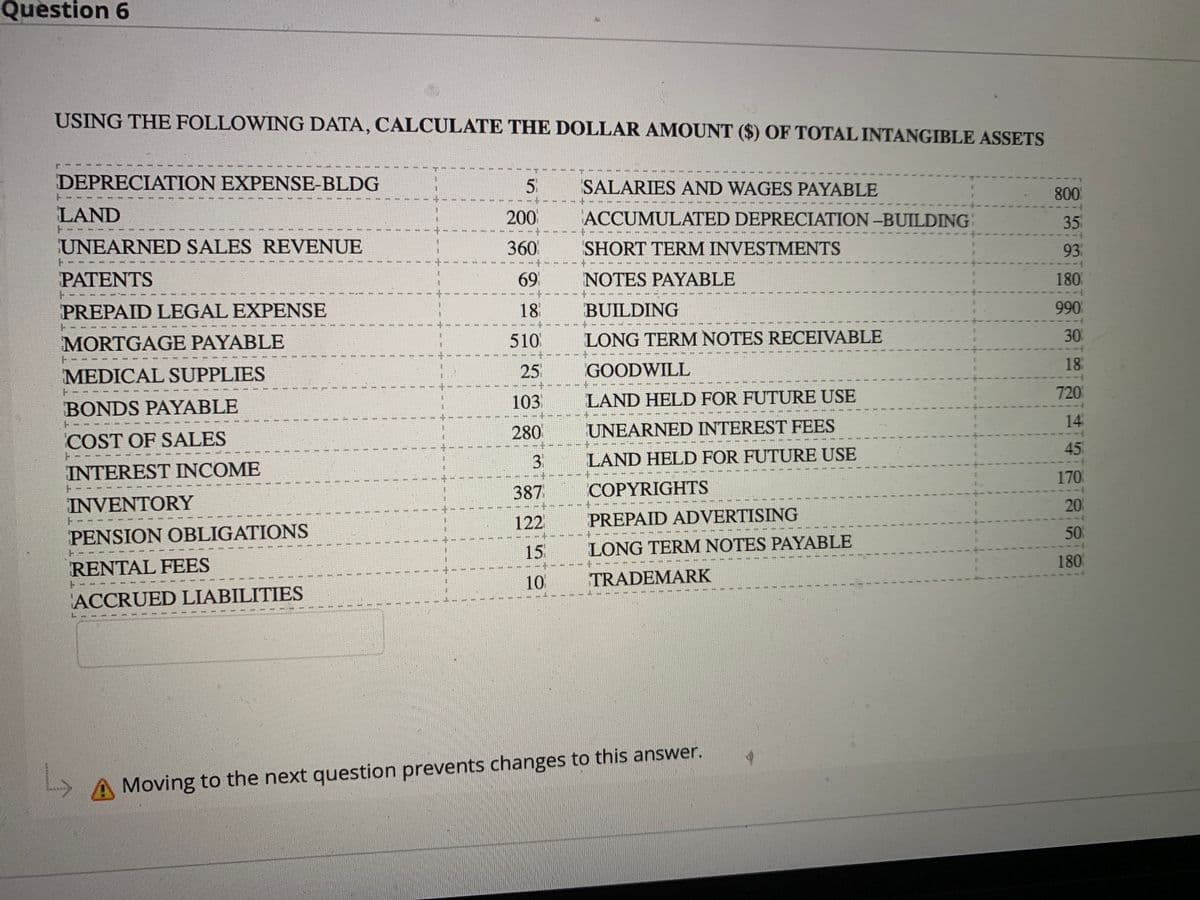

USING THE FOLLOWING DATA, CALCULATE THE DOLLAR AMOUNT ($) OF TOTAL INTANGIBLE ASSETS DEPRECIATION EXPENSE-BLDG 5. SALARIES AND WAGES PAYABLE 800 LAND 200 ACCUMULATED DEPRECIATION-BUILDING 35 UNEARNED SALES REVENUE 360 SHORT TERM INVESTMENTS 93 PATENTS 69 NOTES PAYABLE 180 --- PREPAID LEGAL EXPENSE 18 BUILDING 990 MORTGAGE PAYABLE 510 LONG TERM NOTES RECEIVABLE 30 25 GOODWILL 18 MEDICAL SUPPLIES 720 103 LAND HELD FOR FUTURE USE BONDS PAYABLE 14 280 UNEARNED INTEREST FEES COST OF SALES 45 3 LAND HELD FOR FUTURE USE INTEREST INCOME 170 387 COPYRIGHTS INVENTORY 20 122 PREPAID ADVERTISING PENSION OBLIGATIONS 50 15 LONG TERM NOTES PAYABLE 180 RENTAL FEES 10 TRADEMARK ACCRUED LIABILITIES

USING THE FOLLOWING DATA, CALCULATE THE DOLLAR AMOUNT ($) OF TOTAL INTANGIBLE ASSETS DEPRECIATION EXPENSE-BLDG 5. SALARIES AND WAGES PAYABLE 800 LAND 200 ACCUMULATED DEPRECIATION-BUILDING 35 UNEARNED SALES REVENUE 360 SHORT TERM INVESTMENTS 93 PATENTS 69 NOTES PAYABLE 180 --- PREPAID LEGAL EXPENSE 18 BUILDING 990 MORTGAGE PAYABLE 510 LONG TERM NOTES RECEIVABLE 30 25 GOODWILL 18 MEDICAL SUPPLIES 720 103 LAND HELD FOR FUTURE USE BONDS PAYABLE 14 280 UNEARNED INTEREST FEES COST OF SALES 45 3 LAND HELD FOR FUTURE USE INTEREST INCOME 170 387 COPYRIGHTS INVENTORY 20 122 PREPAID ADVERTISING PENSION OBLIGATIONS 50 15 LONG TERM NOTES PAYABLE 180 RENTAL FEES 10 TRADEMARK ACCRUED LIABILITIES

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section19.6: Buying Intangible Assets And Calculating Amortization Expense

Problem 1OYO

Related questions

Question

Transcribed Image Text:Question 6

USING THE FOLLOWING DATA, CALCULATE THE DOLLAR AMOUNT ($) OF TOTAL INTANGIBLE ASSETS

DEPRECIATION EXPENSE-BLDG

5.

SALARIES AND WAGES PAYABLE

800

LAND

200

ACCUMULATED DEPRECIATION -BUILDING

35

UNEARNED SALES REVENUE

360

SHORT TERM INVESTMENTS

93

PATENTS

69

NOTES PAYABLE

180

PREPAID LEGAL EXPENSE

18

BUILDING

990

MORTGAGE PAYABLE

510

LONG TERM NOTES RECEIVABLE

30

25

GOODWILL

18

MEDICAL SUPPLIES

720

103

LAND HELD FOR FUTURE USE

BONDS PAYABLE

14

280

UNEARNED INTEREST FEES

COST OF SALES

45

3.

LAND HELD FOR FUTURE USE

INTEREST INCOME

170

387

COPYRIGHTS

INVENTORY

20

122

PREPAID ADVERTISING

PENSION OBLIGATIONS

50

15

LONG TERM NOTES PAYABLE

RENTAL FEES

180

10

TRADEMARK

ACCRUED LIABILITIES

A Moving to the next question prevents changes to this answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning