per $...

A: Broker Quotes price 111.25 for a bond on Sep ,10 Face Value = $1000 Coupon Rate = 7% Coupon Rate is...

Q: Madtack Company's beginning and ending inventories for the month of November are: November 1 Novembe...

A: Total manufacturing costs = Direct material used + Direct labor costs + Manufacturing overhead appli...

Q: Using the following excerpts from the Michigan Company's financial statements and the list of terms ...

A: Inventory purchased = Ending balance inventory + Cost of goods sold - Beginning balance inventory Ca...

Q: Explain monetary and fiscal measures that should be implemented by the government to cool down an ov...

A: Monetary policy means the management of the money supply and interest rates by central banks. To str...

Q: What is the unearned interest income at YANIG's December 31, 2020 statement of financial position?

A: Lessor - YANIG Company Leasee- SIKLAB Machine Cost 10500000 Lease Payment ( paid the ...

Q: Dan with xed-rate

A: Introduction FRA (Forward Rate Agreement) refers to personalized financial contracts that are trade...

Q: Sheffield, Inc., manufactures clamps used in the overhead bin latches of several leading airplane mo...

A: Calculation of period cost , product cost , and manufacturing overhead are as follows:

Q: An auditor suspects that a client's cashier is misappropriating cash receipts for personal use by la...

A: Lets understand the basics. Lapping is a method in which payment received from the account receivabl...

Q: Weighted average cost per unit = per unit. Cost Cost of Goods Allocation Cost of Goods Sold Ending I...

A: Units Sold = Total Units - Ending Inventory = 2450 - 550 = 1900 Units Sales = Units Sold x Sale Pric...

Q: On March 2, Cullumber Company sold $835,000 of merchandise on account to Bramble Company, terms 2/10...

A: Sales = $835,000 Cost of goods sold = $585,000

Q: Determine the assessed levels of detection risk and inherent risk

A: Audit is defined as an investigation of some statements of figure involving examination of certain e...

Q: Problem 2 On January 1, 2020, RAGASA Company leased a building with the following information: Annua...

A: Accounting for leases There are two types of leases are there one is operating leases and another on...

Q: Phil Corporation gave Manager A, a resident citizen grocery allowance worth P 39,000 How much is th...

A: Fringe benefit tax: It implies to a financial levy that is imposed or charged on the extra benefits ...

Q: Solve for maturity value, discount period, bank discount, and proceeds. Assume a bank discount rate ...

A: The note receivable is the assets for the business, which is a promissory note for the payment due f...

Q: r's stock. The land has a fair market value (FMV) of $40,000 and an adjusted basis of $23,000. The s...

A: Given: Fair market value (FMV)=$40,000 Adjusted basis =$23,000 The corporation's stock = $30,000

Q: Sunny Groves is Citrus grower in a southern state that has several citrus orchards, Weather forcaste...

A: Solution Working note- Near freezing Temperatures = 25% Probability. Deep freeze condition = 10% pro...

Q: When control risk is assessed at less than high for all financial statements assertions, an auditor ...

A: Control Risk: Control risk is the risk that a misrepresentation due to mistake or fraud that might o...

Q: Congratulations on your appointment as a Tax Trainee at a recognized audit firm in Jamaica. On your...

A: Solution Capital allowance is the practice of allowing tax payers to get relief on capital expenditu...

Q: Weighted average cost per unit = per unit. Cost Cost of Goods Allocation Cost of Goods Sold Ending I...

A: Sales = (50 units x $120) + (25 units x $125) = $6000 + $3125 = $9125 Cost of Goods Available = (100...

Q: CDE3. From the following, construct a bank reconciliation with heading for Woody Co. as of May 31, 2...

A: Please see Step 2 for the required information.

Q: 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for...

A: Passive income is the income generated from the job in which you are not actively involved. Interest...

Q: Sarasota Corp. reported net sales $ 600,000, cost of goods sold $ 336,000, operating expenses $ 160,...

A: Profit margin = Net Income / Net sales where, Net Income = Sales - cost of goods sold - operating ex...

Q: Goodwill Corporation was authorized to issue 60,000, P100 par value ordinary share capital on Novemb...

A: Authorized share capital—also known as "authorized stock," "authorized shares," or "authorized capit...

Q: 48.) PLEASE ANSWER NOW PLEASE

A: Capital gain tax is calculated on principal residence @ 6% of the hig...

Q: QUESTION 8 Which of the following statements about the accounting profession is true? O Accountants ...

A: Accountants cannot legally offer management consultancy services. Private accountants serve individu...

Q: c. Purchased Php2,500 worth of supplies on accounts (on credit) d. Returned defective piece of equip...

A: Assets = Liabilities + Owner’s equity

Q: O a. Only S1 is true O b. Only S2 is true O c. Both are true O d. Both are false

A: S1 Received P 30000 as fringe Benefits from Company. Statement :- Nicanor has the obligation to rep...

Q: What is not included in a sales budget for a retail business? A.expected sales in units B.selling ...

A: Sales Budget includes expected sales in units, selling price per unit and cash collections from sale...

Q: Capital balances in Grouper Co, are Dene S64,000, Aneta $38,200, and Harriet $25,500. The partners s...

A: when there is a deal between two or more person to share profit and losses and contribute capital in...

Q: Calculate the dividend payout ratio for 2020. (Do not round intermediate calculations.)

A: Lets understand the basics. Dividend payout ratio indicates that, how much amount of net income is p...

Q: CDE1. Nezee Paints purchased merchandise on account from a supplier for $9,000, terms 2/10, n/30. Ne...

A: If goods were returned by buyer then net amount due is $9000-$1200= $ 7800 1. If amount is paid with...

Q: 1. Earnings per share. (Round your answer to 2 decimal places.) 2. Price-earnings ratio. (Round you...

A: Below mentioned Ration needs to be calculated Earning Per share Price Earning Ratio Dividend Payo...

Q: ellco p

A: These are the accounting transactions that are having a monetary impact on the financial statement o...

Q: The following is an alphabetical list of Lloyd’s Hudson Dealership Inc.’s December 31, 2019, balance...

A: A Balance Sheet is the financial statement that is prepared by every organization at the end of an a...

Q: p. expects to sell 620 sun visors in May and 380 in June. Each visor sells for $22 Shadee's beginnin...

A: Calculation of Budgeted Cost of Closures Purchased May June Total Number of Sun visors to b...

Q: 41. The following transaction relate to Tool Company’s contingencies. The financial statements ar...

A:

Q: porated's contribution margin ratio is 61% and its fixed monthly expenses are $45,500. Assuming that...

A: Net operating income refers to the concept of evaluating the expected sum of money arising out of an...

Q: You audited the financial statements of PIS Corp. for the first time in 2022. The company started it...

A: Solution Working note- Year 2020 2021 2022 Unadjusted 104000 140000 160000 B-Omission of prep...

Q: ich of the following procedures would an auditor most likely perform to test trols relating to manag...

A: The given scenario relates with cash receipts. To check the authenticity of the transaction the audi...

Q: Discuss the legal effect of incorporation or registration of a Limited Liability Partnership. State ...

A: A limited liability partnership is a separate legal and business entity from its partners. Only afte...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Cindy operates a computerized engineering drawing business from her home. Cindy maintains a home office and properly allocates the following expenses to her office: Depreciation $1,500 Utilities 500 Real estate taxes 325 Mortgage interest (100 percent deductible) 500 Assume that Cindy earns income of $4,400 from her business for the year before deducting home office expenses. She has no other expenses associated with the business. Calculate Cindy's deduction for home office expenses. $__________ Assume that Cindy earns income of $2,600 from her business during the year before deducting home office expenses. Calculate Cindy's deduction for home office expenses. $__________Brittany started a law practice as a sole proprietor. She owned a computer, printer, desk, and file cabinet she purchased during law school (several years ago) that she is planning to use in her business. FMV at Time Purchase Converted to Asset Price Business Use Computer $ 6,900 $ 5,200 Printer 4,700 4,550 Desk 5,600 5,400 File cabinet 4,600 4,625 Using the above information, what is the depreciable basis that Brittany should use in her business for each asset? ASSET DEPRECIABLE BASIS Computer Printer Desk File Cabinet- Brittany started a law practice as a sole proprietor. She owned a computer, printer, desk, and file cabinet she purchased during law school (several years ago) that she is planning to use in her business. What is the depreciable basis that Brittany should use in her business for each asset, given the following information? Asset Purchase Price FMV at Time Converted to Business Use Computer $5,500 $3,800 Printer $3,300 $3,150 Desk $4,200 $4,000 File Cabinet $3,200 $3,225

- June Cleaver owns and operates a home goods store in Chicago, Illinois. She recently acquired a new building, which will allow space for her growing business. In addition to purchasing the land and building, she also has purchased new office furniture for her staff, a delivery van and a new computer to automate her operations. Now that she has the larger space, she acquired home goods to display and sell. A. From the information provided above, what property and equipment would June list on her books for her business? B. What distinguishes property and equipment from other assets June might have, such as inventory and accounts receivable? C. At what value are property and equipment recorded on the balance sheet?2. Fauzana owns a business that makes and sells pets clay. During the financial year ended 31 July 2020, she incurred the following items of expenditure. State whether each of the below is Capital Expenditure or Revenue Expenditure.a. Clay for making the pets toys.b. Wages of sales staffc. Purchase of potters wheel for use in the businessd. Installation costs for the potters wheele. Wages of staff operating the potters wheelf. Redecoration of store roomg. Payment of extra wages to own staff for fitting the alarm and cctvh. Payment of architect fees for designing the proposed new shopi. Purchase of new telephone system for the businessRita owns a sole proprietorship in which she works as a management consultant. She maintains an office in her home (500 square feet) where she meets with clients, prepares bills, and performs other work-related tasks. Her business expenses, other than home office expenses, total $5,600. The following home-related expenses have been allocated to her home office under the actual expense method for calculating home office expenses. Real property taxes $ 1,600 Interest on home mortgage 5,100 Operating expenses of home 800 Depreciation 1,600 Also, assume that, not counting the sole proprietorship, Rita's AGI is $60,000. Rita itemizes deductions, and her itemized deduction for non-home business taxes is less than $10,000 by more than the real property taxes allocated to business use of the home.Assume Rita’s consulting business generated $15,000 in gross income. (Leave no answer blank. Enter zero if applicable.) a. What is Rita’s home office deduction for the current…

- Rita owns a sole proprietorship in which she works as a management consultant. She maintains an office in her home (500 square feet) where she meets with clients, prepares bills, and performs other work-related tasks. Her business expenses, other than home office expenses, total $5,600. The following home-related expenses have been allocated to her home office under the actual expense method for calculating home office expenses. Real property taxes $ 1,600 Interest on home mortgage 5,100 Operating expenses of home 800 Depreciation 1,600 Also, assume that, not counting the sole proprietorship, Rita's AGI is $60,000. Rita itemizes deductions, and her itemized deduction for non-home business taxes is less than $10,000 by more than the real property taxes allocated to business use of the home. Assume Rita’s consulting business generated $13,000 in gross income for the current year. Further, assume Rita uses the actual expense method for computing her home office expense…Rita owns a sole proprietorship in which she works as a management consultant. She maintains an office in her home (500 square feet) where she meets with clients, prepares bills, and performs other work-related tasks. Her business expenses, other than home office expenses, total $5,600. The following home-related expenses have been allocated to her home office under the actual expense method for calculating home office expenses. Real property taxes $ 1,600 Interest on home mortgage 5,100 Operating expenses of home 800 Depreciation 1,600 Also, assume that, not counting the sole proprietorship, Rita's AGI is $60,000. Rita itemizes deductions, and her itemized deduction for non-home business taxes is less than $10,000 by more than the real property taxes allocated to business use of the home. Assume Rita’s consulting business generated $13,000 in gross income for the current year. Further, assume Rita uses the actual expense method for computing her home office expense…Rita owns a sole proprietorship in which she works as a management consultant. She maintains an office in her home (500 square feet) where she meets with clients, prepares bills, and performs other work-related tasks. Her business expenses, other than home office expenses, total $5,600. The following home-related expenses have been allocated to her home office under the actual expense method for calculating home office expenses. Real property taxes $ 1,600 Interest on home mortgage 5,100 Operating expenses of home 800 Depreciation 1,600 Also, assume that, not counting the sole proprietorship, Rita's AGI is $60,000. Rita itemizes deductions, and her itemized deduction for non-home business taxes is less than $10,000 by more than the real property taxes allocated to business use of the home. Assume Rita’s consulting business generated $13,000 in gross income for the current year. Further, assume Rita uses the actual expense method for computing her home office expense…

- Rita owns a sole proprietorship in which she works as a management consultant. She maintains an officein her home (500 square feet) where she meets with clients, prepares bills, and performs other work-related tasks. Her business expenses, other than home office expenses, total $5,600. The followinghome-related expenses have been allocated to her home office under the actual expense method forcalculating home office expenses. Real property taxes $ 1,600Interest on home mortgage 5,100Operating expenses of home 800Depreciation 1,600 Also, assume that, not counting the sole proprietorship, Rita AGI is $60,000. Rita itemizes deductions,and her itemized deduction for non-home business taxes is less than $10,000 by more than the realproperty taxes allocated to business use of the home.Assume Rita’s consulting business generated $15,000 in gross income. a. What is Rita's home office deduction for the current year? b. What would Rita's home office deduction be if her business generated…Charlotte Braun is a realtor. She buys and sells properties on her own and she also earns commission as a real estate agent for buyers and sellers. She organized her business as a proprietorship on November 24, 19X4. Consider the following facts as November 30, 19x4. a Braun owed 85,000 on a note payable for some underdeveloped land that had been acquired by her business for a total price of 140,000 b. Braun’s business had spend 20,000 for a century 21 real estate franchise which entitled her to represent herself as a century 21 agent. Century 21 is a national affiliation of independent real estate agents. This franchise is a business asset c. Braun owed 120,000 on personal mortgage on her personal residence which she acquired in 19X1 for a total price of 170,000 d. Braun had 10,000 in her personal bank account and 12,000 in her business bank account e. Braun owed 1,800 on a personal charge account with Neiman-Marcus Department Store f. Braun acquired business for 17,000 on November…Rita owns a sole proprietorship in which she works as a management consultant. She maintains an office in her home (500 square feet) where she meets with clients, prepares bills, and performs other work-related tasks. Her business expenses, other than home office expenses, total $5,720. The following home-related expenses have been allocated to her home office under the actual expense method for calculating home office expenses. Real property taxes $ 1,660 Interest on home mortgage 5,190 Operating expenses of home 830 Depreciation 1,636 Also, assume that, not counting the sole proprietorship, Rita's AGI is $61,200. Rita itemizes deductions, and her itemized deduction for non-home business taxes is less than $10,000 by more than the real property taxes allocated to business use of the home. Assume Rita's consulting business generated $15,300 in gross income. Note: Leave no answer blank. Enter zero if applicable. Required: What is Rita's home office deduction for the current…