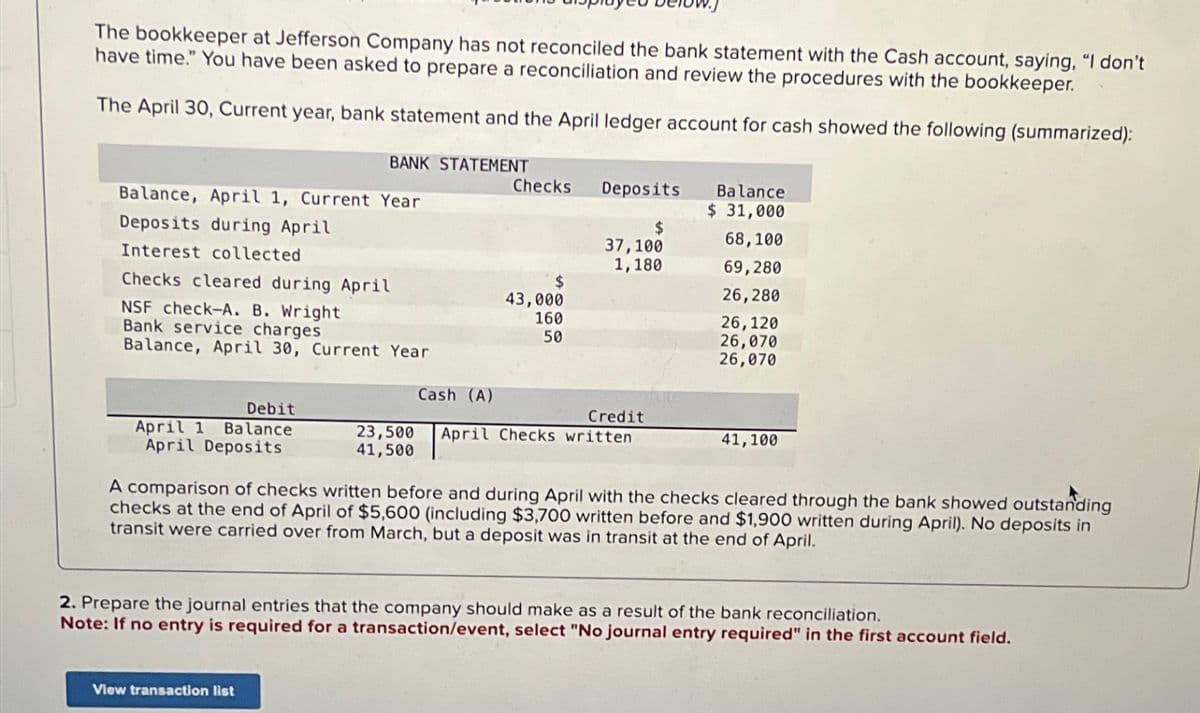

The bookkeeper at Jefferson Company has not reconciled the bank statement with the Cash account, saying. "I don't have time." You have been asked to prepare a reconciliation and review the procedures with the bookkeeper. The April 30, Current year, bank statement and the April ledger account for cash showed the following (summarized): BANK STATEMENT Checks Deposits Balance, April 1, Current Year Balance $ 31,000 Deposits during April $ 68,100 37,100 Interest collected 1,180 69,280 Checks cleared during April $ 26,280 43,000 NSF check-A. B. Wright 160 26,120 Bank service charges 50 26,070 Balance, April 30, Current Year 26,070 Cash (A) Debit Credit April 1 Balance April Deposits 23,500 April Checks written 41,500 41,100 A comparison of checks written before and during April with the checks cleared through the bank showed outstanding checks at the end of April of $5,600 (including $3,700 written before and $1,900 written during April). No deposits in transit were carried over from March, but a deposit was in transit at the end of April. 2. Prepare the journal entries that the company should make as a result of the bank reconciliation. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

The bookkeeper at Jefferson Company has not reconciled the bank statement with the Cash account, saying. "I don't have time." You have been asked to prepare a reconciliation and review the procedures with the bookkeeper. The April 30, Current year, bank statement and the April ledger account for cash showed the following (summarized): BANK STATEMENT Checks Deposits Balance, April 1, Current Year Balance $ 31,000 Deposits during April $ 68,100 37,100 Interest collected 1,180 69,280 Checks cleared during April $ 26,280 43,000 NSF check-A. B. Wright 160 26,120 Bank service charges 50 26,070 Balance, April 30, Current Year 26,070 Cash (A) Debit Credit April 1 Balance April Deposits 23,500 April Checks written 41,500 41,100 A comparison of checks written before and during April with the checks cleared through the bank showed outstanding checks at the end of April of $5,600 (including $3,700 written before and $1,900 written during April). No deposits in transit were carried over from March, but a deposit was in transit at the end of April. 2. Prepare the journal entries that the company should make as a result of the bank reconciliation. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter5: Internal Control And Cash

Section: Chapter Questions

Problem 2SEQ

Related questions

Question

Dhapa

Transcribed Image Text:The bookkeeper at Jefferson Company has not reconciled the bank statement with the Cash account, saying, "I don't

have time." You have been asked to prepare a reconciliation and review the procedures with the bookkeeper.

The April 30, Current year, bank statement and the April ledger account for cash showed the following (summarized):

BANK STATEMENT

Checks

Deposits

Balance, April 1, Current Year

Balance

$ 31,000

Deposits during April

$

68,100

37,100

Interest collected

1,180

69,280

Checks cleared during April

$

43,000

26,280

NSF check-A. B. Wright

160

26,120

Bank service charges

50

26,070

Balance, April 30, Current Year

26,070

Cash (A)

Debit

Credit

April 1 Balance

April Deposits

23,500 April Checks written

41,500

41,100

A comparison of checks written before and during April with the checks cleared through the bank showed outstanding

checks at the end of April of $5,600 (including $3,700 written before and $1,900 written during April). No deposits in

transit were carried over from March, but a deposit was in transit at the end of April.

2. Prepare the journal entries that the company should make as a result of the bank reconciliation.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning