Using the da

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.26EX: Comprehensive Income Anson Industries, Inc. reported the following information on its 20Y1 income...

Related questions

Question

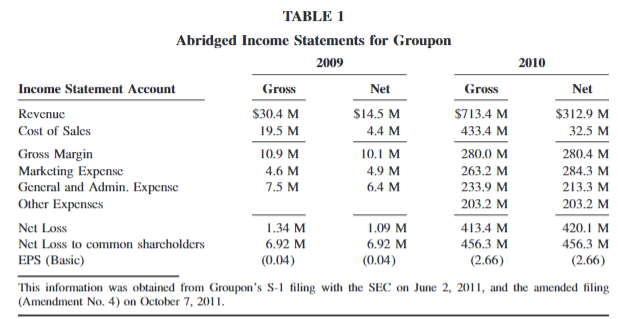

3. Using the data provided in Table 1, prepare common size income statements using

revenues and cost-of-goods-sold in the original S-1 and amended S-1. Analyze trends of

expenses as a percentage of revenue for 2009 and 2010. Compare and contrast the

following ratios:

a. Gross Margin Percentage;

b. Asset Turnover Ratio.

Transcribed Image Text:TABLE 1

Abridged Income Statements for Groupon

2009

2010

Income Statement Account

Gross

Net

Gross

Net

Revenue

$30.4 M

$14.5 M

$713.4 M

$312.9 M

Cost of Sales

19.5 M

4.4 M

433.4 M

32.5 M

280.0 M

Gross Margin

Marketing Expense

General and Admin. Expense

Other Expenses

10.9 M

10.1 M

280.4 M

4.6 M

4.9 M

263.2 M

284.3 M

7.5 M

6.4 M

233.9 M

213.3 M

203.2 M

203.2 M

Net Loss

1.34 M

1.09 M

413.4 M

420.1 M

Net Loss to common sharcholders

6.92 M

6.92 M

456.3 M

456.3 M

EPS (Basic)

(0.04)

(0.04)

(2.66)

(2.66)

This information was obtained from Groupon's S-1 filing with the SEC on June 2, 2011, and the amended filing

(Amendment No. 4) on October 7, 2011.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning