Anal

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.18MCE

Related questions

Question

100%

Below are the two basic financial statements of Chiz Trading Company. You are tasked to prepare an analysis using Horizontal and Vertical Analysis of their two-dated financial statements. In addition to this you have been tasked to prepare financial ratios measuring the company’s:

- Liquidity Status

Current Ratios - Quick Asset Ratios

- Efficiency Status

- Asset Turnover

- Fixed Asset Turnover

- Inventory Turnover

- Days in Inventory

Accounts Receivable Turnover- Days in Receivable

- Profitability Status:

- Gross Profit margin Ratio

- Operating Income Ratio

- Net Profit Ratio

- Return on Assets

- Return on Equity

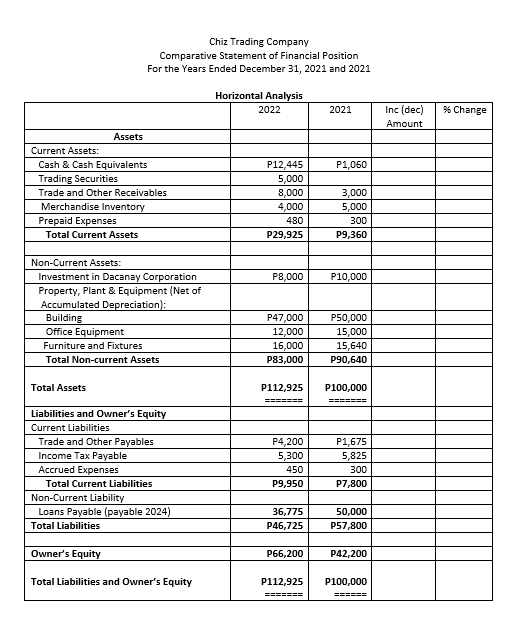

Transcribed Image Text:Chiz Trading Company

Comparative Statement of Financial Position

For the Years Ended December 31, 2021 and 2021

Horizontal Analysis

2022

2021

Inc (dec)

% Change

Amount

Assets

Current Assets:

Cash & Cash Equivalents

P12,445

5,000

8,000

P1,060

Trading Securities

Trade and Other Receivables

3,000

Merchandise Inventory

4,000

5,000

Prepaid Expenses

480

300

Total Current Assets

P29,925

P9,360

Non-Current Assets:

Investment in Dacanay Corporation

Property, Plant & Equipment (Net of

Accumulated Depreciation):

Building

Office Equipment

P8,000

P10,000

P47,000

P50,000

12,000

16,000

15,000

Furniture and Fixtures

15,640

Total Non-current Assets

P83,000

P90,640

Total Assets

P112,925

P100,000

=====3=

Liabilities and Owner's Equity

Current Liabilities

Trade and Other Payables

Income Tax Payable

Accrued Expenses

P4,200

P1,675

5,300

5,825

450

300

Total Current Liabilities

P9,950

P7,800

Non-Current Liability

Loans Payable (payable 2024)

36,775

50,000

Total Liabilities

P46,725

P57,800

Owner's Equity

P66,200

P42,200

Total Liabilities and Owner's Equity

P112,925

P100,000

=======

======

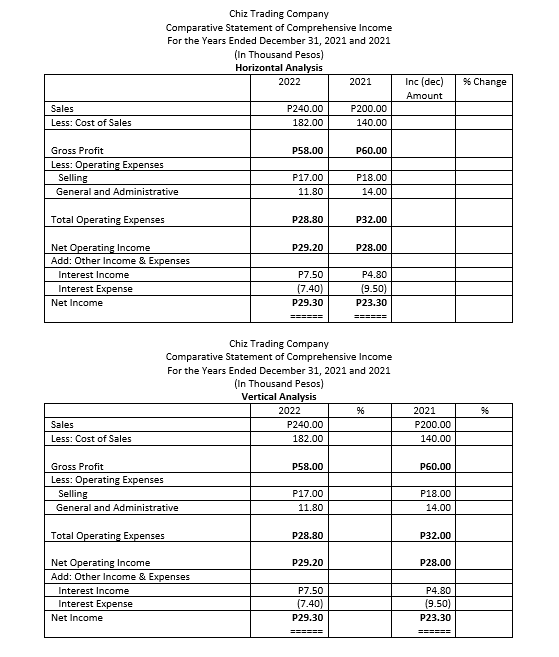

Transcribed Image Text:Chiz Trading Company

Comparative Statement of Comprehensive Income

For the Years Ended December 31, 2021 and 2021

(In Thousand Pesos)

Horizontal Analysis

2022

2021

Inc (dec)

% Change

Amount

Sales

P240.00

P200.00

Less: Cost of Sales

182.00

140.00

Gross Profit

P58.00

Р60.00

Less: Operating Expenses

Selling

General and Administrative

P17.00

P18.00

11.80

14.00

Total Operating Expenses

P28.80

P32.00

Net Operating Income

Add: Other Income & Expenses

P29.20

P28.00

Interest Income

P7.50

P4.80

Interest Expense

(7.40)

(9.50)

Net Income

P29.30

P23.30

=====%3D

======

Chiz Trading Company

Comparative Statement of Comprehensive Income

For the Years Ended December 31, 2021 and 2021

(In Thousand Pesos)

Vertical Analysis

2022

2021

Sales

P240.00

P200.00

Less: Cost of Sales

182.00

140.00

Gross Profit

Less: Operating Expenses

Selling

P58.00

Р60.00

P17.00

P18.00

General and Administrative

11.80

14.00

Total Operating Expenses

P28.80

Р32.00

Net Operating Income

Add: Other Income & Expenses

P29.20

P28.00

Interest Income

P7.50

P4.80

Interest Expense

(7.40)

(9.50)

Net Income

P29.30

P23.30

=====

======

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning