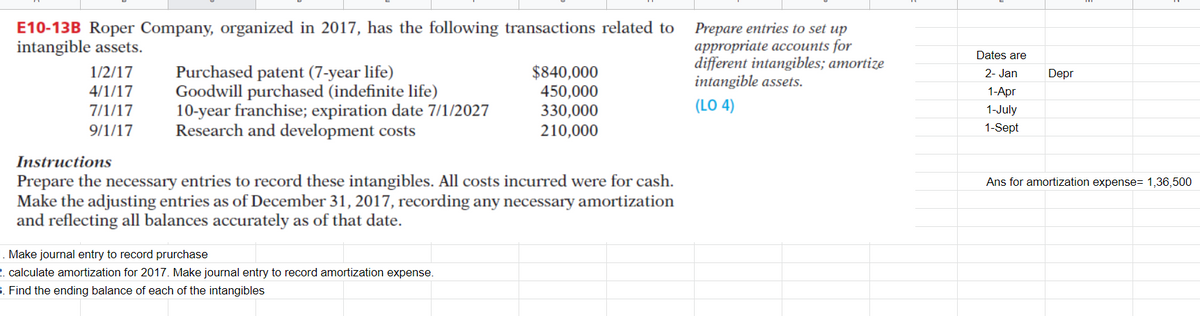

E10-13B Roper Company, organized in 2017, has the following transactions related to intangible assets. Prepare entries to set up appropriate accounts for different intangibles; amortize intangible assets. Dates are 1/2/17 4/1/17 7/1/17 9/1/17 Purchased patent (7-year life) Goodwill purchased (indefinite life) 10-year franchise; expiration date 7/1/2027 Research and development costs $840,000 450,000 330,000 2- Jan Depr 1-Apr (LO 4) 1-July 210,000 1-Sept Instructions Prepare the necessary entries to record these intangibles. All costs incurred were for cash. Make the adjusting entries as of December 31, 2017, recording any necessary amortization and reflecting all balances accurately as of that date. Ans for amortization expense= 1,36,500 Make journal entry to record prurchase calculate amortization for 2017. Make journal entry to record amortization expense. Find the ending balance of each of the intangibles

E10-13B Roper Company, organized in 2017, has the following transactions related to intangible assets. Prepare entries to set up appropriate accounts for different intangibles; amortize intangible assets. Dates are 1/2/17 4/1/17 7/1/17 9/1/17 Purchased patent (7-year life) Goodwill purchased (indefinite life) 10-year franchise; expiration date 7/1/2027 Research and development costs $840,000 450,000 330,000 2- Jan Depr 1-Apr (LO 4) 1-July 210,000 1-Sept Instructions Prepare the necessary entries to record these intangibles. All costs incurred were for cash. Make the adjusting entries as of December 31, 2017, recording any necessary amortization and reflecting all balances accurately as of that date. Ans for amortization expense= 1,36,500 Make journal entry to record prurchase calculate amortization for 2017. Make journal entry to record amortization expense. Find the ending balance of each of the intangibles

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 62E

Related questions

Question

Prepare entries to set up appropriate accounts for different intangibles; amortize intangible assets. (LO 4) Depr E10-13B Roppls answer the following:

1) Make

2) Calculate amortization for 2017. Make journal entry to record amortization expense.

3) Find the ending balance of each of the intangibles.

Transcribed Image Text:E10-13B Roper Company, organized in 2017, has the following transactions related to

intangible assets.

Prepare entries to set up

аppropriate acсоиnts for

different intangibles; amortize

intangible assets.

Dates are

Purchased patent (7-year life)

Goodwill purchased (indefinite life)

10-year franchise; expiration date 7/1/2027

Research and development costs

$840,000

450,000

330,000

210,000

1/2/17

2- Jan

Depr

4/1/17

1-Apr

7/1/17

(LO 4)

1-July

9/1/17

1-Sept

Instructions

Prepare the necessary entries to record these intangibles. All costs incurred were for cash.

Make the adjusting entries as of December 31, 2017, recording any necessary amortization

and reflecting all balances accurately as of that date.

Ans for amortization expense= 1,36,500

Make journal entry to record prurchase

2. calculate amortization for 2017. Make journal entry to record amortization expense.

3. Find the ending balance of each of the intangibles

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning