Using the following graduated income tax rates, find the tax withheld per pay period. State Tax Rate 2.75% 3.25% 5.00% Annual Income Earned First $10,000 Next $15,000 Over $25,000 1. Annual salary: $38,550; personal exemptions: $4,400; paid biweekly. 2. Annual salary: $47,425; personal exemptions: $3,000; paid weekly. 3. Annual salary: $29,149; personal exemptions: $2,200; paid monthly. 4. Annual salary: $24,872; personal exemptions: $1,500; paid semimonthly. 5. Standardized Test Practice Mitchell Gomez is an auto mechanic. His annual gross s is $35,500. He is married with 1 dependent, allowing him $3,700 in yearly personal exemptions. If his state income tax is based on the following graduated rate, how mu is withheld from his semimonthly paycheck? State Tax Rate 3.25% 3.60% 4.90% Annual Income Earned First $15,000 Next $15,000 Over $30,000 A. $46.49 B. $54.04 C. $92.98 D. $1,115.70

Using the following graduated income tax rates, find the tax withheld per pay period. State Tax Rate 2.75% 3.25% 5.00% Annual Income Earned First $10,000 Next $15,000 Over $25,000 1. Annual salary: $38,550; personal exemptions: $4,400; paid biweekly. 2. Annual salary: $47,425; personal exemptions: $3,000; paid weekly. 3. Annual salary: $29,149; personal exemptions: $2,200; paid monthly. 4. Annual salary: $24,872; personal exemptions: $1,500; paid semimonthly. 5. Standardized Test Practice Mitchell Gomez is an auto mechanic. His annual gross s is $35,500. He is married with 1 dependent, allowing him $3,700 in yearly personal exemptions. If his state income tax is based on the following graduated rate, how mu is withheld from his semimonthly paycheck? State Tax Rate 3.25% 3.60% 4.90% Annual Income Earned First $15,000 Next $15,000 Over $30,000 A. $46.49 B. $54.04 C. $92.98 D. $1,115.70

Chapter26: Tax Practice And Ethics

Section: Chapter Questions

Problem 31P

Related questions

Question

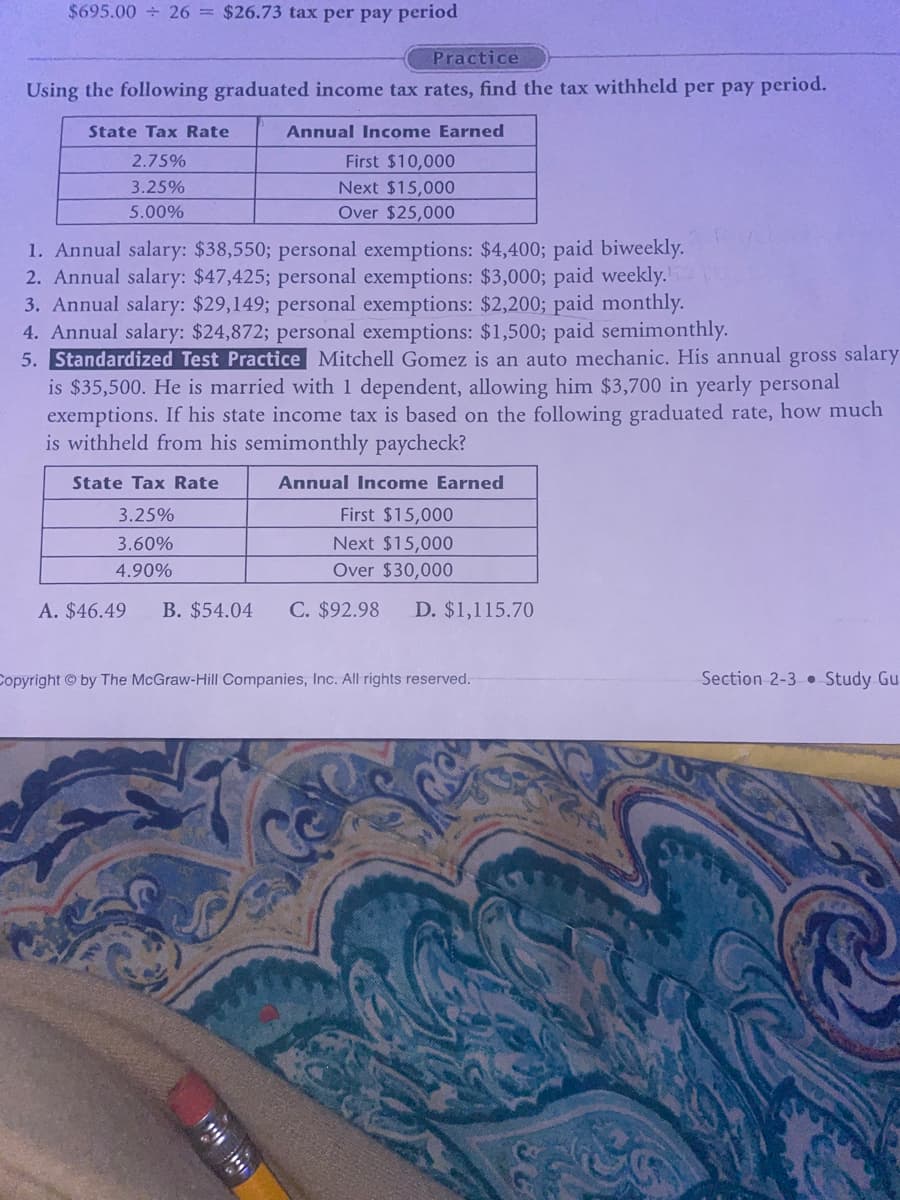

Transcribed Image Text:$695.00 ÷ 26 = $26.73 tax per pay period

Practice

Using the following graduated income tax rates, find the tax withheld per pay period.

State Tax Rate

2.75%

3.25%

5.00%

Annual Income Earned

First $10,000

Next $15,000

Over $25,000

1. Annual salary: $38,550; personal exemptions: $4,400; paid biweekly.

2. Annual salary: $47,425; personal exemptions: $3,000; paid weekly.

3. Annual salary: $29,149; personal exemptions: $2,200; paid monthly.

4. Annual salary: $24,872; personal exemptions: $1,500; paid semimonthly.

5. Standardized Test Practice Mitchell Gomez is an auto mechanic. His annual gross salary

is $35,500. He is married with 1 dependent, allowing him $3,700 in yearly personal

exemptions. If his state income tax is based on the following graduated rate, how much

is withheld from his semimonthly paycheck?

State Tax Rate

3.25%

3.60%

4.90%

A. $46.49 B. $54.04

Annual Income Earned

First $15,000

Next $15,000

Over $30,000

C. $92.98 D. $1,115.70

Copyright by The McGraw-Hill Companies, Inc. All rights reserved.

Section 2-3 Study Gu

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning