using the following additional information for Abby Company, along with the information in #3 above, complete the requirements below. Raw materials inventory, beginning Raw materials inventory, ending Work in process inventory, beginning Sales Work in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending $180,000 185,000 54,000 2,960,000 58,000 76,000 84,000 Required: 1. Prepare the schedule of cost of goods manufactured for the current year. 2. Prepare the current year income statement.

using the following additional information for Abby Company, along with the information in #3 above, complete the requirements below. Raw materials inventory, beginning Raw materials inventory, ending Work in process inventory, beginning Sales Work in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending $180,000 185,000 54,000 2,960,000 58,000 76,000 84,000 Required: 1. Prepare the schedule of cost of goods manufactured for the current year. 2. Prepare the current year income statement.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 14E

Related questions

Topic Video

Question

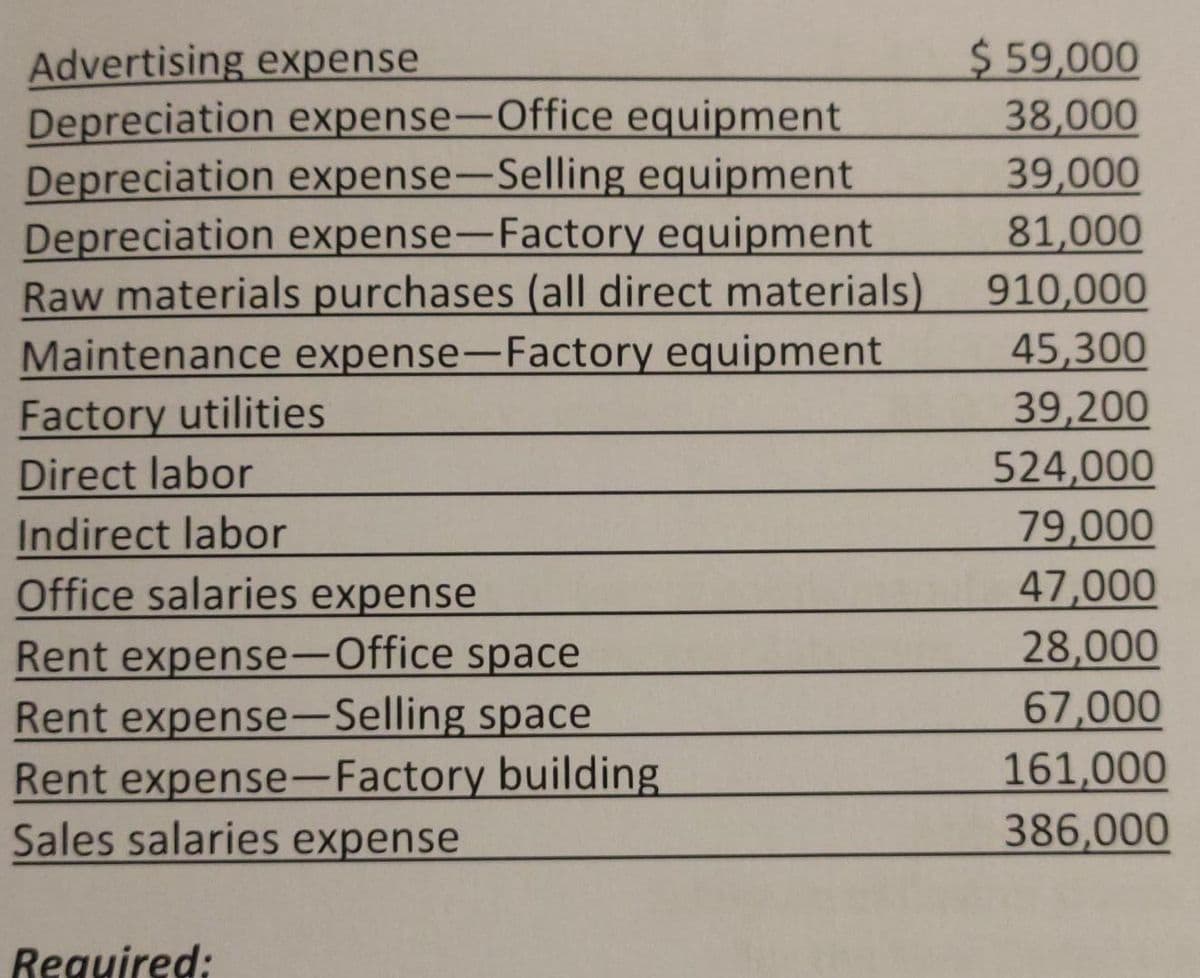

Transcribed Image Text:Advertising expense

Depreciation expense-Office equipment

Depreciation expense-Selling equipment

Depreciation expense-Factory equipment

Raw materials purchases (all direct materials)

Maintenance expense-Factory equipment

Factory utilities

Direct labor

Indirect labor

Office salaries expense

$59,000

38,000

39,000

81,000

910,000

45,300

39,200

524,000

79,000

47,000

Rent expense-Office space

28,000

Rent expense-Selling space

Rent expense-Factory building

Sales salaries expense

67,000

161,000

386,000

Required:

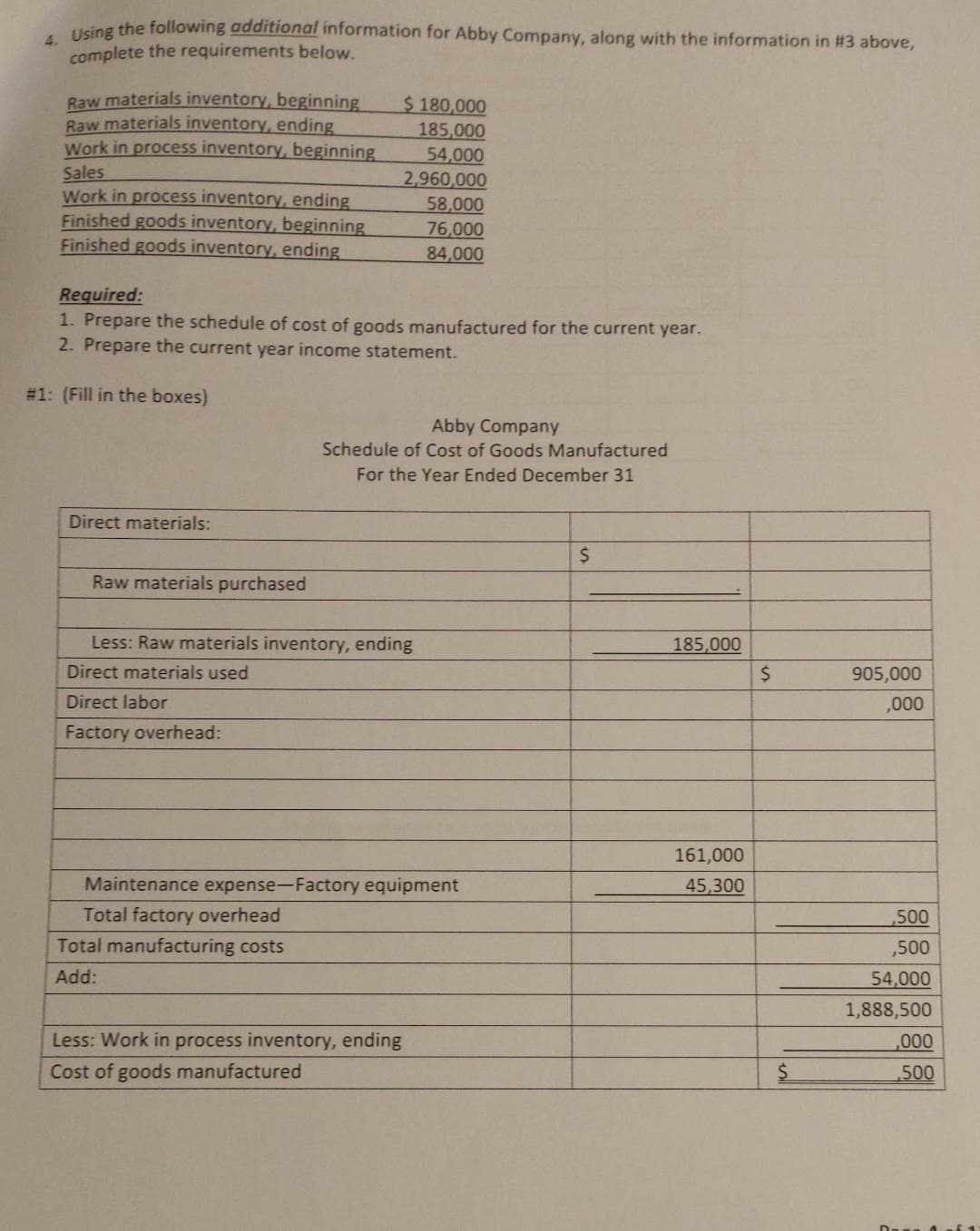

Transcribed Image Text:using the following additional information for Abby Company, along with the information in #3 above,

complete the requirements below.

Raw materials inventory, beginning

Raw materials inventory, ending

Work in process inventory, beginning

$ 180,000

185,000

54,000

2,960,000

58,000

Sales

Work in process inventory, ending

Finished goods inventory, beginning

Finished goods inventory, ending

76,000

84,000

Required:

1. Prepare the schedule of cost of goods manufactured for the current year.

2. Prepare the current year income statement.

# 1: (Fill in the boxes)

Abby Company

Schedule of Cost of Goods Manufactured

For the Year Ended December 31

Direct materials:

$4

Raw materials purchased

Less: Raw materials inventory, ending

185,000

Direct materials used

905,000

Direct labor

,000

Factory overhead:

161,000

Maintenance expense-Factory equipment

45,300

Total factory overhead

500

Total manufacturing costs

,500

Add:

54,000

1,888,500

Less: Work in process inventory, ending

,000

Cost of goods manufactured

500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you